Travel Impact: Coronavirus 2020 (Updates as of February 25)

Travel sector continues to see impact as coronavirus spreads globally.

Hayley Berg - Wed Feb 26 2020

Summary

Note: The demand data below is reflected through February 23rd, ahead of the CDC announcement raising the travel advisory level for Italy, Japan, South Korea and Iran. The impact of this announcement will be included in the next update from Hopper.

United States

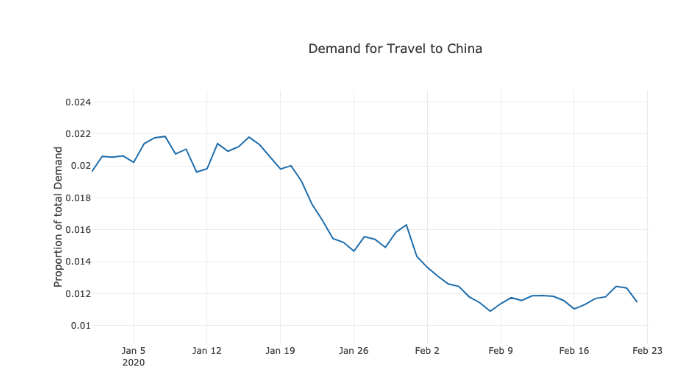

Demand from the US to China stabilized in the last 2 weeks, at a level ~48% lower than early January levels.

Round trip airfare prices from the US to China rose by more than 20% at their peak, but have also stabilized around 14% higher than in early January.

Round trip airfare from the US to non-Chinese destinations in Asia has stabilized, while demand to these countries continues to fall anywhere from -8% to -38% in the wake of the virus.

Tourism to destinations in Vietnam, Philippines, Malaysia and much more of SE Asia is likely to be heavily impacted by the virus, as 30% or more of available flights from the US to these countries included a layover in China.

Europe

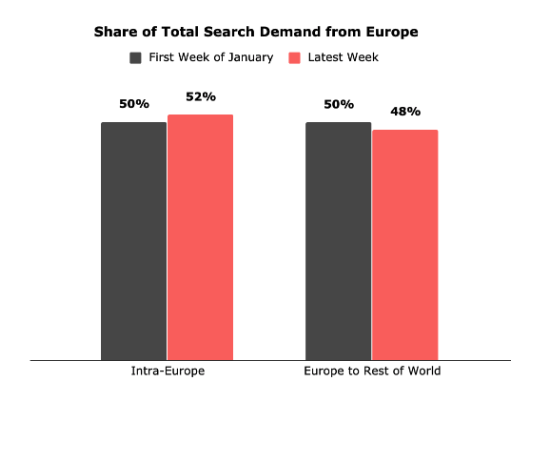

Demand for travel from Europe to rest-of-world destinations including Asia, has dropped -5.1%, while demand for intra-European flights has grown, +0.9%.

US Demand and Price Impact

Demand from the US to China fell rapidly with the news of the Coronavirus, but the drop has stabilized in the last 2 weeks, at a level ~48% lower than early January levels. Demand is expected to remain low until the virus is contained and government and health officials like the CDC and WHO indicate it is safe for Americans to travel.

Round trip airfare prices from the US to China and other Asian destinations remained relatively stable through January, but round trip airfare began to spike following announcements from airlines indicating a significant reduction in service to mainland China. At their peak, prices from the US to China rose by more than 20%, but the spike has since stabilized and prices are now hovering around 14% higher than in early January. Prices are typically higher in February and March than in January, due to the seasonality of travel demand, so some of the 14% increase in prices to China is expected; prices from the US to China rose 6% during the same period last year.

Round trip airfare from the US to non-Chinese destinations in Asia also spiked in early February as the news of the virus spread globally. Since then, prices to most destinations have peaked and are returning to more expected seasonal levels. Demand to these countries, however, continues to fall from -8% to -38% in the wake of the spread of the virus.

To see the impact on more destinations, follow this link.

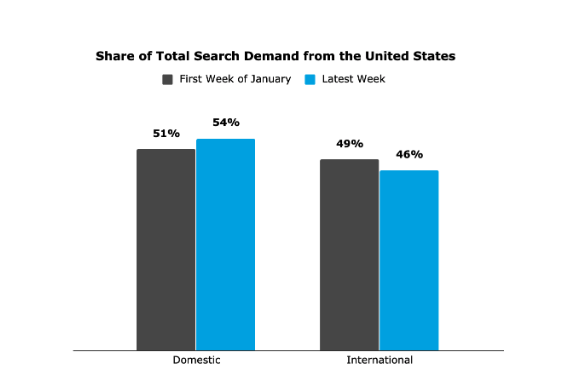

As demand shifts away from Asian destinations, the US is seeing an increase in demand for domestic travel. Between the first week of January and mid-February, there has been a distinct shift (+3% points) in the share of travel searches made by Americans towards domestic destinations over international destinations. Demand for international travel has slipped -5% since early January, while demand for domestic destinations has continued to grow (+6.3%) during the same period.

Airline Capacity Impact Beyond Routes Direct to China

Nearly 5% of all international capacity from the US in the next 2 months was planned to route travelers to China. Some of these travelers were headed onto further destinations, primarily across Asia and Southeast Asia. Our ranking below shows the international destinations where flights with connections through China have previously represented a large proportion of the available routes US travelers could fly to visit.

Read as: Nearly 50% of all route options for travelers flying from the US to Ho Chi Minh, Vietnam have a connection in China.

European Demand and Price Impact

As Coronavirus has spread beyond China, parts of Europe have begun to feel the impact of this fast spreading virus. Within Europe, demand has already begun to shift as concern over the illness grows. Since the first week of January, demand for travel from Europe to rest-of-world destinations has dropped -5.1%, while demand for intra-European flights has grown slightly, +0.9%. This has led to the proportion of searches for travel outside of Europe to drop by 2% points in just 8 weeks, from 50% to 48%.