Hopper Secures $175 Million Growth Investment Led By GPI Capital

Travel fintech accelerates company’s growth to new heights

Brianna Schneider - Tue Aug 17 2021

Today, Hopper is announcing that it has completed a $175 million Series G financing led by GPI Capital with participation from Glade Brook Capital, WestCap, Goldman Sachs Growth and Accomplice as the company emerges from the pandemic stronger than ever.

As the travel industry continues to rebound, Hopper has demonstrated significant outperformance with its category-leading mobile-only marketplace, delivering value to customers and supply partners with the company’s proprietary suite of fintech offerings. Hopper has over 60 million downloads, consistently ranks as one of the most downloaded travel apps, and now has a larger air travel market share in North America than it did before the pandemic (source: MIDT) along with a growing suite of API-enabled solutions for its B2B initiative. Based on its current run rate, Hopper is pacing towards 330% revenue growth compared to last year and it has already surpassed its pre-pandemic revenue peak from Q1 2020 by over 100%. Product roll-outs have been delivered over an increasingly diversified mix of air, hotel and car rental bookings with the company’s fintech offerings now representing a majority of its revenue.

Whether it’s pricing volatility or avoiding trip disruptions, Hopper’s fintech offerings aim to address every pain point in the customer journey while driving conversion, repeat purchases, and profitability. Earlier in the year, Hopper announced that it was launching a B2B initiative called Hopper Cloud. Through this partnership program, any travel provider – airlines, online travel agencies, meta-search companies, travel agencies, etc. – can integrate and seamlessly distribute Hopper’s fintech or agency content. Additionally, Hopper Cloud offers white-label travel portals for companies that aspire to sell travel with a differentiated consumer experience and offering. By leveraging its vast data assets, Hopper takes on all financial risk as its AI is able to dynamically price each fintech offering on a real-time basis at scale.

“The success of our fintech offerings demonstrate that travelers are willing to pay for flexibility and assurance as they resume traveling again,” said Frederic Lalonde, CEO and Co-Founder of Hopper. “We feel strongly that our fintech offerings through Hopper Cloud can help supercharge the travel industry’s recovery by introducing a totally unique revenue stream for other brands. In fact, if all travel distribution channels offered our fintech, it could increase the total consumer spend for the sector by $200 billion annually. We are excited to be partnering with GPI and their distinguished track record of supporting iconic consumer internet companies. We welcome Khai to the board as we execute on a roadmap for sustained growth over the long term.”

Khai Ha, Managing Partner at GPI Capital, commented “Hopper has created a large market opportunity with unique fintech products for the travel industry that applies an entirely differentiated and attractive business model in which we are excited to work with Fred and the leadership team to accelerate the flywheel. The company emerged from a challenging period for the industry, bolstering its technology capabilities, customer service and its opportunity set with a stronger, durable foundation. We are thrilled to be a partner in this category-defining story.”

The funds will be used to accelerate the company’s growth across several fronts including customer support. Following a year of unprecedented customer support requests, Hopper has scaled its customer support team by 200% and developed several self-serve automation tools so that 60% of customer support requests are now resolved instantly. Hopper is hiring an additional 500 employees, of which 300 of them are focused on customer service. The company is actively looking to acqui-hire other teams in travel, data science, or engineering-heavy startups to introduce new product offerings and fuel international expansion. Hopper has had recent success integrating the teams of Journy and Mowgli, which will accelerate entry into new travel categories such as home rentals and regional expansion to Europe.

Kirkland & Ellis LLP and McCarthy Tétrault LLP acted as legal counsel to GPI Capital.

###

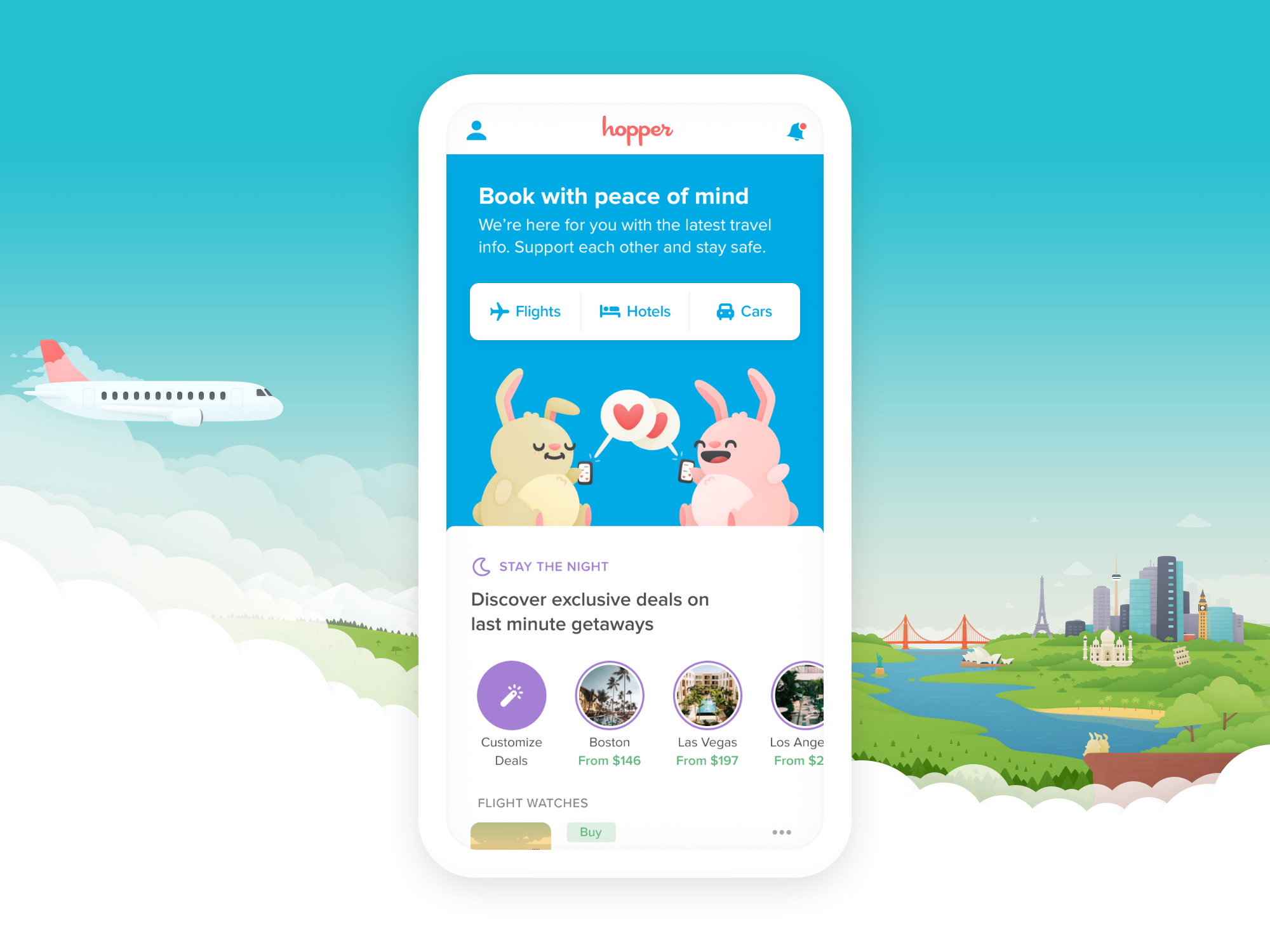

About Hopper

Hopper is the world’s fastest-growing mobile-first travel marketplace. By leveraging massive amounts of data and machine learning, the company has developed several unique fintech solutions that help customers save money and travel better. Through its B2B initiative, Hopper Cloud, the company is syndicating its fintech solutions, infrastructure, and agency content. Whether it’s pricing volatility or trip disruptions, Hopper’s proprietary suite of fintech solutions address every pain point in the customer journey while driving conversion, repeat purchases, and profitability. To find out more about Hopper, visit Hopper.com.

About GPI Capital

GPI Capital is an alternative investment firm specializing in leading growth equity investments in technology, consumer and industrial companies. GPI focuses on identifying high quality businesses looking to accelerate growth and execute on transformational opportunities with an engaged and value-add partner. For more information about GPI, please visit http://www.gpicap.com/.