Q1 2023 Consumer Travel Index

2023 airfares expected to climb higher than pre-pandemic prices, but will drop below 2022 levels come spring.

Hayley Berg - Thu Feb 02 2023

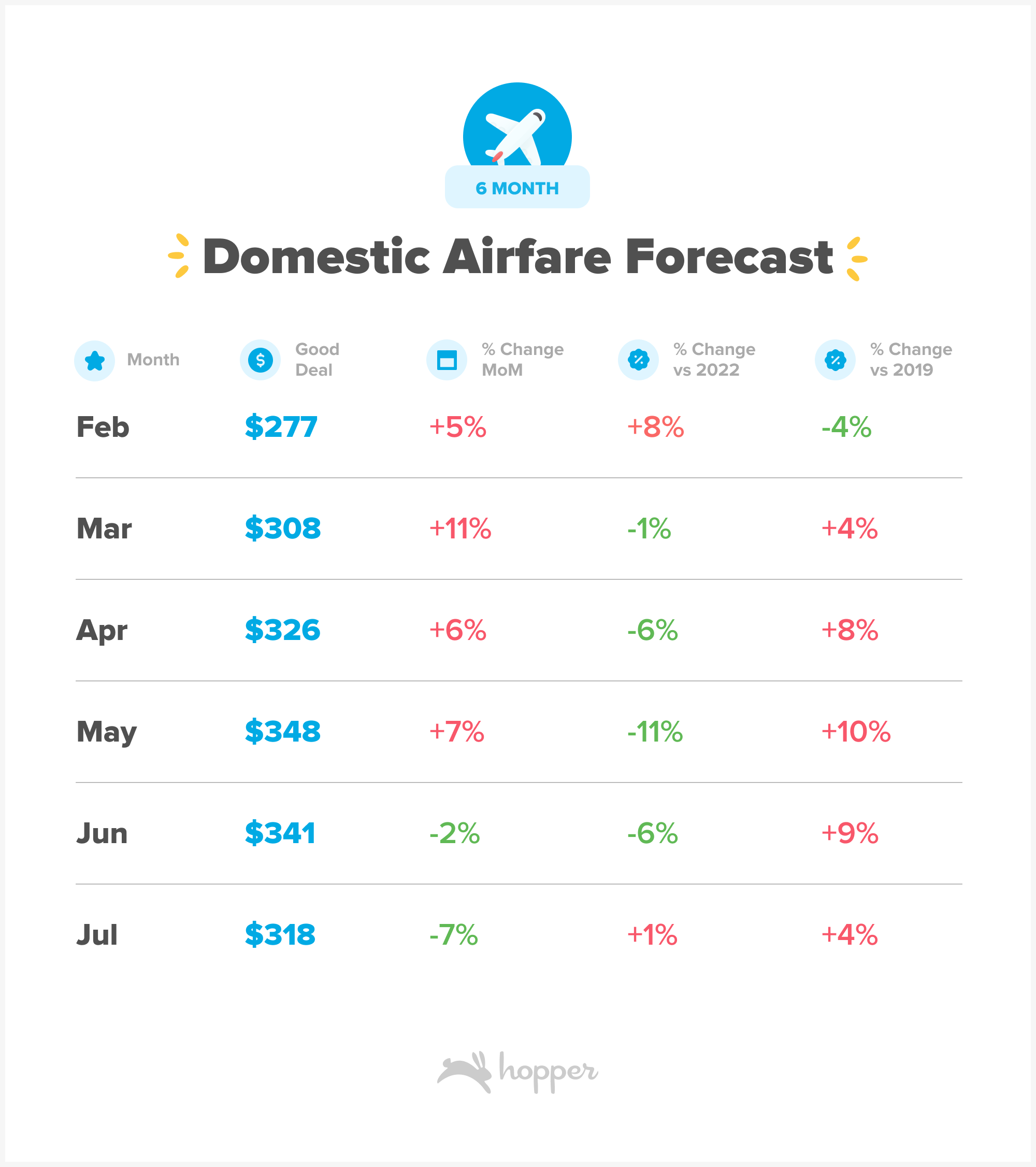

6 Month Airfare Index

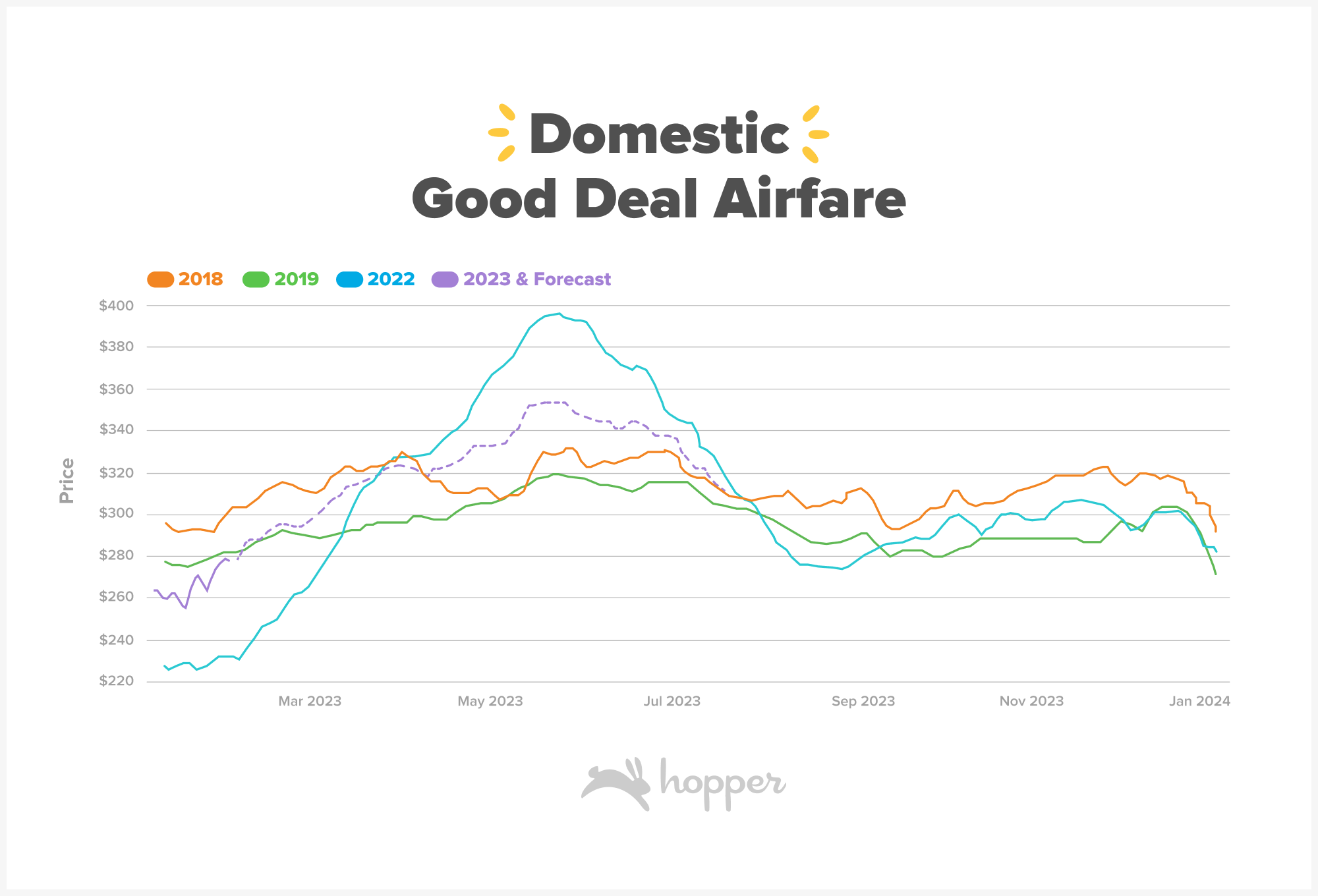

Domestic airfare will rise slightly (+5%) to $277 per round trip ticket in February, before accelerating into peak spring and summer travel booking months. Airfare will peak ~$350 per ticket this summer, down 11% from the peak ~$400 last year. Though prices are expected to remain lower than 2022 levels for late spring and summer, airfare is expected to be higher than pre pandemic levels, as costs remain high and demand continues to outstrip airline capacity.

Factors Influencing 2023 Travel Prices:

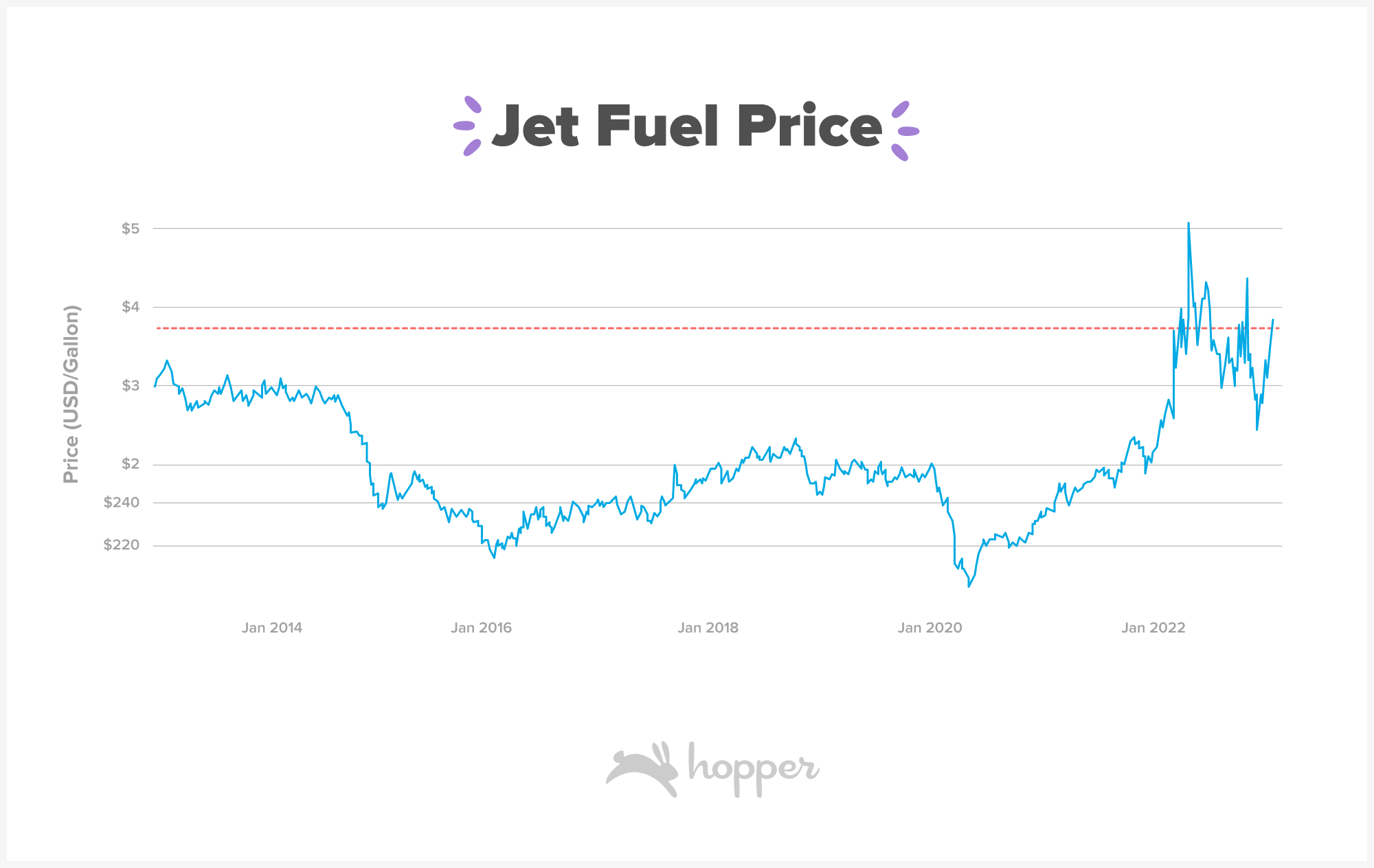

Rising Costs: Inflation continues to drive costs up across the travel industry and will likely result in elevated prices for airfare and hotels well into 2023. Jet fuel prices are at the highest levels seen since 2008, meaning airlines will be pressured to maintain higher airfares to compensate for the higher operational costs.

Surging Demand: Demand for travel continues to surge post-pandemic, with 96% of Hopper users claiming they plan to take at least one trip in 2023. Sustained strong demand into 2023 will put additional pressure on prices, especially to and within regions where travel has only recently reopened like parts of Asia.

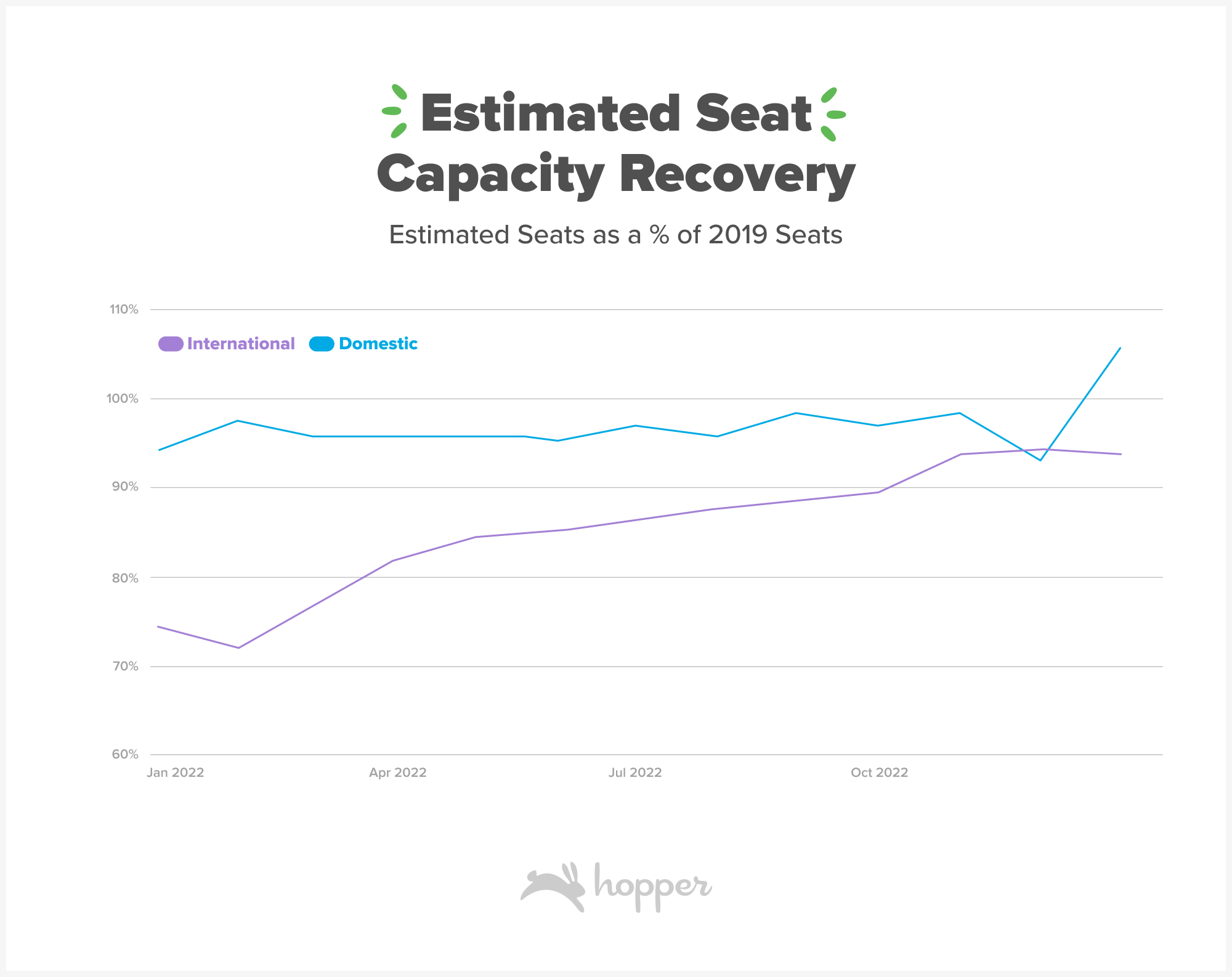

Constrained Supply: Supply has improved across the travel industry, from airline capacity to hotel room availability and rental car supply. However, growth of supply across the travel industry remains constrained into 2023 and beyond. In an already high demand market, where demand is set to continue building year to year, constrained supply will continue to put intense pressure on consumer travel prices.

Current Price of Travel

After a year full of revenge travel, demand for travel has not yet waned among Americans. 96% of Hopper users, who are predominantly Gen Z and millennial travelers, claim they plan to take at least one trip in 2023, with nearly 80% planning at least one vacation, and half traveling to see family or friends. 93% of Hopper customers are planning to fly at some point during the course of their travels and 61% plan to stay in a hotel at least once.

Current Price of Travel

After a year full of revenge travel, demand for travel has not yet waned among Americans. 96% of Hopper users, who are predominantly Gen Z and millennial travelers, claim they plan to take at least one trip in 2023, with nearly 80% planning at least one vacation, and half traveling to see family or friends. 93% of Hopper customers are planning to fly at some point during the course of their travels and 61% plan to stay in a hotel at least once.

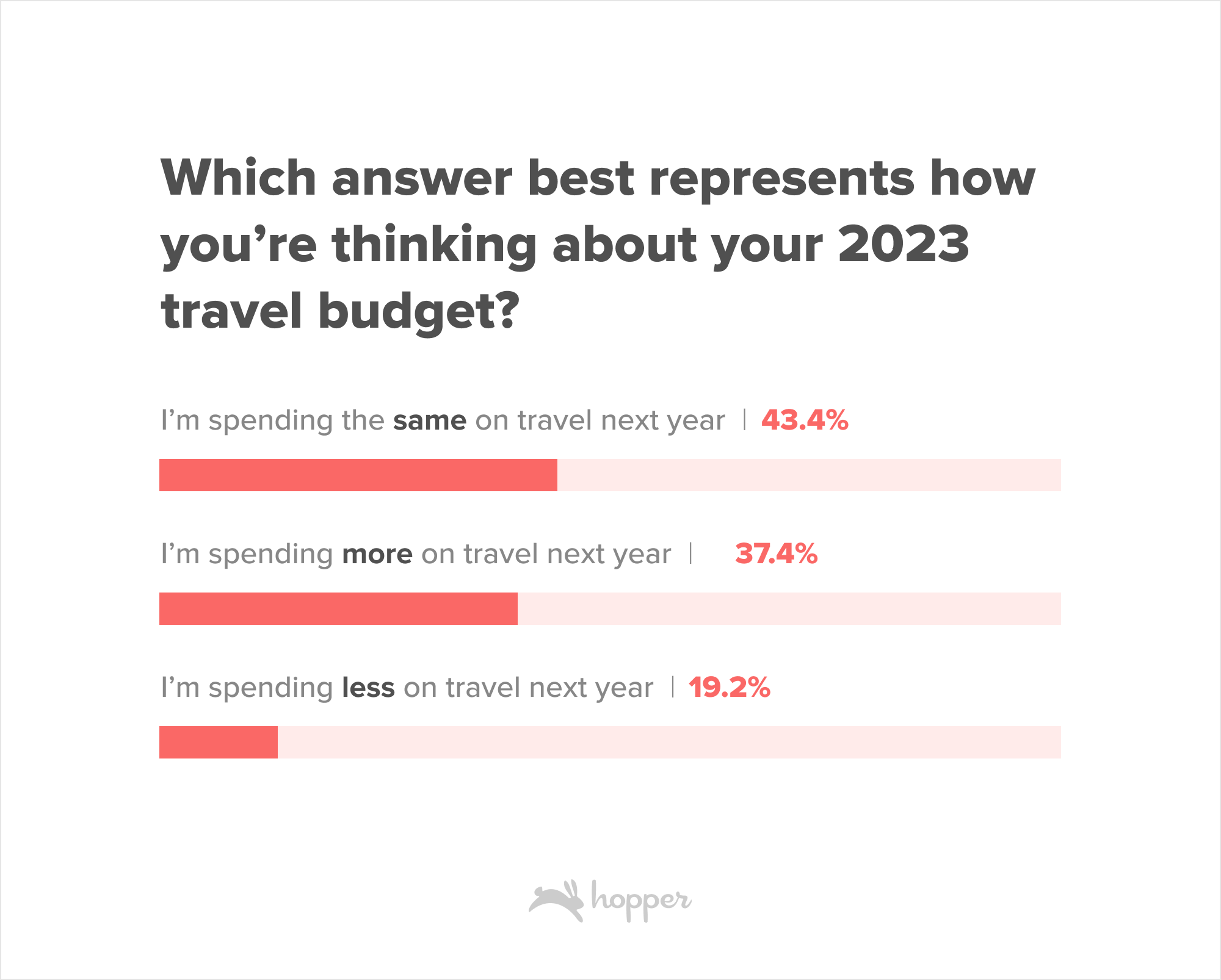

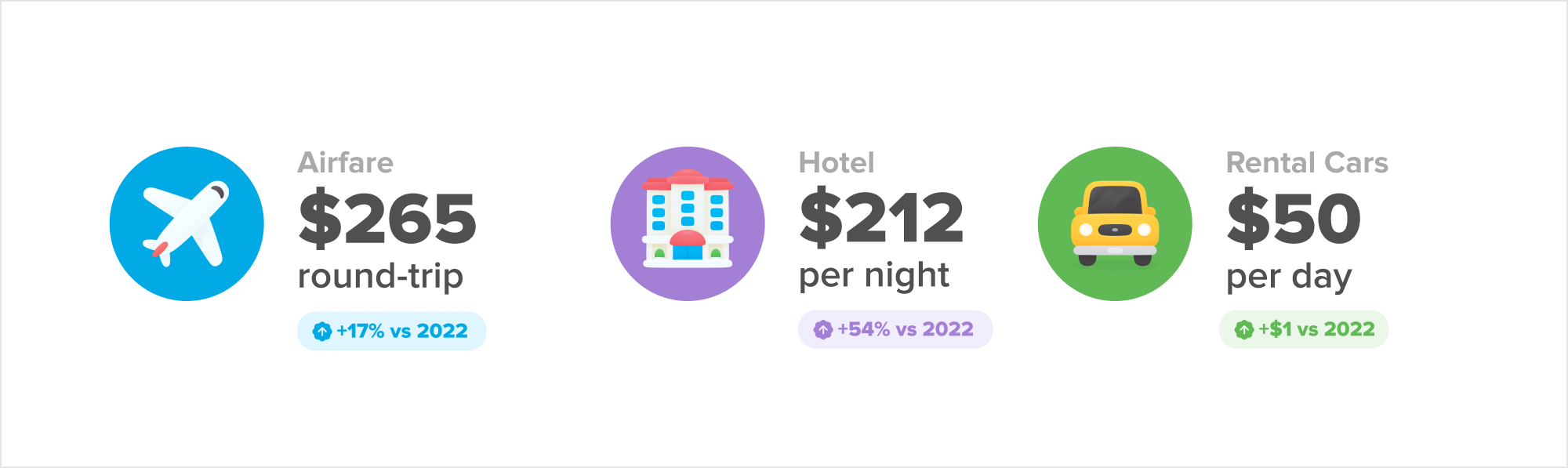

Travelers booking a getaway in early 2023 likely experienced some sticker shock, with airfare nearly 20% higher than last year and hotel rates over 50% higher than in January 2022. While airfares may feel high, prices are actually 6% below pre pandemic levels. Despite any sticker shock, concerns plaguing the US economy and continued inflation, 80% of Hopper customers planning to travel will spend the same, or more, on travel next year. Even as budgets tighten, Americans continue to prioritize travel and experiences as an important part of their expenditure.

Airfare to rise through May

Domestic airfare will rise slightly to $277 in February, before accelerating into peak spring and summer travel booking months. Airfare is expected to peak around $350 per ticket this summer, down 11% from the peak ~$400 last year. A perfect storm of pent up demand, low airline capacity and surging jet fuel costs drove airfare to record highs in May and June 2022. Though prices will remain higher than pre-pandemic levels this spring and summer, some relief in fuel costs and airline capacity improvements will keep airfare below the 2022 peak.

Rising Costs

Inflation

Inflation is not a new story, as we head into 2023, but it remains an important factor in pricing across the industry. Rising costs driven by market wide inflation have plagued industries across the globe in the last year, from energy to labor to goods and services. Travel is no exception with airfare, car rental, hotel and home rental prices expected to remain above pre pandemic levels for most of 2023. Cost pressures will continue to plague the industry until inflation slows and inflationary pressures give some cost relief to companies' bottom line.

Fuel prices will put upward pressure on prices

Jet fuel prices were already high in early 2022 as a result of supply constraints worldwide when the Russian invasion of Ukraine and resulting supply uncertainty put immense upward pressure on prices. Today, jet fuel prices are at the highest levels seen since 2008 and are averaging $3.75 per gallon, an increase of +51% vs January 2022 and 2x the price in January 2019.

On average 15% - 30% of an airline’s operating expenses are from jet fuel, meaning sustained increases in fuel prices have a tangible impact on an airline’s costs. Fuel prices are likely to remain elevated into 2023 which means airlines will be pressured to maintain higher airfares to compensate for the higher operational costs.

Surging Demand

American’s to continue prioritizing travel expenditure

Across the travel industry, airlines and hotels alike have reported continued, surging demand for travel even despite increasing economic concerns and inflation. Despite concerns plaguing the US economy and continued inflation, 80% of Hopper customers planning to travel will spend the same, or more, on travel next year. Even as budgets tighten, Americans continue to prioritize travel and experiences as an important part of their expenditure. Travelers will be looking to make their travel budget go further by finding good deals and booking at the right time. The Hopper app, which over-indexes with millennial and Gen Z travelers, has seen surging downloads as inflation concerns have prevailed and prices have remained high across the industry. January 2023 was Hopper’s strongest month for new installs on record even as domestic airfares stretched 17% higher than at this time last year.

Demand surges, especially to Asia

Search demand for international travel continues to surge into 2023 with demand to Asia driving much of international growth. Today, international trips represent ~56% of searches made by US travelers, up from 46% at this time last year. Today, more than half of all searches made to international destinations are for cities in Europe (34%) and Asia (25%), while destinations in Mexico, Central America and the Caribbean capture ~20% of searches.

Demand to Asia, which had been growing steadily throughout 2022, surged at the end of the year and into 2023 as China announced the end of strict covid-10 travel restrictions. Only a handful of airlines are currently operating flights to and from China but many will begin rebuilding their trans pacific fleets this spring.

Constrained Supply

Airline capacity recovering, but supply to remain constrained

January has already seen domestic seat capacity beat 2019 levels, with about 6% more seats flying in January 2023 compared to January 2019. Many airlines have brought capacity back by swapping out smaller planes for larger jets to capture demand with fewer flights. These equipment swaps have allowed airlines to bring back much of 2019 seat capacity, while keeping flight volume below 2019 levels. The cost of these changes has been felt most by regional airports, some of which lost airlines during the pandemic which have yet to return to service.

International seat capacity recovered significantly in the last year, from 75% of 2019 levels in January 2022 to 93% in January of this year. With the reopening of China beginning in late 2022, airlines are expected to bring transpacific fleets back online in Q1 2023. This combined with surging demand to long haul destinations in Europe and Asia means capacity will likely meet or exceed 2019 levels by mid year.

While capacity has seen strong growth in the last year, future capacity growth will likely be hindered by delays in new aircraft deliveries. Between the halting of Boeing production following the 737-Max 8 crashes in 2019 and pandemic driven supply chain constraints beginning in 2020, many airlines are still waiting for new aircrafts to be delivered. Until aircraft supply can catch up with airline needs, capacity growth will remain slow and concentrated on destinations with the highest demand in each season.

In addition to equipment stalling airlines’ plans to expand schedules, staffing and training will pressure supply this year. Airlines are rapidly hiring pilots from a shrinking pool of candidates, rebuilding ground and air staffing to pre pandemic levels while TSA and the FAA are also working to expand resources. Until the entire industry is back to high, efficient levels of employment, capacity growth will be constrained across the US and internationally.

Hotels occupancy high headed into 2023

US hotel occupancy has recovered to 95% of 2019 levels along with most regions of the world except China and Australia, according to CoStar. A survey of Hopper users who will travel this year revealed that more than 60% plan to stay at least one night in a hotel in 2023. With millions of Americans planning to travel this year, demand will be high for accommodation along the entire range of economy to luxury stays.

Despite this, there remain fewer hotel rooms under construction than pre-pandemic. Covid-19 had a significant impact on the construction industry; from lock-downs stopping work, supply chain challenges slowing or stopping work and illness hampering employment, it’s no surprise new properties have been delayed and overall fewer rooms remain under construction. With high interest rates today the cost of money, or loans, for new construction or investment is high, meaning many chains will focus on renovation of rooms vs new construction.

As demand continues to recover and eventually rises beyond 2019 levels, new properties and hotel expansions will become even more important to capturing demand for hotel stays. While supply remains tight in the accommodation industry, prices will remain high.

Rental car supply optimized, but still low

Loosening of rental car supply last year slowed the rapid growth of rental car prices, though prices remain 1% higher than at this time in 2022. Most rental car providers optimized supply in 2022 to their highest demand pick up regions, enabling prices to fall significantly in their most popular (mostly warm weather) destinations like Miami (-55%), Fort Lauderdale (-38%) and Tampa (-36%) compared to last year. Price drops in these destinations were offset at the national level by increasing prices in many markets where supply was cut, markets like Indianapolis (+57%), Philadelphia (+30%) and Minneapolis (+16%).

Though optimizing existing supply is an effective way to drop prices in some markets, new supply will be needed to see improvement in prices across the US. With high interest rates, the price of borrowing money to fund new fleets remains extremely high. Many rental car companies are choosing to instead maintain current fleets and hold out for lower interest rates or a drop in new car prices before expanding rental car supply this year or in future.

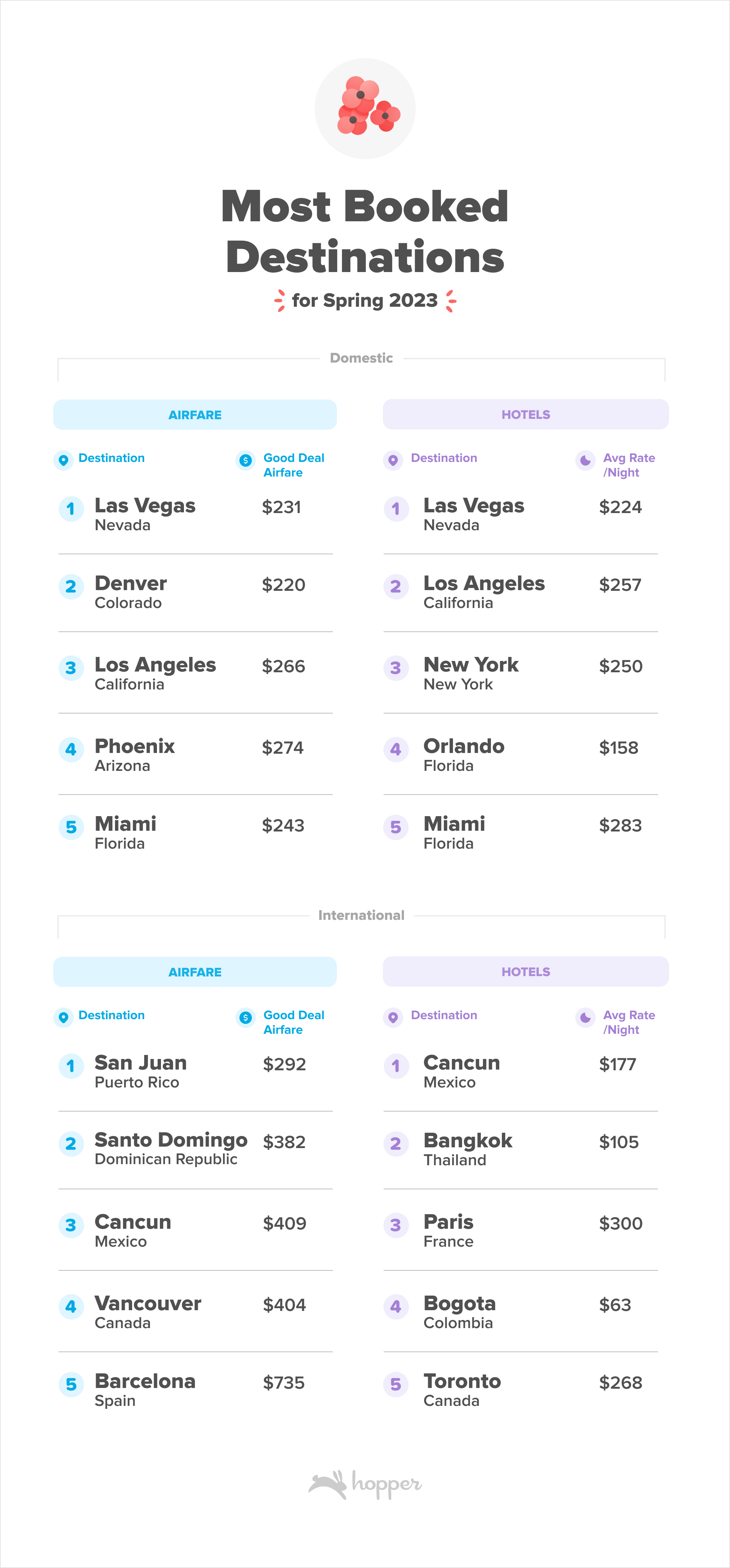

Where are travelers going in 2023?

2023 Deals Available to Book in the Hopper app now

Hopper is running its Flash Sale through 2/2 with exclusive deals on flights and hotels available to book now in the app.

Domestic:

New York City: $201 round-trip on the Hopper app (additional 30% off hotels when you book on Hopper)

Fort Lauderdale: $207 round-trip on the Hopper app (additional 25% off hotels when you book on Hopper)

Las Vegas: $211 round-trip on the Hopper app (additional 25% off hotels when you book on Hopper)

Denver: $222 round-trip on average (additional 30% off hotels when you book on the Hopper app)

Miami: $224 round-trip on the Hopper app (additional 25% off hotels when you book on the Hopper app)

International:

Toronto: $311 round-trip on the Hopper app (additional 25% off hotels when you book on Hopper)

Los Cabos: $405 round-trip on the Hopper app (additional 20% off hotels when you book on Hopper)

London: $696 round-trip on the Hopper app (additional 30% off hotels when you book on Hopper)

Bangkok: $1,190 round-trip on the Hopper app (additional $30% off hotels when you book on Hopper)

Tokyo: $1,208 round-trip on the Hopper app (additional 40% off hotels when you book on Hopper)

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!