Consumer Airfare Index Report - August 2021

Aligning with typical seasonal demand, domestic airfare prices are expected to drop 10% headed into the fall, before spiking with holiday demand.

Adit Damodaran - Tue Aug 10 2021

Summary:

Airfare Pricing Trends

Current Airfare:

A good deal for a round-trip domestic flight is $275, and $735 for a round-trip international flight.

Six-Month Airfare Forecast

Domestic: We’re expecting airfare to drop a total of 10% ($288/rt to $260/rt) into September, primarily driven by seasonally lower demand over the fall shoulder season. After September, we’re expecting prices to rise a total of 11% ($260/rt to $289) going into December. This would make domestic airfare over the holiday season equivalent to summer airfare, similar to what we saw in 2019 and 2020.

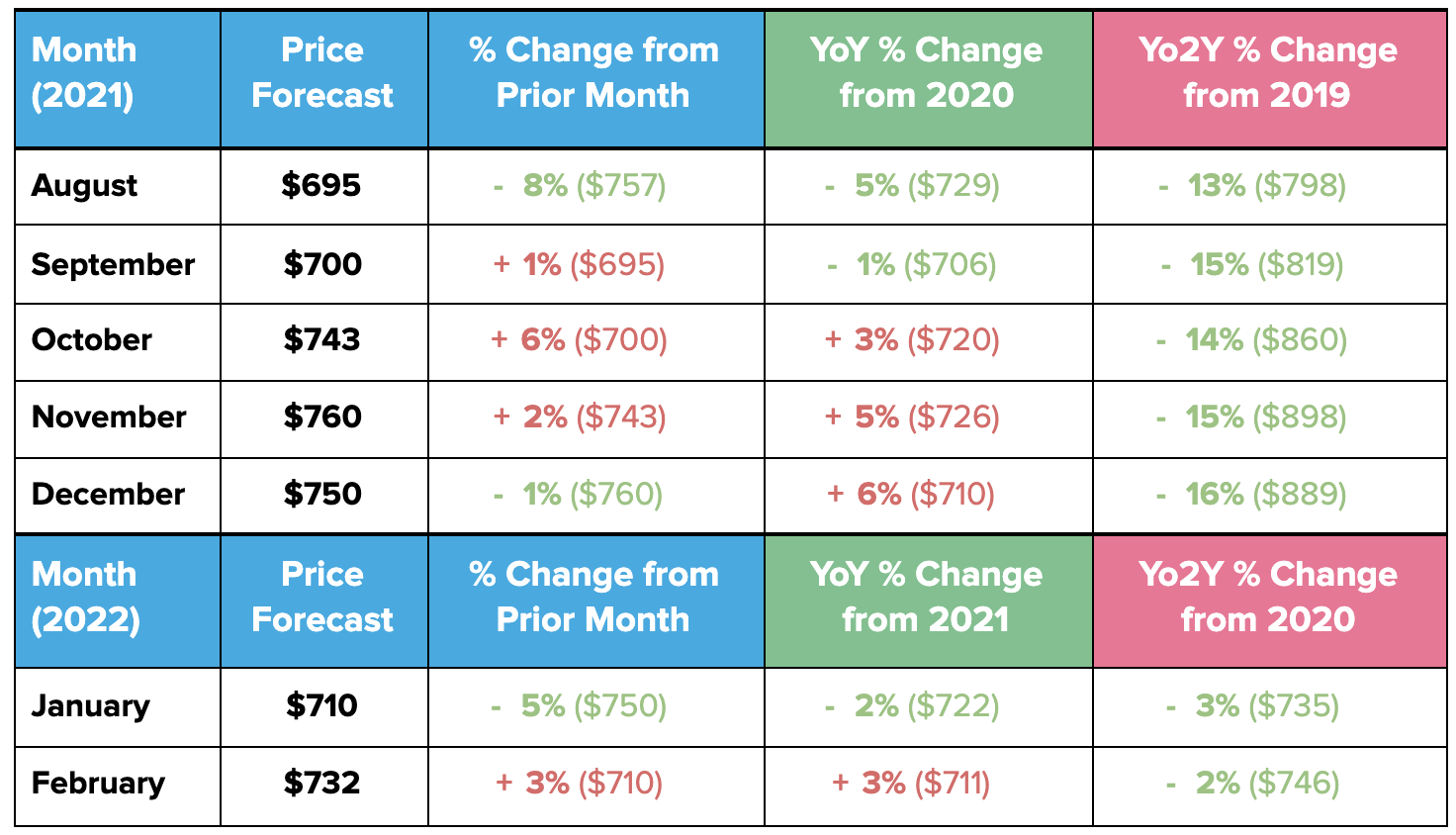

International: We’re expecting international airfare to decline 8% between July and September (from $757/rt to $700/rt). From there, we’re forecasting a rise of 9% ($700/rt to $760/rt) prior to the holiday season.

Destination Trends

Most Popular Searches (Where are most people thinking of going?)

Domestic: Las Vegas (#1), Denver (#2), and Los Angeles (#3) topped the most popular destinations in searches for domestic fall flights.

International: San Juan (#1), London (#2), and Cancun (#3) topped the most popular destinations in searches for international fall flights.

Trending Searches (What’s rising the quickest in search interest?)

Domestic: Burbank (#1), New York City (#2), and San Jose (#3) topped our domestic trending destination list. California performed especially well, seeing 6 cities in the Top 20 trending domestic destinations -- the most of any state.

International: Santo Domingo, Dominican Republic (#1), Bogotá, Colombia (#2), and Punta Cana, Dominican Republic (#3) were the highest trending international destinations for the fall. Toronto (#5) grabbed a spot in the Top 10 after Canada reopened to fully vaccinated U.S. travelers. London (#7) also trended up strongly amid dropping travel restrictions.

Most Popular Bookings (Where are Hopper users headed?)

Since Hopper users tend to skew towards younger leisure travelers, our bookings also tend to reflect this demographic’s interests.

Domestic: Las Vegas (#1), Orlando (#2), and Miami (#3) were the most booked fall domestic destinations.

International: Cancun, Mexico (#1), San Juan, Puerto Rico (#2), and San Jose del Cabo, Mexico (#3) were the most booked fall international destinations.

Search Traffic + Demand Trends

When is Demand Clustering in 2021?

Domestic: Labor Day weekend domestic search demand is sending strong recovery signals, comparable to mid-July travel demand.

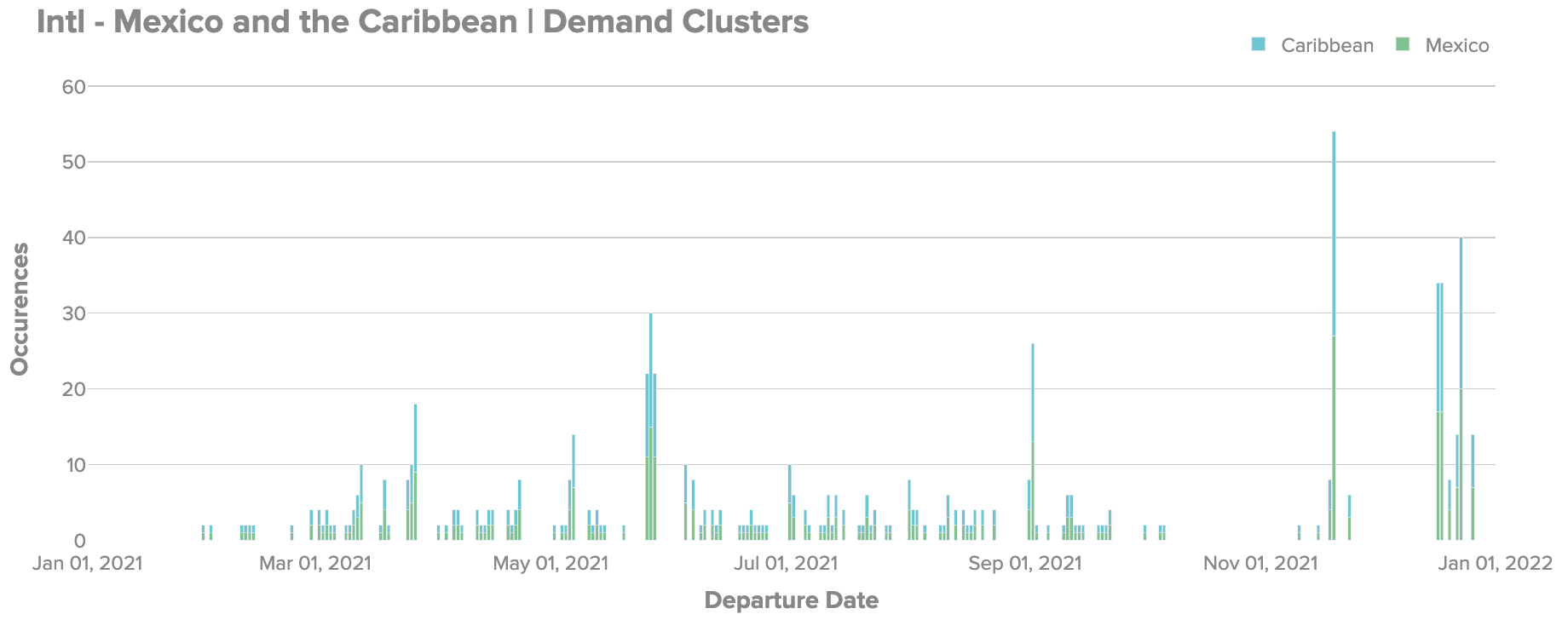

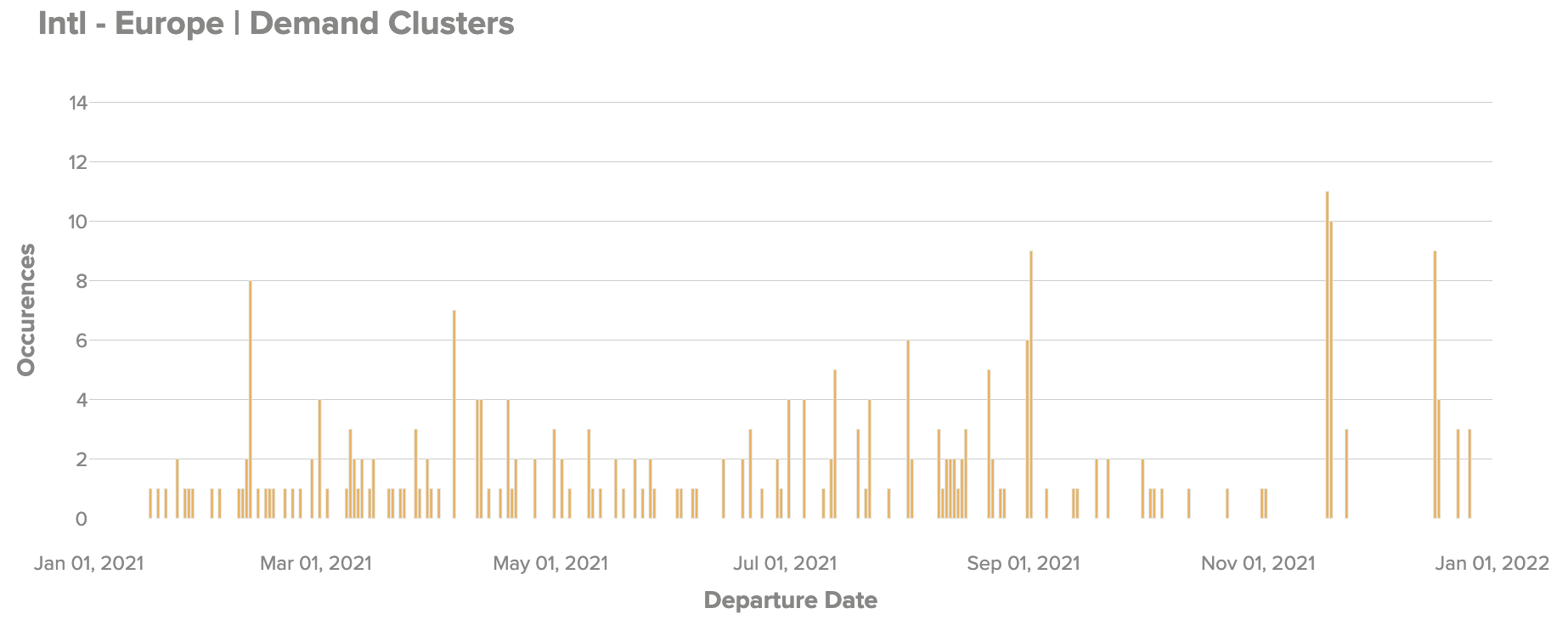

International: The strongest signal at the moment is for Christmas and New Year’s for Mexico, Central America, and the Caribbean. Europe is seeing a cluster of search interest in mid-August, the first week of September, and Thanksgiving.

How far are travelers booking in advance?

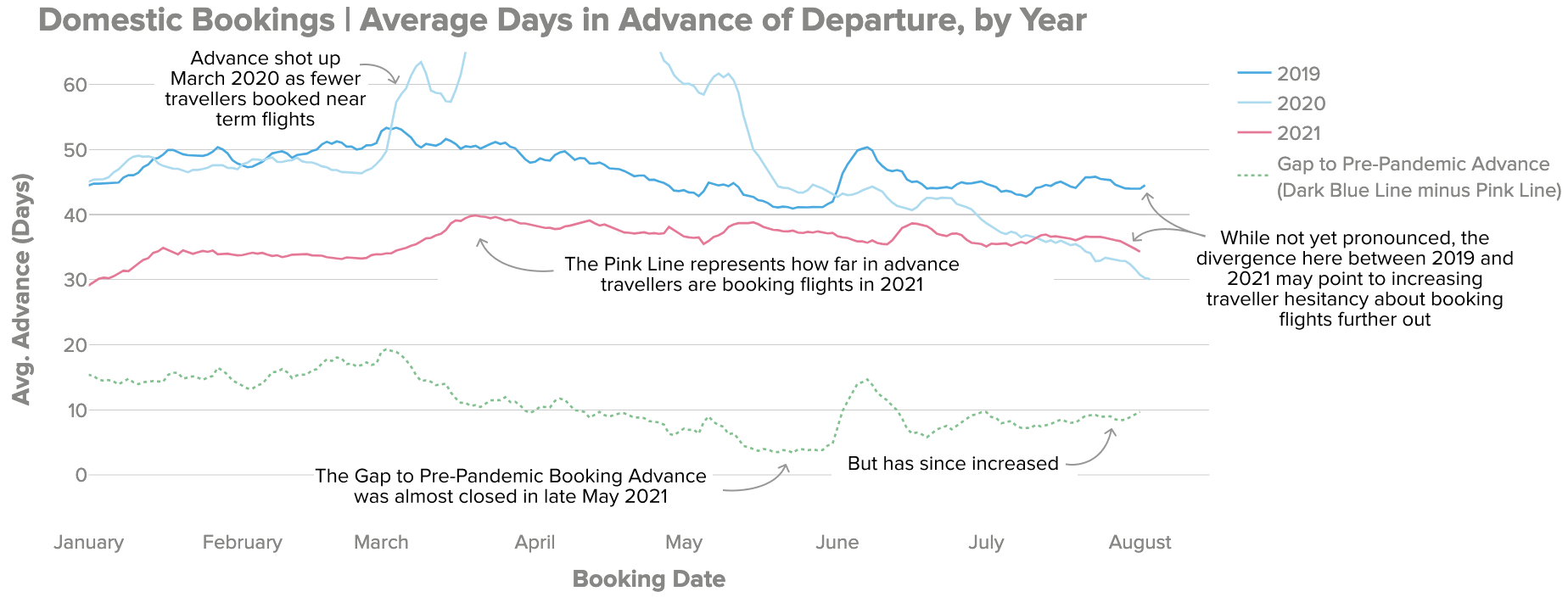

Domestic: Pre-pandemic, travelers booked domestic flights around 45-50 days in advance. Currently, they are booking flights around 35 days in advance, up from 30 days at the start of the year but down from 39 days in early June. This suggests travelers are feeling slightly less confident about booking flights further out, and indicates a reversal (albeit rather modest thus far) from the relatively higher confidence we saw in late May and early June.

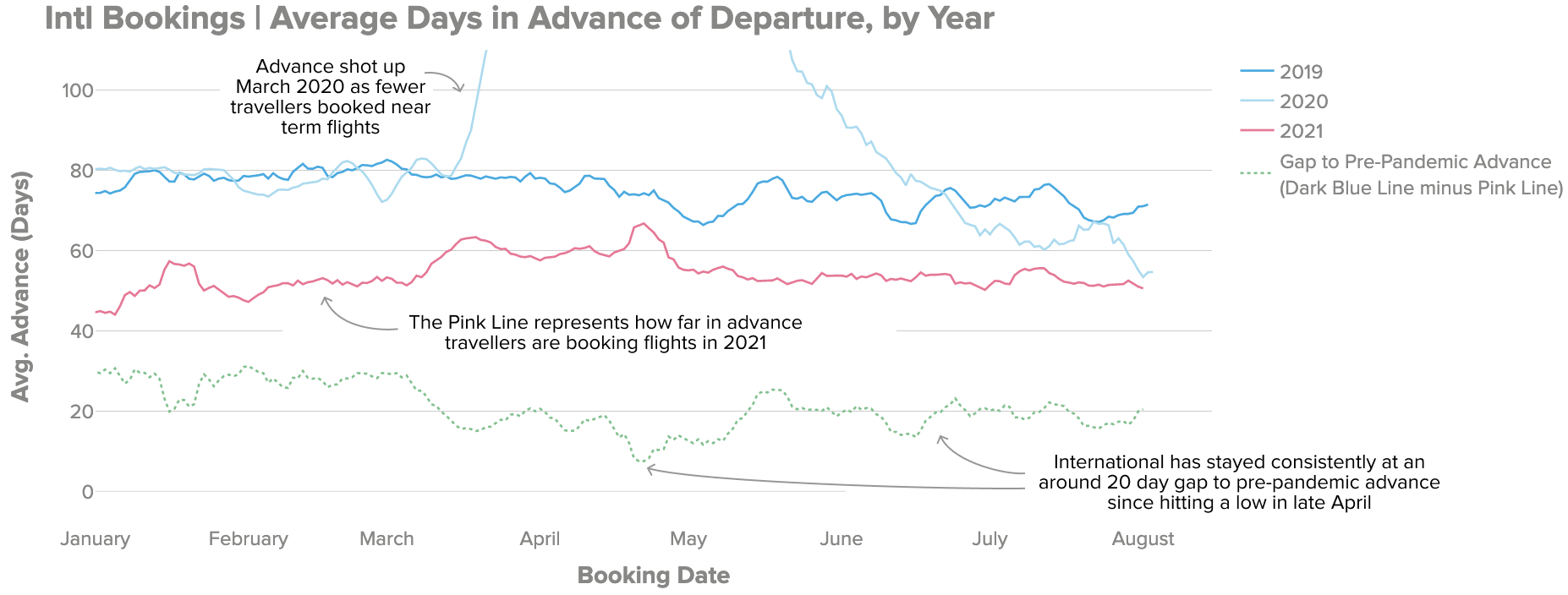

International: Pre-pandemic, travelers booked international flights around 70 days in advance. Currently, they are booking flights around 50 days in advance, up from 45 days at the start of the year. The gap between current advance and 2019 (pre-pandemic) advance has hovered around 20 days for international flights since mid-May. This implies to lingering hesitancy from travelers about booking international travel too far in advance.

Airfare Pricing Trends

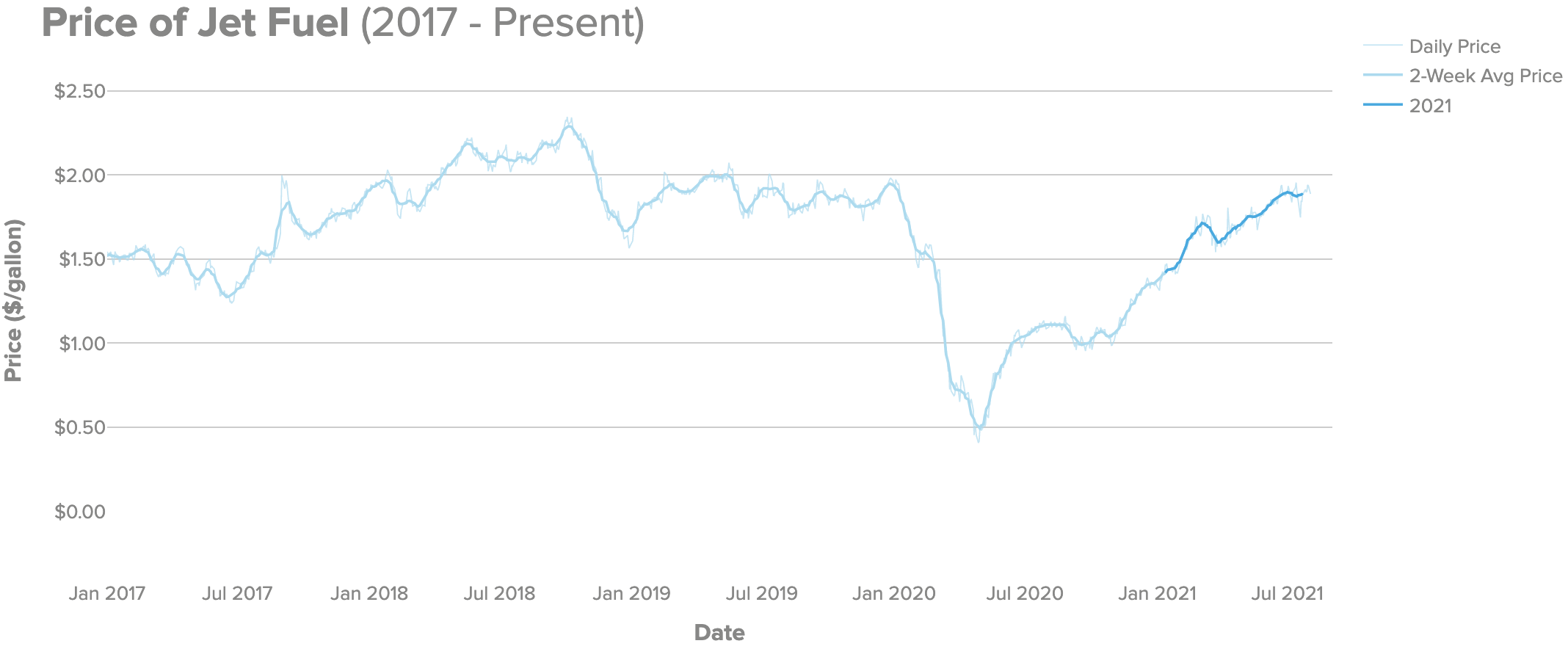

Price of Jet Fuel

The price of jet fuel according to the EIA is currently hovering at $1.90/gallon, up 32% since the start of the year and equivalent to jet fuel prices around September 2019. The steady increase in jet fuel prices will likely contribute to additional upwards pressure on airfare heading into the fall shoulder season.

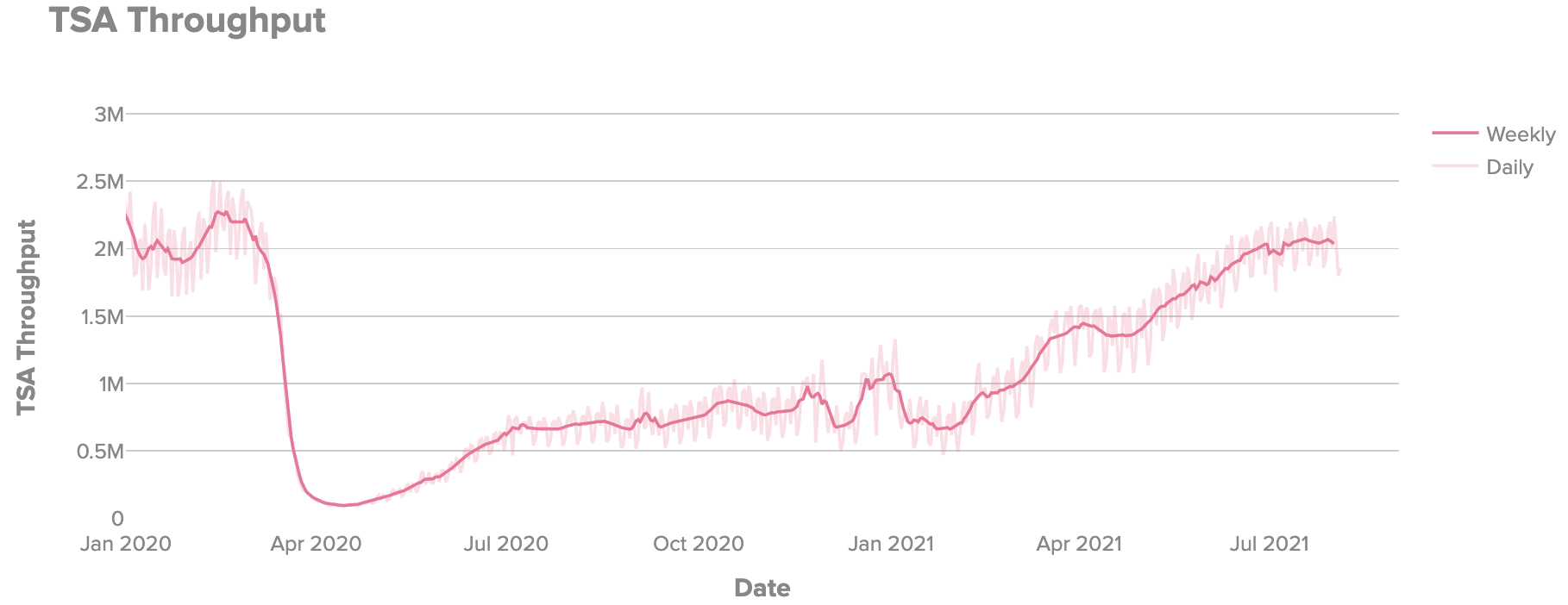

TSA Throughput

The daily number of travelers at TSA checkpoints in the U.S. crossed over the 2M level for the first time since the start of the pandemic on June 13th. Traveller numbers have since trended steadily at the 2M level, down about 20% from around 2.6M this time in 2019.

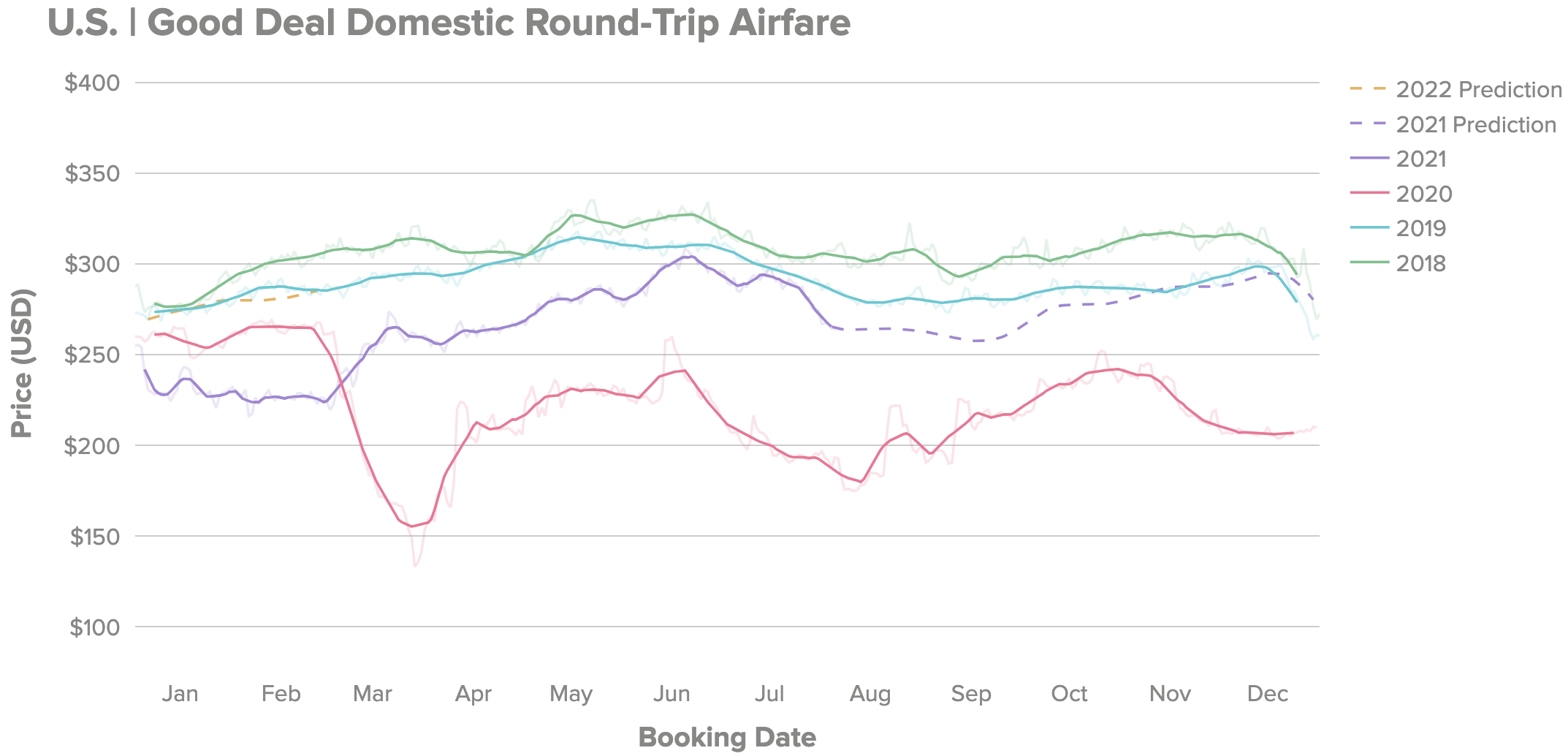

Domestic Consumer Airfare Prices

Domestic airfare was steadily decreasing each year prior to the Covid-19 pandemic. Domestic airfare averaged $315, $306, and $291 per round-trip in 2017, 2018, 2019 respectively. In the wake of the Covid-19 pandemic in 2020, airfare plummeted 25% ($60) to an average of $220/round-trip. Thus far in 2021, domestic round-trip airfare has averaged $262 (up 19% from 2020), and we’re forecasting that to climb to an average of $268 by year end (up 22% from 2020).

We usually see prices rise into the summer, fall in the autumn shoulder season, and rise again into the holiday season. This year, we expect prices to fall relatively less after the summer, and spike more into the holidays as airlines capitalize on the improving domestic travel outlook.

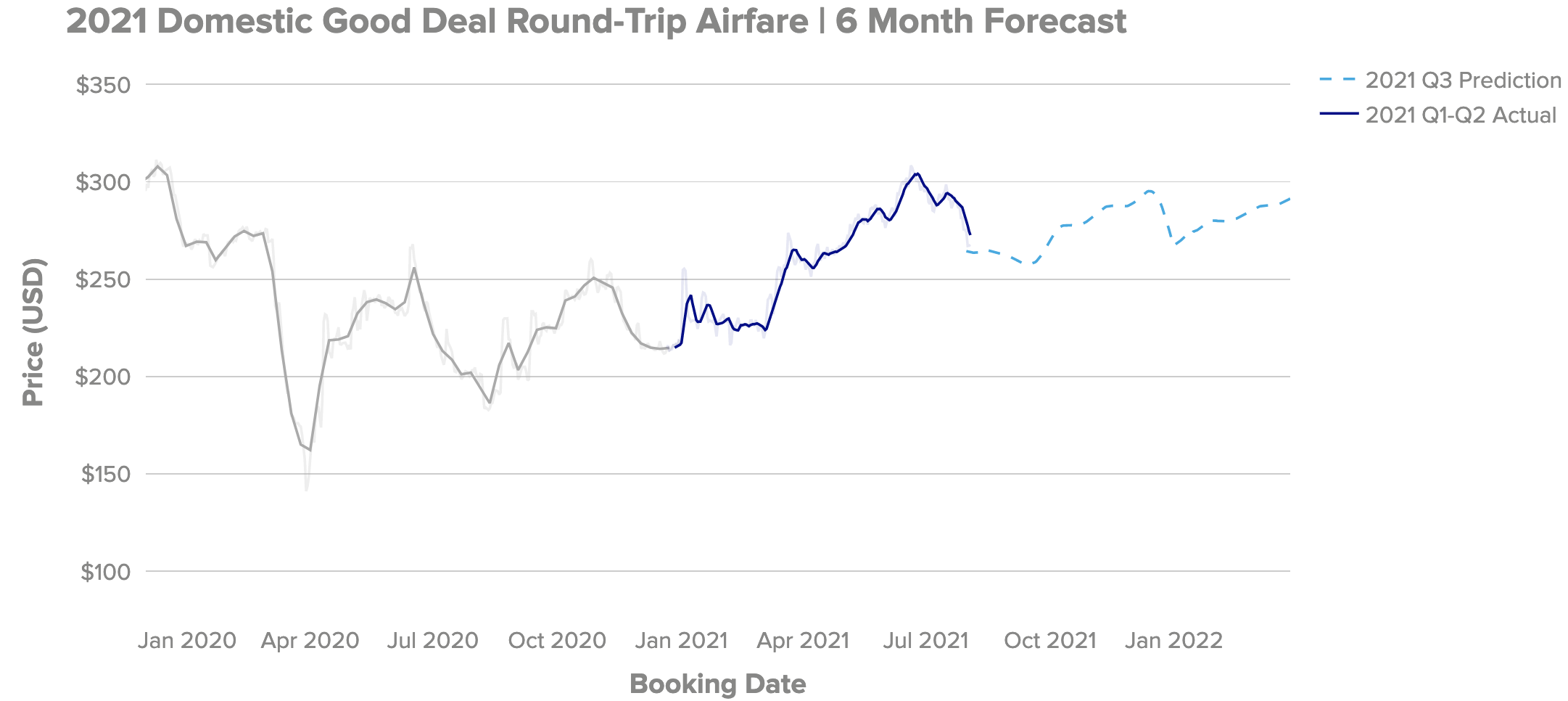

Six-Month Price Forecast (Domestic)

Factors Pushing Up Airfare

Pent Up Travel Demand: Since late February, we’ve seen pent-up travel demand unleashed on the domestic air market. Airfare rose 36% between March 1st and June 20th, peaking just before the July 4th weekend. While we expect the resurgence in travel demand to taper off seasonally heading into the fall shoulder season (and as TSA throughput approaches pre-pandemic levels), we think the effect of pent up demand will “linger” in the upcoming months, especially given last year’s somewhat muted holiday travel season.

Jet Fuel Prices: Having risen 32% in 2021 thus far, jet fuel prices returning to Autumn 2019 levels at $1.90/gallon will provide upwards pressure on airfare.

Factors Countering the Rise in Airfare

Seasonality of Travel Demand: Travel demand has seasonal peaks during the summer and holiday season, with lower demand (and thus airfare) often observed during the “fall shoulder season”. In the years 2018-2020, airfare dropped 10%, 9%, and 15% respectively going into the autumn. This year, we’re expecting a 10% drop ($288/rt in July to a bottom of around $260/rt in September).

Delta Variant Concerns: It’s possible that concerns and travel restrictions over Covid-19’s Delta variant may dampen demand for autumn travel, which would correspond with lower than forecasted airfare. Domestic search volumes are down 9% MoM from their peak in July, but this decline is not yet significant and could be due to seasonality as we come off the peak of summer travel in July. We’re not yet seeing any impact in domestic air bookings.

Returning full seating capacity and fleets into operation: OAG reported that the U.S. domestic market’s seat capacity in July 2021 was just 11% below 2019 levels. With airlines continuing to return planes back to operation, the additional seat capacity will offer some downward pressure on airfare.

Domestic Airfare Forecast

We’re expecting airfare to drop a total of 10% ($288/rt to $260/rt) into September, primarily driven by seasonally lower demand over the fall shoulder season. The good news for travelers is that although we had initially anticipated a shallower dip in airfare this fall, this is a similar decline to what we saw in 2018 and 2019. After September, we’re expecting prices to rise a total of 11% ($260/rt to $289) going into December. We forecast domestic airfare this holiday season to be about equivalent to summer airfare, similar to what we saw in 2019 and 2020.

Forecast by Month

We forecast Fall 2021 (September to November) will average $274 for round-trip domestic airfare, up 22% from Fall 2020 ($224), but down 4% from Fall 2019 ($284).

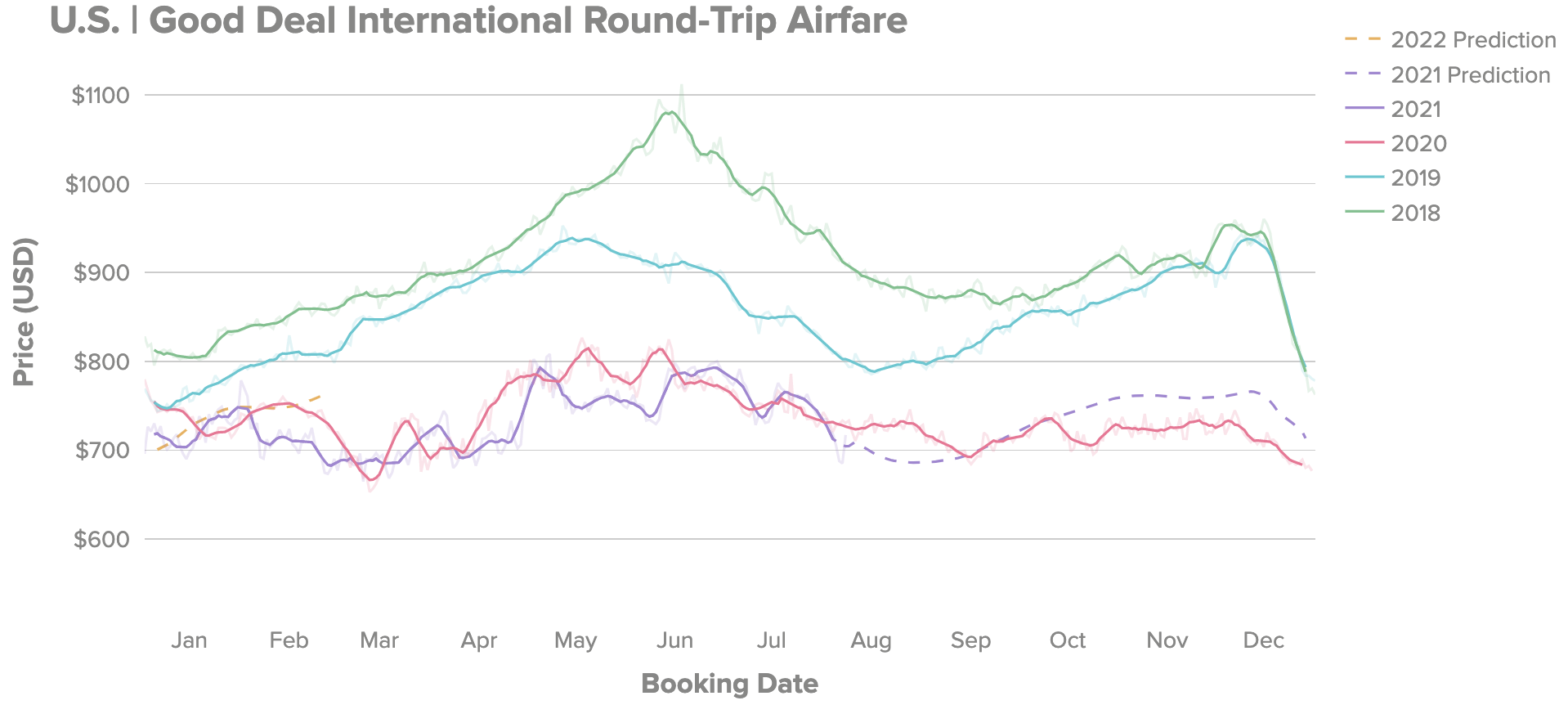

International Consumer Airfare Prices

International round-trip airfare averaged $857, $911, and $854 in 2017, 2018, and 2019 respectively. In 2020, we saw record low international airfare averaging $735. Unlike domestic airfare, which we forecasted to rise an average of 22% from 2020, we expect international airfare to remain nearly consistent with 2020 levels at just $732. While the trans-Atlantic market is in the early stages of recovering, amid varying travel restrictions and the continued near standstill of the trans-Pacific market, international airfare has tracked closely with 2020 prices.

Our forecast of international airfare prices suggests prices will reach new lows for the fall season in August and September (at under $700/rt on average), before tracking closely with 2020 until mid-October. From there, prices will exceed 2020 levels by about 5-6%, but remain still well below 2019 levels by around 15%.

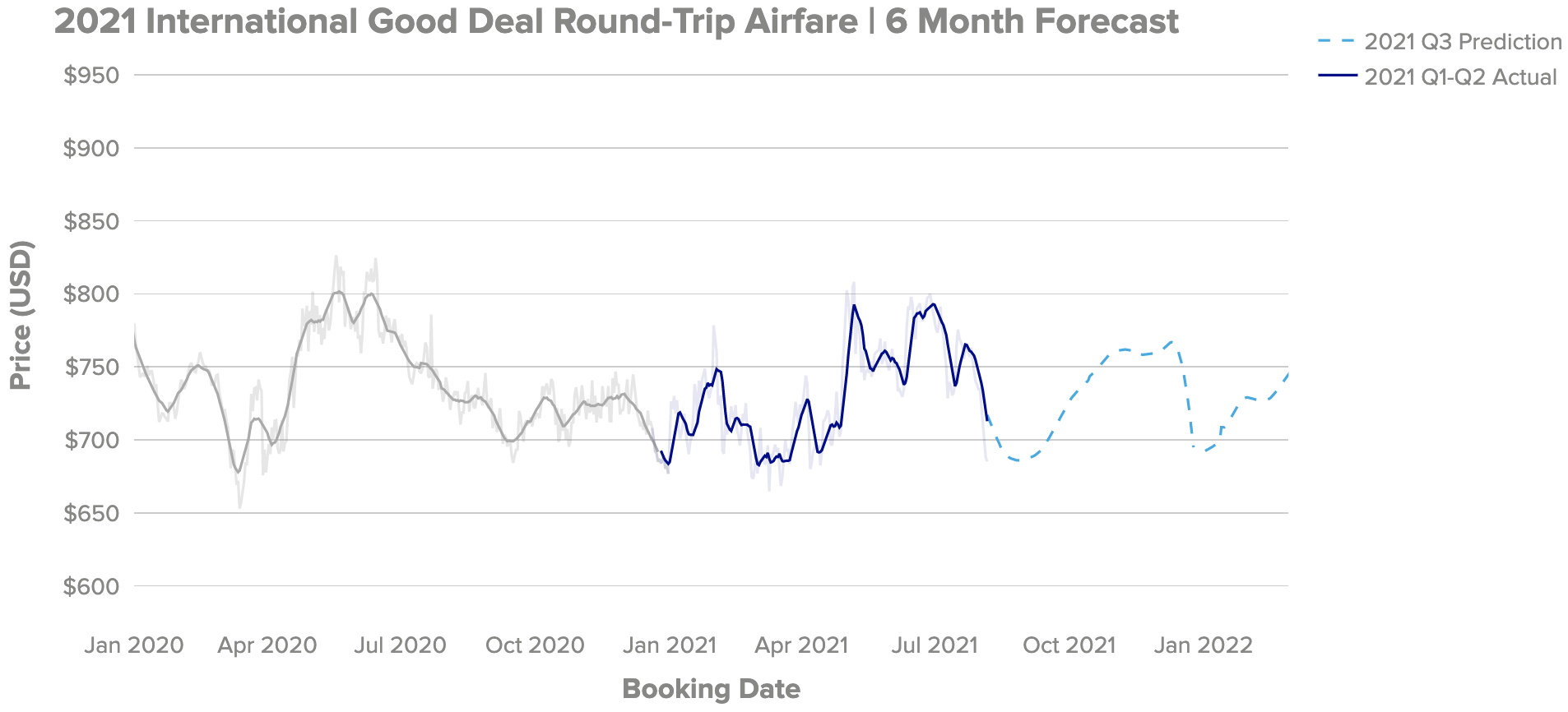

Six-Month Price Forecast (International)

Factors Pushing Up Airfare

Heavy Travel Restrictions ⇒ Few Operating Flights: Carriers have had to significantly reduce flights to countries with tight travel restrictions. With less supply and competition, prices are higher for flights to countries with significant travel restrictions.

Stronger Demand to Reopened Destinations: When an international destination reopens, we’ve seen a resurgence in search demand to that destination. Higher demand will drive higher airfare for reopened destinations.

Factors Countering the Rise in Airfare

Piecemeal Re-Openings ⇒ More Operating Flights: As a counterpoint to the one above, we’ve seen some destinations (like Iceland) drop in airfare upon re-opening. Reopening a country can enable more competition and increase the supply of seats sold, which tends to lower airfare in some cases.

Seasonal Effects: Similar to domestic travel, summer tends to be the peak travel season for international flights from the U.S. Heading into the fall season, we expect lower prices for international travel as well.

Delta Variant Related Restrictions: Travel and border restrictions over Covid-19’s Delta variant may also dampen demand for international autumn travel, which would correspond with lower than forecasted airfare. International booking volumes on Hopper started to level off in late-July, but there has not been a notable downtrend in international bookings. International searches were down 12% MoM from their peak in the summer, which is higher than the 9% dip we saw in domestic searches. This is a more noteworthy decline in search volume that we will monitor to see if it is sustained. As a very preliminary signal, it may point to lessening international travel demand over Delta variant related concerns and restrictions.

International Airfare Forecast

The way carriers are adjusting prices for international flights later this year appears very similar to the second half of 2020. We’re expecting international airfare to decline 8% between July and September (from $757/rt to $700/rt). From there, we’re forecasting a rise of 9% ($700/rt to $760/rt) prior to the holiday season.

Forecast by Month

We forecast Fall 2021 (September to November) will average $734 for round-trip international airfare, up 2% from Fall 2020 ($717), but down 15% from Fall 2019 ($859).

Searches | Fall 2021 Most Popular Destinations

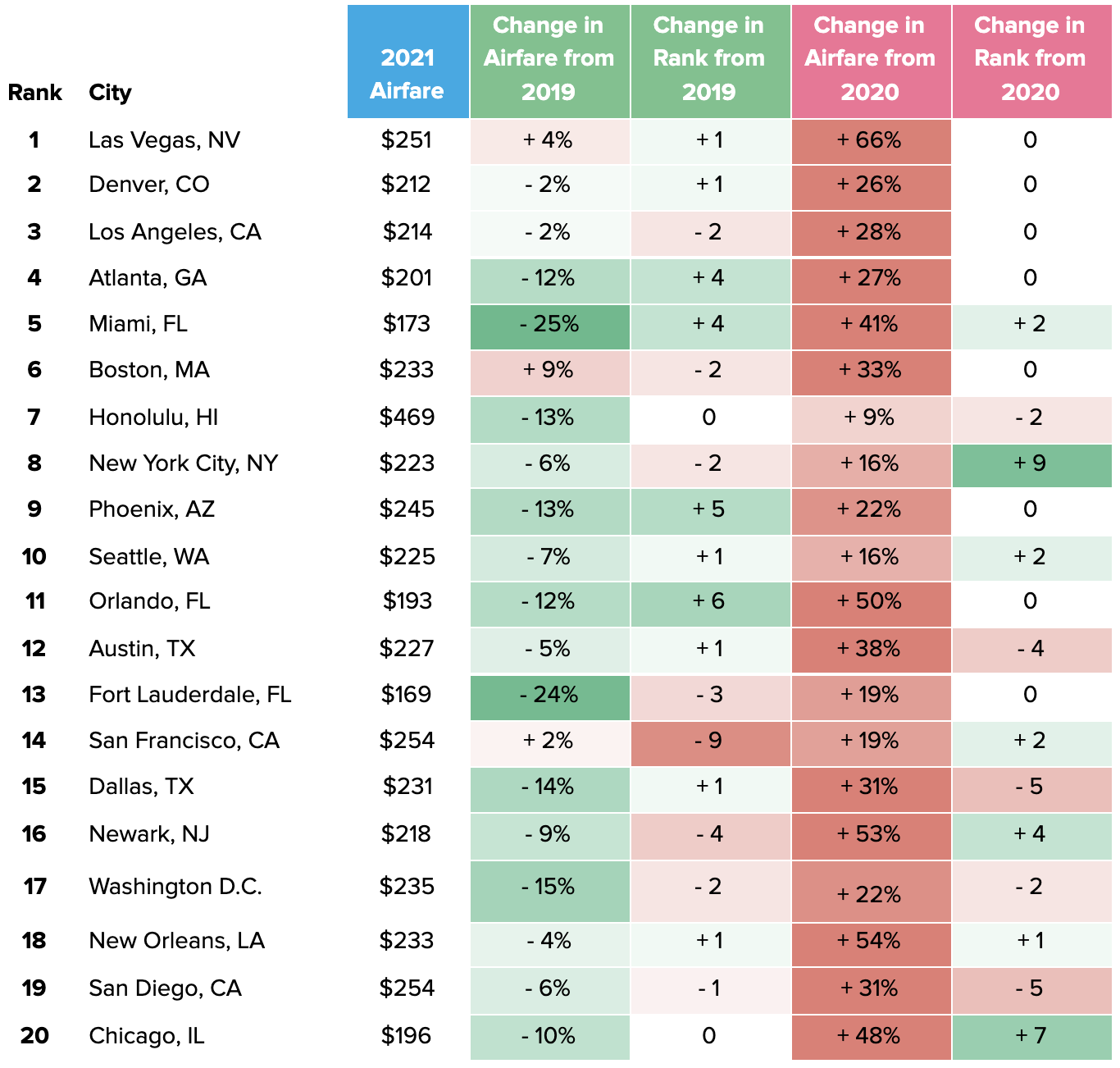

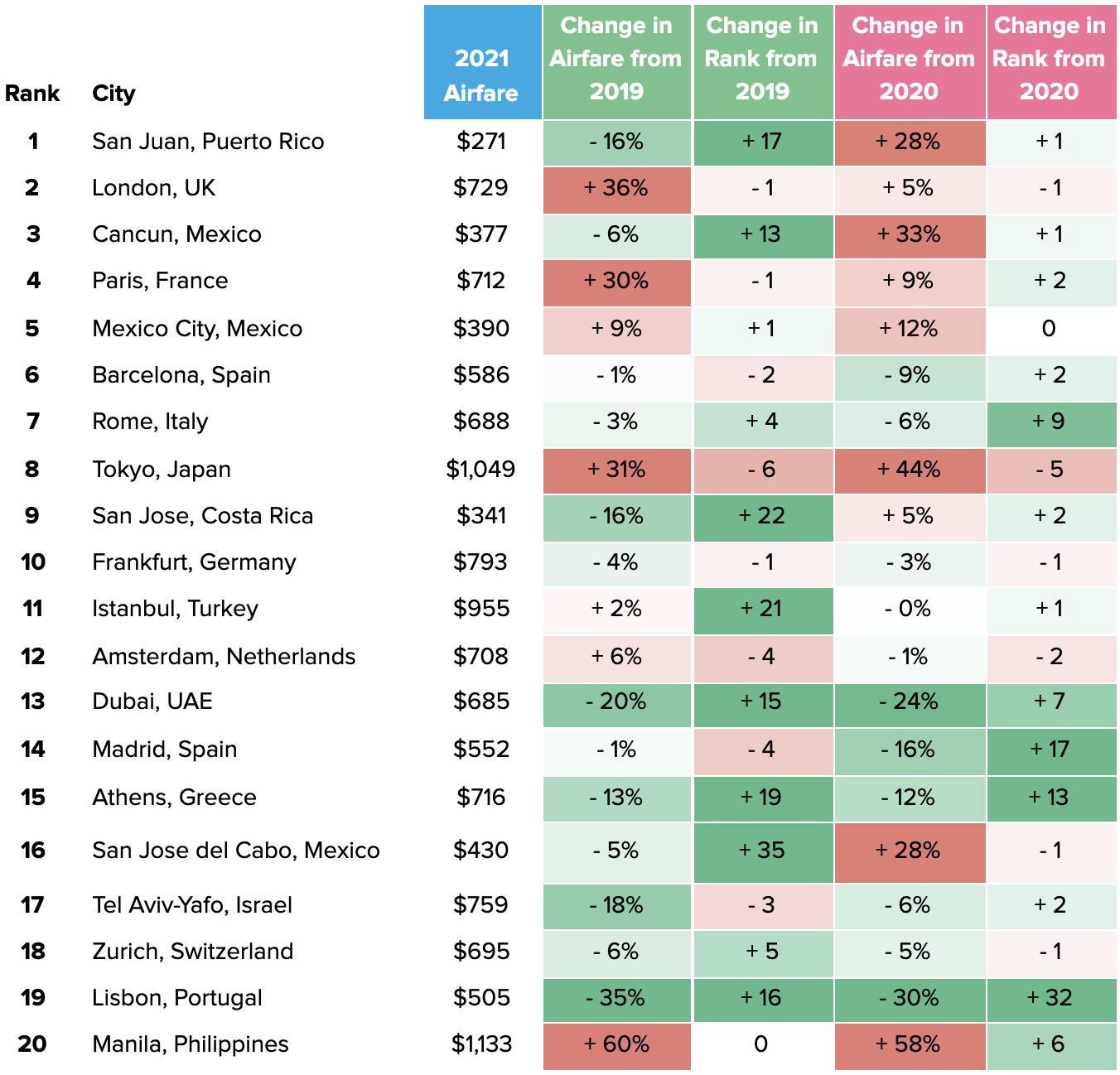

Most Popular Methodology: Hopper collects, from several Global Distribution System partners, 25 to 30 billion airfare price quotes every day from searches happening all across the web. Here we simply rank destinations by which ones have received the most searches in the last 6 weeks, filtering for fall departures dates (September 1st to November 30th, 2021). Think of most popular as a measure of “Where are most people thinking of going?” Note that this does tend to favor larger cities.

Domestic: Las Vegas (#1), Denver (#2), and Los Angeles (#3) topped the most popular destinations in searches for domestic fall flights. Compared to the summer, Miami dropped 2 spots while Los Angeles moved up one spot. The top four in the list match rankings from this time in 2020, but further down the list we’re seeing some interesting movement. New York City (#8) is up 9 places, making it the 8th most popular destination in domestic searches. This indicates a renewal in travel demand for the country’s largest metro, and a welcome signal of returning confidence in big city travel. Chicago (#20) moved up 7 spots to nab 20th, where it used to sit in 2019.

International: San Juan (#1), London (#2), and Cancun (#3) topped the most popular destinations in searches for international fall flights. With England dropping travel restrictions for fully vaccinated U.S. travellers, London moved up two spots from the summer and is quickly returning to the #1 spot it used to hold in 2019. Mexico and the Caribbean have been popular international getaways throughout the pandemic and continue to see proportionally higher international search interest, with Puerto Rico (#1), Cancun (#2), Mexico City (#5), Costa Rica (#9), and Cabo (#16) all in the Top 20. Further down the list, Spain (#14), Greece (#15), and Portugal (#19) have made a big return this year compared to 2020, with the EU lowering travel restrictions for fully vaccinated U.S. travellers. With some of the strictest travel restrictions even as the host of the Olympics, Tokyo (#8) moved down relative to prior years the most among the cities in the Top 10, holding the same spot it did for the summer.

Domestic | Fall 2021 Most Popular In Searches

International | Fall 2021 Most Popular In Searches

Searches | Fall 2021 Trending Destinations

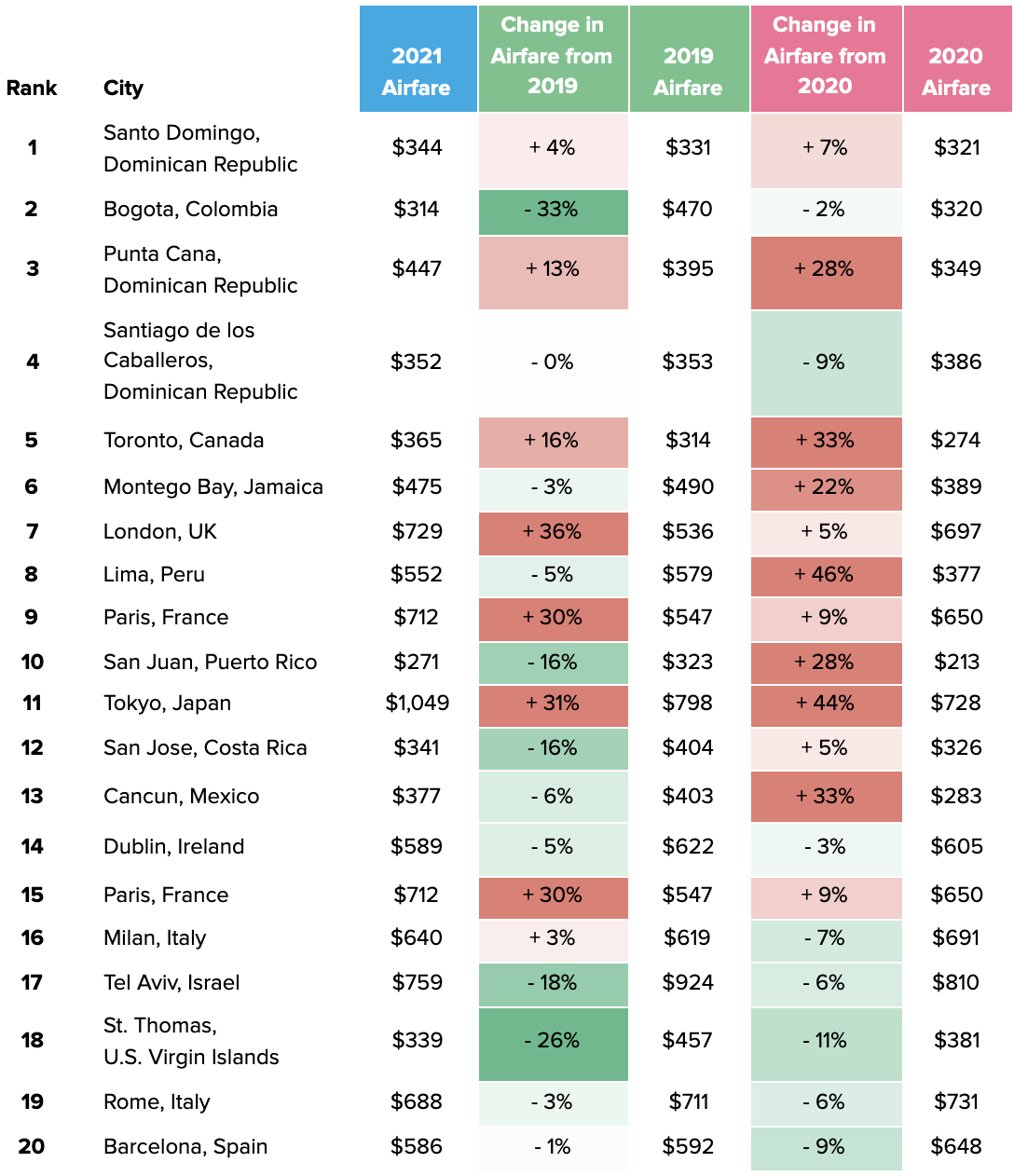

Trending Methodology: Hopper collects, from several Global Distribution System partners, 25 to 30 billion airfare price quotes every day from searches happening all across the web. We use our search traffic data to track the rate of increase in searches for a destination over the latest 6 week period, filtering for fall departures dates (September 1st to November 30th, 2021). We rank cities by their rate of increase in search volume. This does not necessarily represent what’s most popular with travellers, but rather what’s quickly becoming more popular.

Domestic: Burbank (#1), New York City (#2), and San Jose (#3) topped our domestic trending destination list. California performed especially well, seeing 6 cities in the Top 20 trending domestic destinations -- the most of any state. Fort Lauderdale (#7) has some of the best deals on airfare right now, with round-trips averaging just $169, over 24% off 2019 prices. Popular outdoor destinations in Colorado such as Colorado Springs (#12), Aspen (#16), and Vail (#20) are also trending high for the fall season. New York City (#2), which moved up a whopping 9 spots on the most popular ranking, is second on our highest trending domestic destination list.

International: Santo Domingo, Dominican Republic (#1), Bogotá, Colombia (#2), and Punta Cana, Dominican Republic (#3) were the highest trending international destinations for the fall. Toronto (#5) grabbed a spot in the Top 10 after Canada reopened to fully vaccinated U.S. travellers. London (#7) also trended up strongly amid dropping travel restrictions. The list is primarily a mix of European and Caribbean destinations. Olympic host Tokyo was the only Asian destination to appear on the list at #11, although spectators are barred from the games this summer.

Domestic | Fall 2021 Trending Destinations

International | Fall 2021 Trending Destinations

Bookings | Fall 2021 Most Booked Destinations

Please note: Since Hopper users tend to skew towards younger leisure travelers, our bookings also tend to reflect this demographic’s interests. We’d suggest “Most Popular in Searches” above for popular destinations more representative of the overall population.

Domestic: Las Vegas (#1), Orlando (#2), and Miami (#3) topped the most booked summer domestic destinations. These three matched the most booked destinations this summer. Since the summer, Seattle, Atlanta, and Fort Lauderdale dropped out of the Top 10, replaced by New Orleans, Nashville, and Boston.

International: Cancun (#1), San Juan (#2), and San Jose del Cabo (#3) topped the most booked summer international destinations. The dominance of Mexican and Caribbean destinations on our most booked rankings seems to be waning. Four Caribbean destinations have fallen off the list, replaced by San Salvador (#7), Paris (#8), London (#9), and Rome (#10). Puerto Vallarta (#5) replaced Punta Cana as the fifth most booked international destination, coincidentally also in the Dominican Republic.

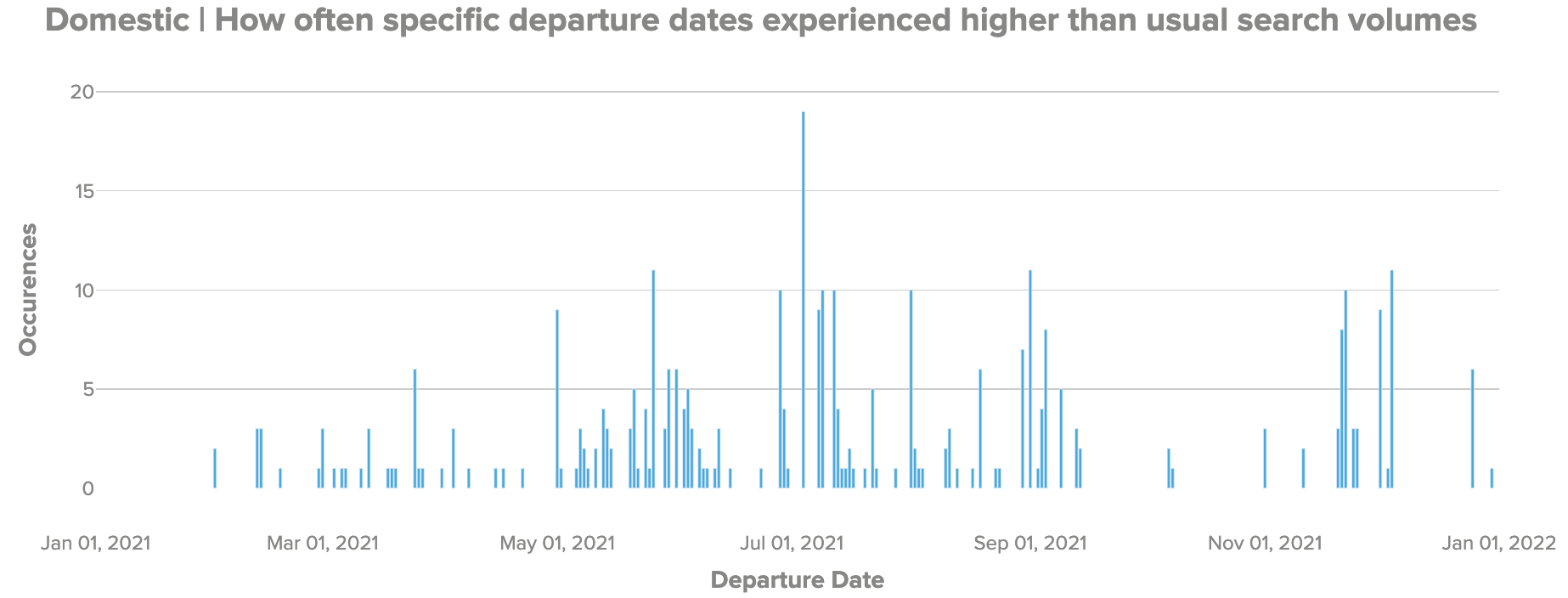

Where is Demand Clustering?

We took a look at which dates tended to have higher than usual search volumes. While this does highlight holidays that are especially popular for travelers, it also reveals other dates that might see higher travel.

Domestic | Labor Day Weekend and Thanksgiving

Labor Day weekend domestic search demand is sending strong recovery signals, comparable to mid-July travel demand. Mid-July (July 18th specifically) saw a record number of passengers at TSA checkpoints since the beginning of the pandemic with 2.23M, so we’re expecting Labor Day weekend to be especially busy as well. Further out, Thanksgiving is seeing a strong clustering of demand that is already beginning to rival Labor Day demand. Given that Thanksgiving is further away, this represents an even stronger signal. October appears to be a lull, with almost no travel dates seeing notably high search demand. This could be a good time for those looking to beat the crowds at otherwise popular destinations.

We’re seeing early December travel dates experiencing high volumes, but mid-to-late December departure dates around the holidays haven’t yet trended up as much as Thanksgiving. That may just be because those dates are further out, and thus sending a weaker signal.

International | Varies by Region

International demand varies significantly by region due to varying travel restrictions and timelines. The strongest signal at the moment is for Christmas and New Year’s for Mexico, Central America, and the Caribbean. Europe is seeing a cluster of search interest in mid-August, the first week of September, and Thanksgiving. Canada is not seeing any notable demand clusters, while Asia, South America, and Africa and the Middle East are also seeing their strongest demand around Thanksgiving and Christmas.

Mexico, Central America, & the Caribbean : Christmas

Europe: mid-August, first week of September, and Thanksgiving

How far in Advance are Travelers Booking Flights?

Since Summer 2020, we’ve seen travelers booking closer to their date of departure. This makes sense in an environment where there can be uncertainty about how travel regulations and the pandemic itself will progress further down the line. How far travelers book in advance is a signal of traveller confidence, and here we compare it to pre-pandemic levels for context.

Domestic | 35 Days

Pre-pandemic, travelers booked domestic flights around 45-50 days in advance. Currently, they are booking flights around 35 days in advance, up from 30 days at the start of the year but down from 39 days in early June. The gap to pre-pandemic booking advance is now around 10 days for domestic flights, and is growing in early August. This suggests travelers are feeling slightly less confident about booking flights further out, and indicates a reversal (albeit rather modest thus far) from the relatively higher confidence we saw in late May and early June. While the divergence between 2021 and 2019 advance is not yet pronounced, it’s another early signal we are monitoring amid concerns about the Delta Variant.

International | 50 Days

Pre-pandemic, travelers booked international flights around 70 days in advance. Currently, they are booking flights around 50 days in advance, up from 45 days at the start of the year. The gap between current advance and 2019 (pre-pandemic) advance has hovered around 20 days for international flights since mid-May. This implies lingering hesitancy from travelers about booking international travel too far in advance.

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!