Consumer Airfare Index Report - January 2022

Domestic airfare will increase 7% monthly through June, reaching 2019 levels by April 2022.

Adit Damodaran - Wed Jan 19 2022

Summary:

Airfare Pricing Trends

Current Airfare: Domestic Airfare is relatively low at just $234/round-trip and International Airfare is at historical lows for January at just $649/round-trip.

Six-Month Airfare Forecast

Domestic: We forecast an average 7% increase in domestic airfare each month until June (topping out at $315/round-trip), with the highest increases in March. We expect to see 2019 prices around April 2022.

International: We expect airfare to increase an average of ~5% each month until June topping out at $830/round-trip, with the most significant increases between now and March as demand recovers following the Omicron variant wave.

Where are Travellers Going?

Most Popular Searches (Where are most people thinking of going?)

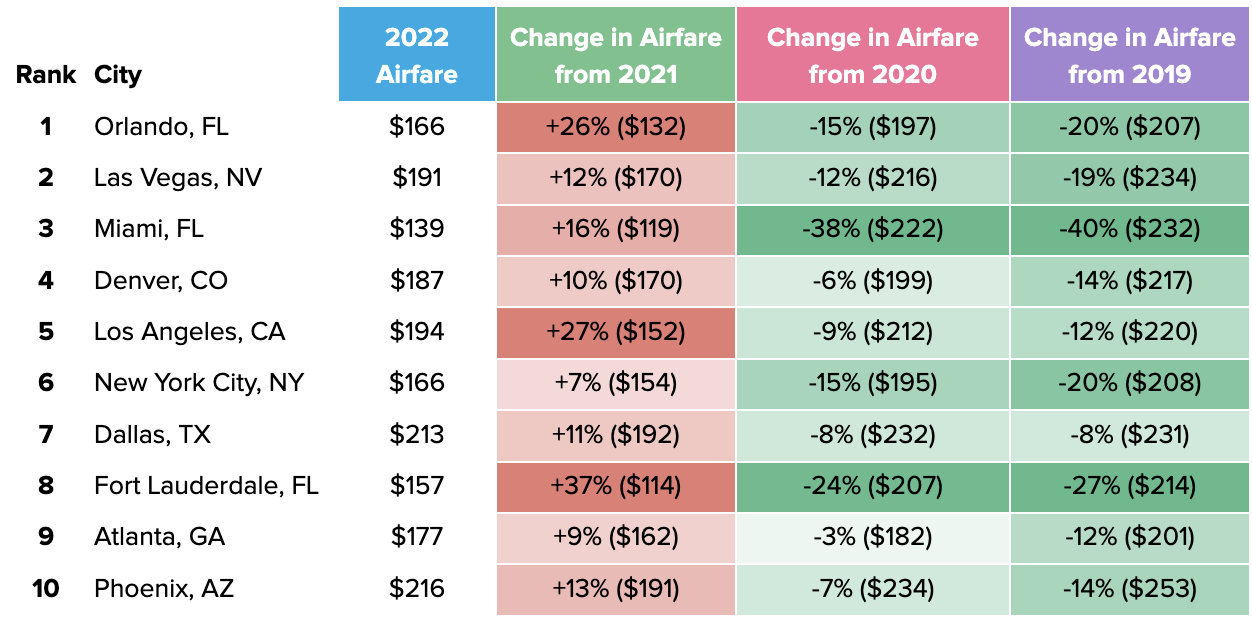

Domestic: Orlando, FL (#1), Las Vegas, NV (#2), and Miami, FL (#3) topped the most popular destinations in searches for domestic flights.

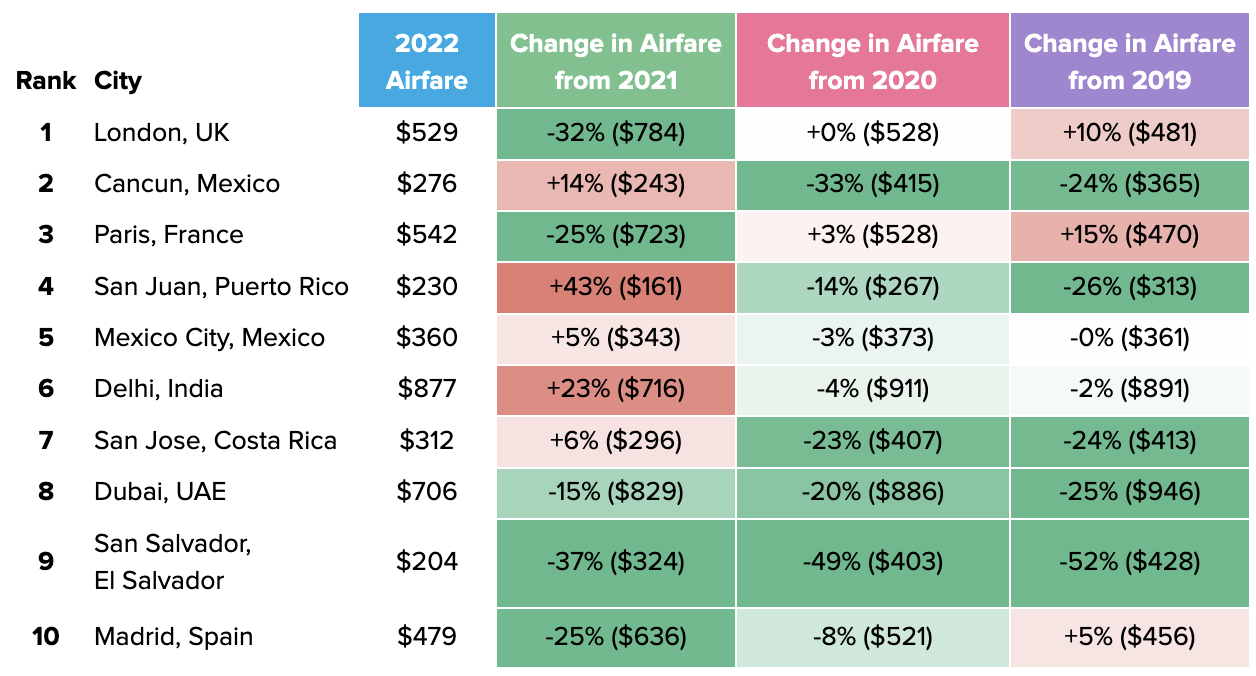

International: London, UK (#1), Cancun, Mexico (#2), and Paris, France (#3) topped the most popular destinations in searches for international flights.

Trending Searches (What’s rising the quickest in search interest?)

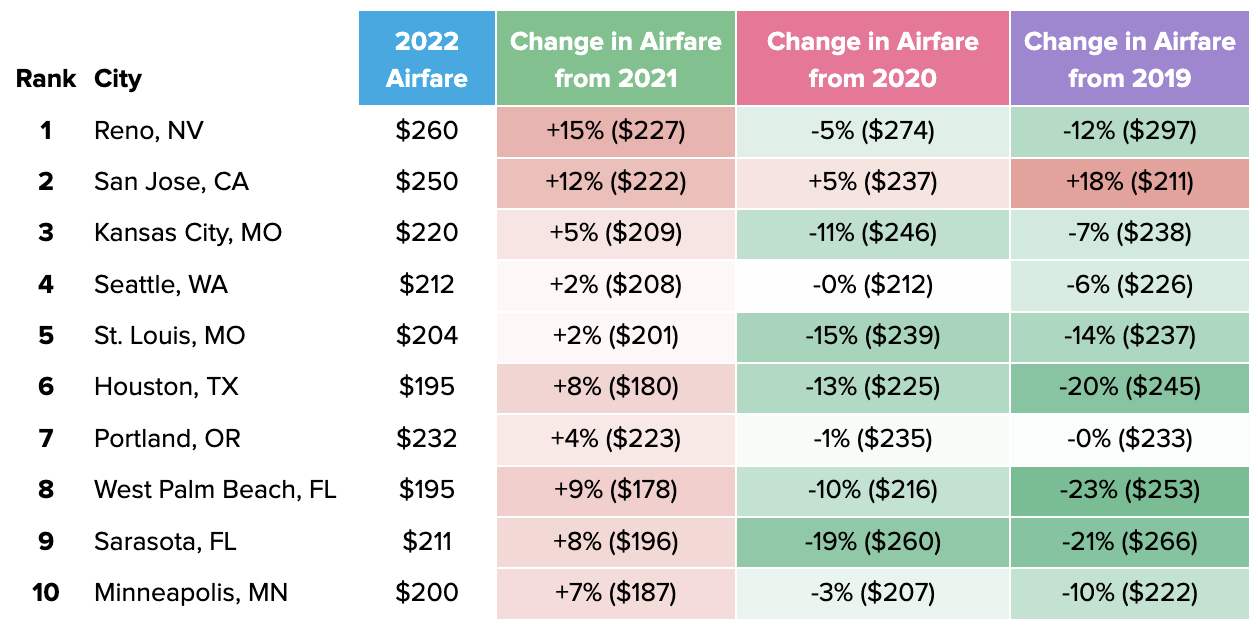

Domestic: Reno, NV (#1), San Jose, CA (#2), and Kansas City, MO (#3) were the highest trending domestic destinations.

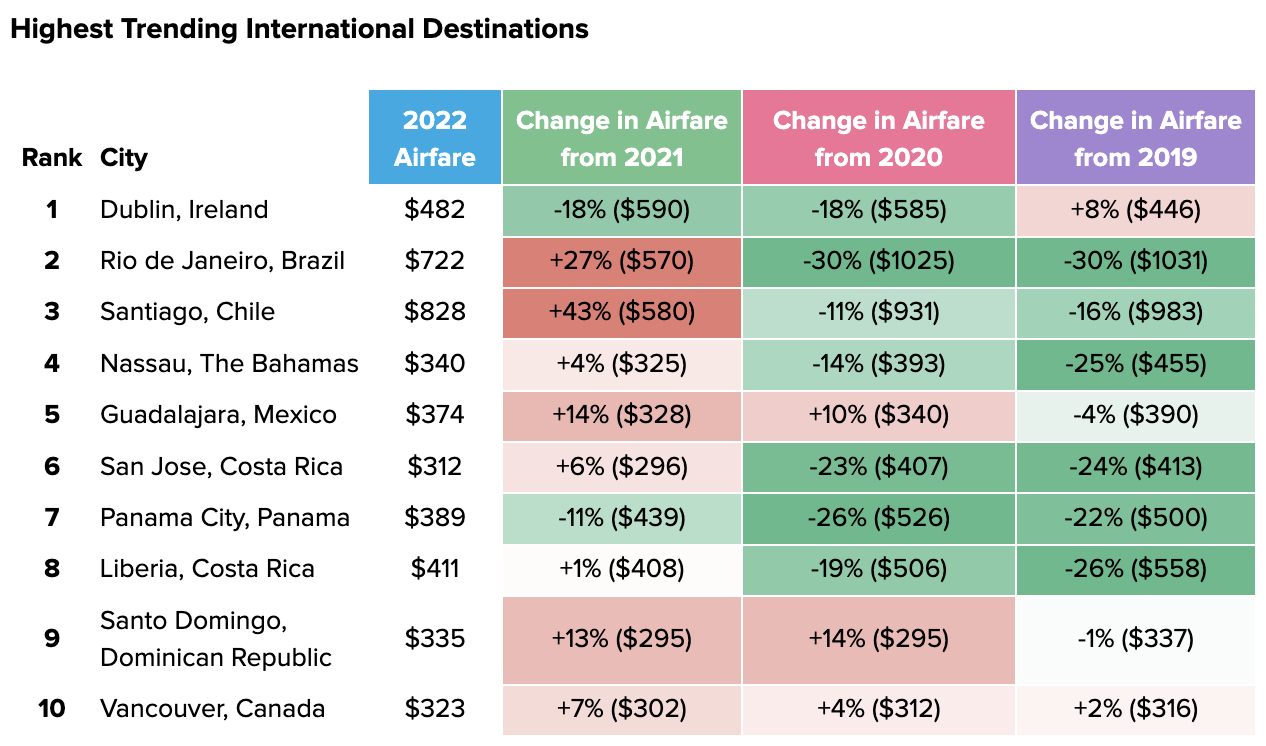

International: Dublin, Ireland (#1), Rio de Janeiro, Brazil (#2), and Santiago, Chile (#3) were the highest trending international destinations.

Most Popular Bookings (Where are Hopper users headed?)

Since Hopper users tend to skew towards younger leisure travelers, our bookings also tend to reflect this demographic’s interests.

Domestic: Las Vegas, NV (#1), Orlando, FL (#2), and Denver, CO (#3) were the most booked domestic destinations on Hopper.

International: Cancun, Mexico (#1), San Juan, Puerto Rico (#2), and San Jose del Cabo, Mexico (#3) were the most booked international destinations on Hopper.

Search Traffic + Demand Trends

When is Demand Clustering in 2021?

Domestic: The weekend following Valentine’s Day and mid-March appeared to see higher than expected domestic search volume. This might suggest a rough timeline for when travellers are expecting the situation with the Omicron variant to improve domestically.

International: For international destinations, it seems travellers are generally eyeing mid-March. Canada was one of the only international regions seeing earlier demand for February.

How far are travellers booking in advance?

Travellers continue to book closer to their dates of travel in an environment where there can be greater uncertainty about how the pandemic and corresponding travel restrictions may develop in the coming months.

Domestic: Travellers are booking domestic flights 35 days in advance on average, down from 45 days this time in January 2019 but up from 30 days this time last year.

International: Travellers are booking international flights 55 days in advance on average. This is quite a bit off of the 74 days in advance in January 2019. However, it is up from 45 days in advance this time last year.

Airfare Pricing Trends

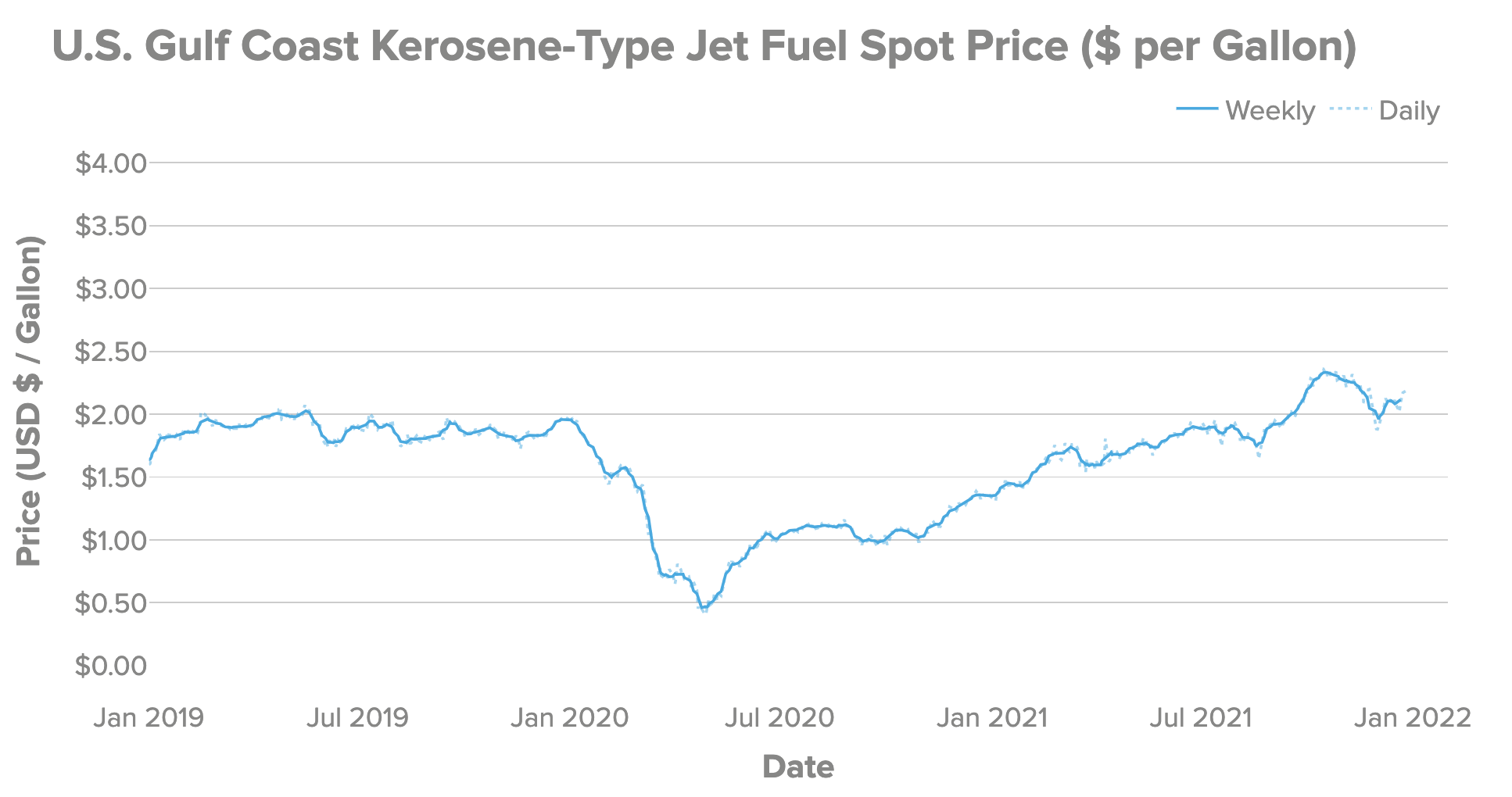

Price of Jet Fuel

The price of jet fuel according to the EIA is currently $2.16/gallon, exceeding 2019 prices and continuing its steady upward trend from last year. This marks a 60% increase in jet fuel prices from $1.34/gallon at the start of 2021. We expect higher jet fuel prices to contribute to higher consumer airfare for 2022.

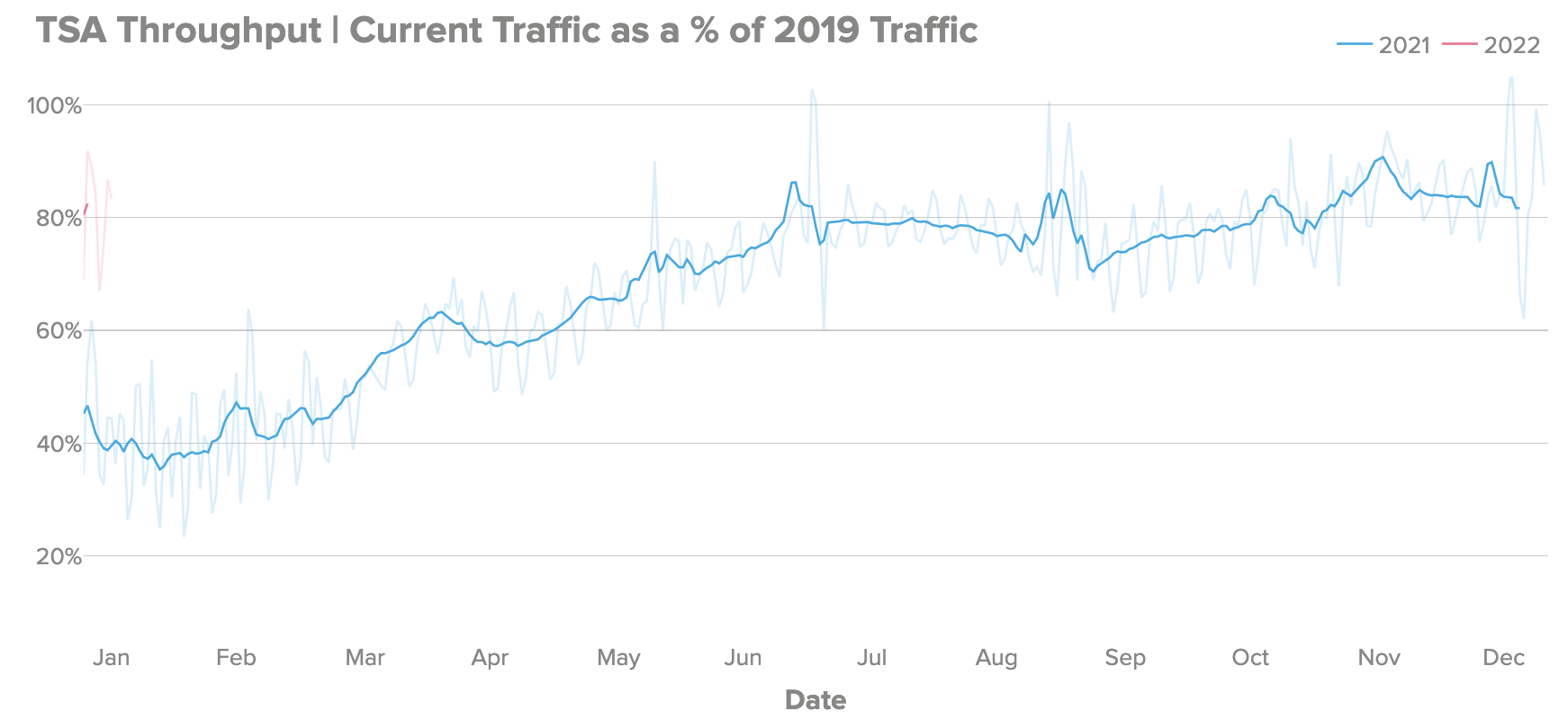

TSA Throughput

The TSA was observing around 84% of 2019 traffic at checkpoints in early December approaching the holiday season. Amid Omicron, passenger traffic decreased to 80% of 2019 levels in late December, and has started the year off at ~82% of January 2019 levels.

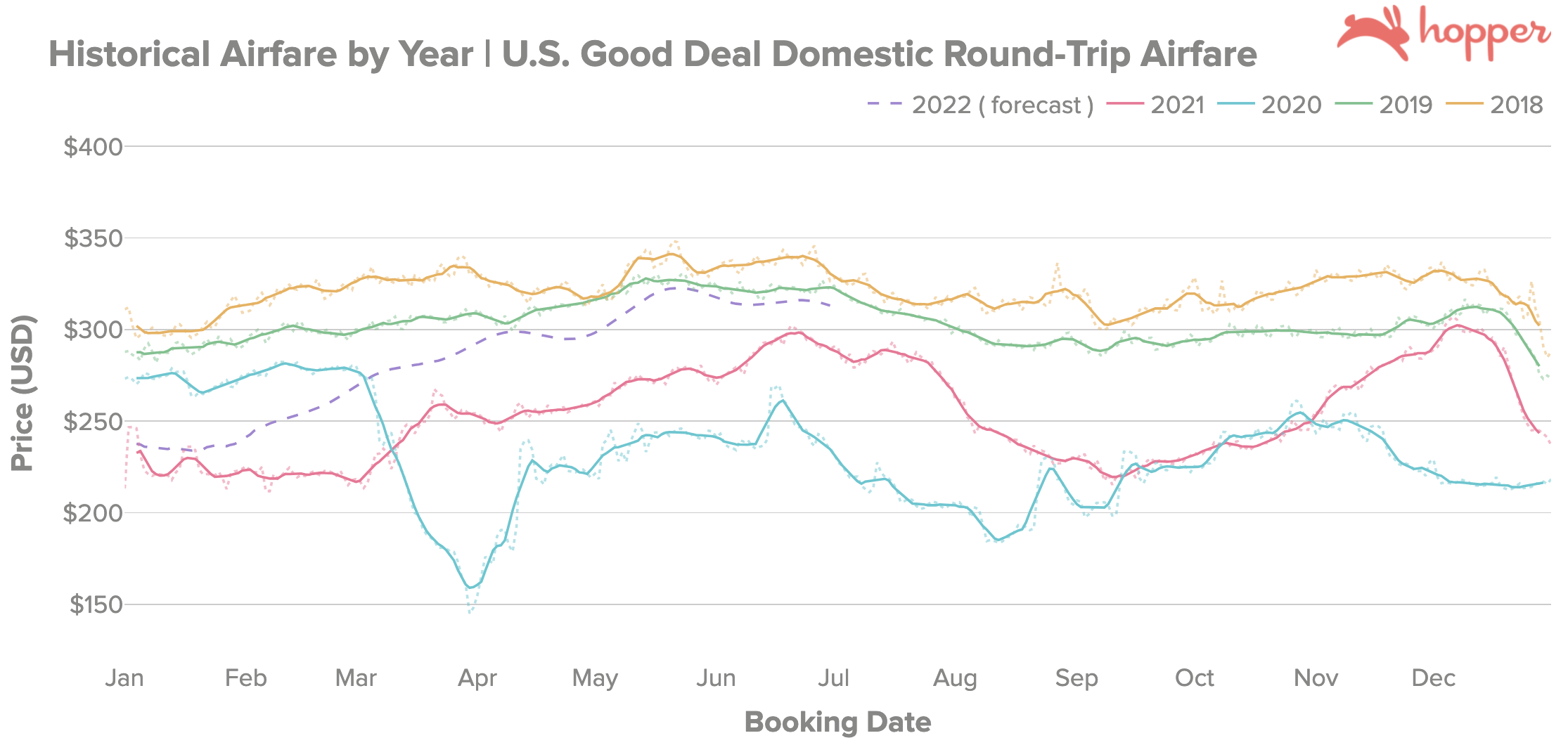

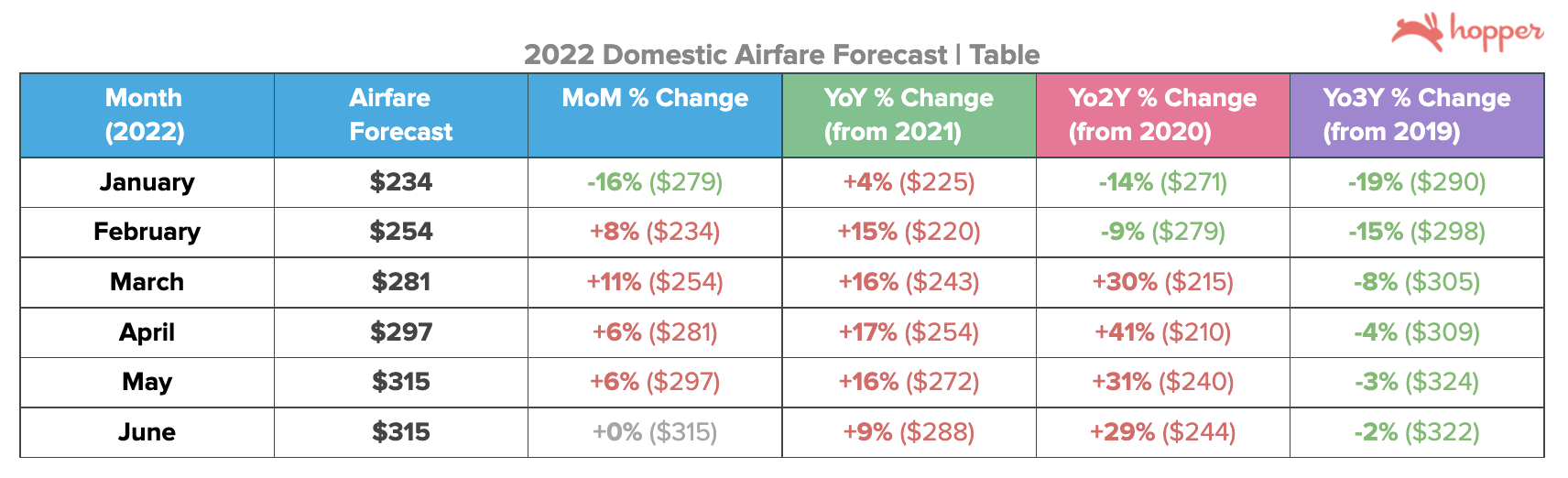

Domestic Consumer Airfare Prices + 6-Month Forecast

2022 has seen relatively cheap domestic airfare in January at just $234/round-trip, only 4% higher than domestic airfare in January 2021 ($225/round-trip). The combination of the Omicron variant and seasonally lower demand after the holiday season has resulted in a steep drop in domestic airfare. Domestic airfare dropped 16% MoM between December 2021 and January 2022 (from $279/round-trip to $234/round-trip) – comparable to the 15% drop we saw in August 2021 during the Delta variant wave. Similar to the months following the Delta variant wave, we expect demand to recover quickly as the situation improves in the U.S., leading to steep increases in domestic airfare in the coming months that resemble the latter half of 2021.

Domestic Airfare Forecast by Month

We forecast an average 7% increase in airfare each month until June, with the highest increases in airfare in March. This amounts to a 35% increase in airfare from current prices by the end of May. After briefly catching up with 2019 pre-pandemic prices in early December 2021, we expect to again see 2019 prices around April 2022.

Factors Affecting Domestic Airfare

The rate of the increase in domestic airfare is significant, but is comparable to what we observed following the Delta variant wave in Fall 2021. There are several factors we expect to drive this increase in airfare:

Factors Contributing to Higher Domestic Airfare

Seasonal Effects: We usually see domestic airfare peak in the summer due to higher seasonal travel demand. Unlike 2021, where airfare began increasing with travel demand in March with the support of the vaccine rollout, we expect airfare will begin rising earlier in February similar to pre-pandemic years 2018/2019.

Post-Omicron Demand Recovery: In a normal pre-pandemic pricing environment such as 2019, we’d usually observe ~2% monthly increases in airfare heading into the summer. This year we’re predicting a much higher 7% MoM increase in airfare on average, driven by demand recovery following the Omicron variant wave. Looking ahead at South Africa, which is gradually emerging from its Omicron wave, the IATA is seeing positive signals for travel demand recovering quickly. This steep increase would relatively align with what we observed in the domestic market between September and December 2021.

Jet Fuel Prices: With jet fuel prices increasing 60% increase throughout 2021, we’re expecting high costs to continue to create upward pressure on airfare in 2022.

Factors Easing the Rise in Domestic Airfare

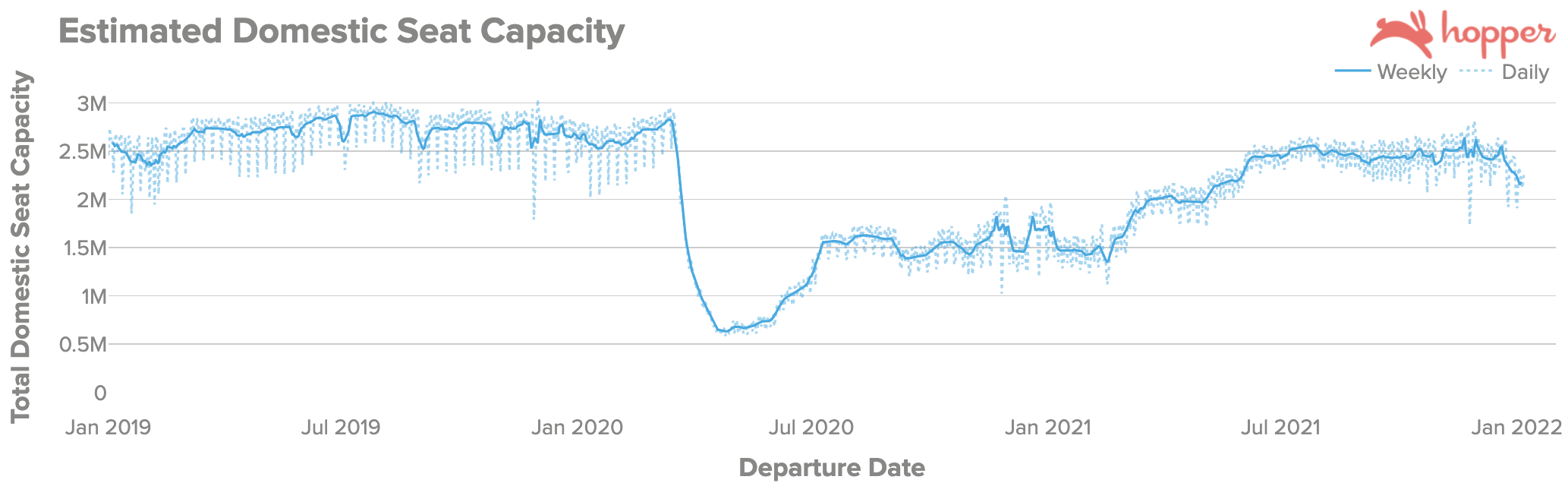

Room to Increase Capacity: We expect carriers to gradually increase capacity throughout the year to more closely align with 2019 figures in the domestic market. At an estimated 2.1m seats, domestic seat capacity in January 2022 remains down 16% from January 2019, suggesting there’s ample room to increase capacity over the coming months.

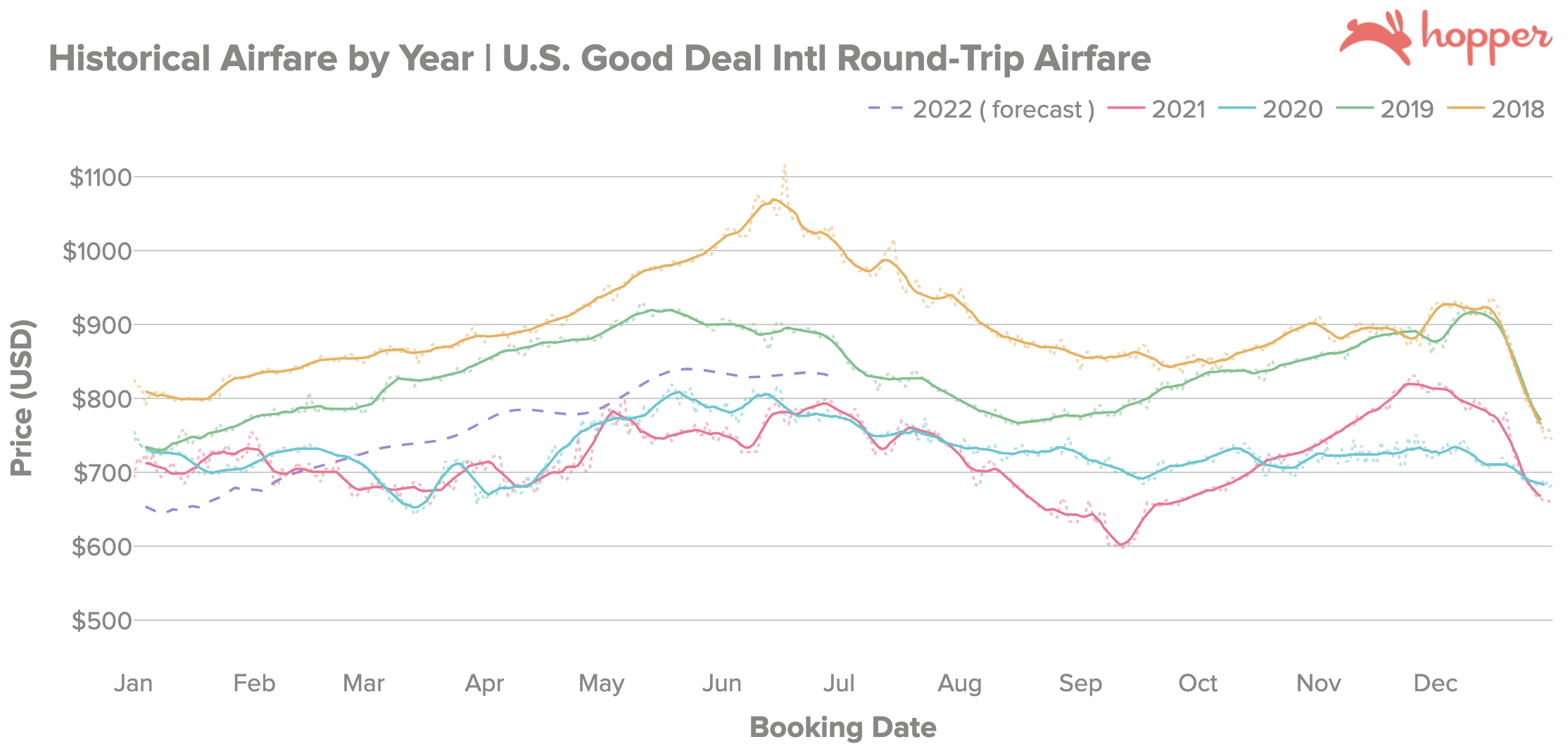

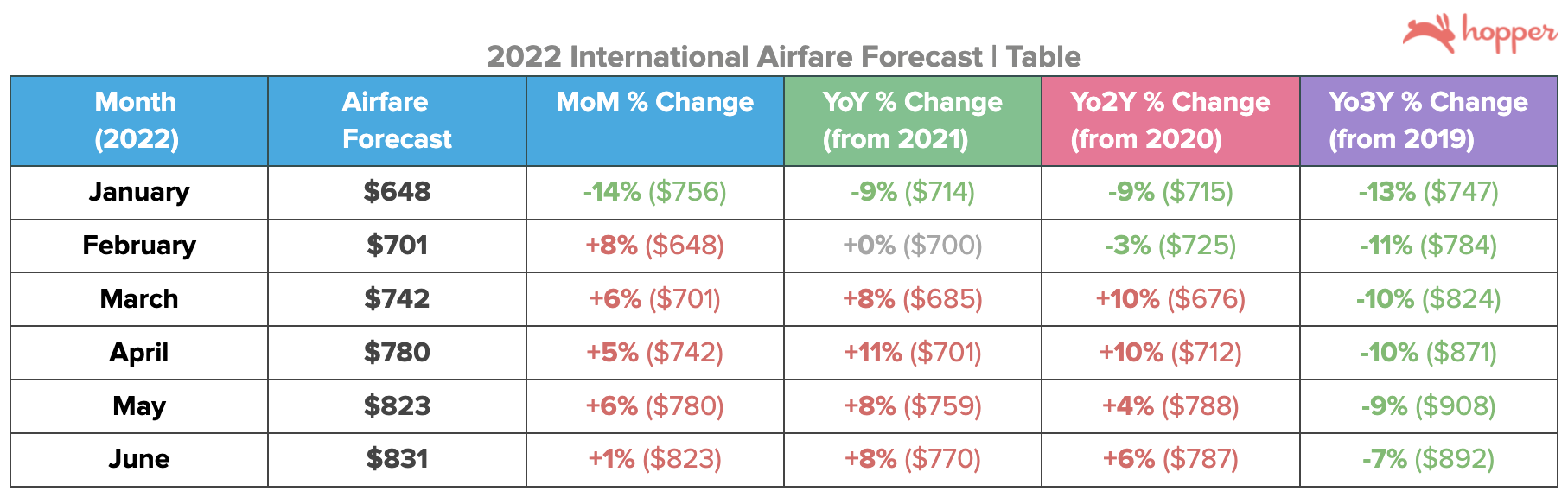

International Consumer Airfare Prices + 6-Month Forecast

International airfare for January 2022 is the lowest it has ever been in January at just $649/round-trip currently. Similar to domestic airfare, this is due to the combination of the Omicron variant and seasonally lower demand after the holiday season. We began seeing international airfare drop in the last week of November, when the Omicron variant was classified as a variant of concern by the WHO. Prices have been especially volatile between the Delta and Omicron variant waves, swinging nearly $200/round-trip twice over four months.

International Airfare Forecast by Month

We think international airfare has likely bottomed out in mid-January, and will increase from here as demand recovers. Without a more definitive recovery in the Trans-Pacific segment, it’s unlikely we’ll see a full return to 2019 prices in the coming months. However, we do expect airfare to increase an average of ~5% each month until June, with the most significant increases between now and March as demand recovers following the Omicron variant wave. Before Omicron, we had seen significant improvements in travel to Canada and Europe compared throughout 2021.

Factors Affecting International Airfare

Factors Contributing to the Rise in International Airfare

In general, the factors affecting domestic airfare are also very much the same ones at play in the international segment.

Seasonal Effects: Similar to the domestic market, we expect to see international airfare peak in the summer with higher seasonal travel demand.

Post-Omicron Demand Recovery: We expect the largest increase in international airfare to come between January and March as demand recovers from the Omicron variant wave. We were seeing incredibly strong demand for Trans-Atlantic travel in early November with the U.S. reopening to inbound international flights, and we expect to see this segment continue to recover in 2022.

Jet Fuel Prices: Similar to domestic airfare, we are expecting higher jet fuel prices in 2022 to contribute to higher international airfare.

Factors Easing the Rise in International Airfare

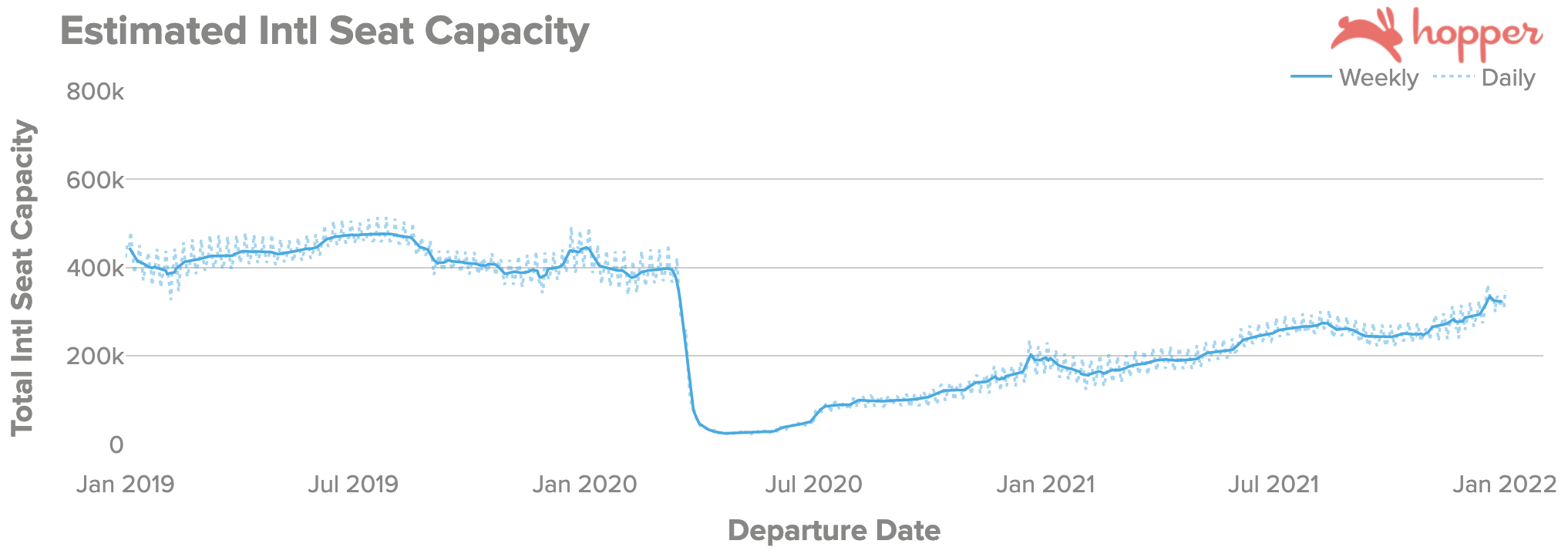

Room to Increase Capacity: Even with manufacturing delays of the 787, we expect carriers to overall increase long-haul international capacity throughout 2022 as demand returns. At an estimated 308k seats for outbound international flights from the U.S., international capacity is down 28% in January 2022 compared to January 2019.

Searches | Winter 2022 Destinations

Most Popular Methodology: Hopper collects, from several Global Distribution System partners, 25 to 30 billion airfare price quotes every day from searches happening all across the web. Here we simply rank destinations by which ones have received the most searches in the last 6 weeks, filtering for winter departures dates (January 15th to March 15th, 2021). Think of most popular as a measure of “Where are most people thinking of going?” Note that this does tend to favor larger cities.

Domestic: Orlando, FL (#1), Las Vegas, NV (#2), and Miami, FL (#3) topped the most popular destinations in searches for domestic flights. With a good deal airfare of just $139/round-trip, Miami was one of the most affordable domestic destinations for Winter 2022, 40% off pre-pandemic 2019 prices this time of year.

International: London, UK (#1), Cancun, Mexico (#2), and Paris, France (#3) all moved up one spot respectively to top the most popular destinations in searches for international flights this year. San Juan, Puerto Rico (#4), dropped three spots from last quarter. Upon reopening its borders in mid-November, India appears on the most searched international destination list for the first time since pre-pandemic with Delhi, India (#6). Down 25% from 2019 airfare, Dubai, UAE (#8) also appeared on the most searched destination list for the first time since pre-pandemic.

Most Searched Domestic Destinations

Most Searched International Destinations

Highest Trending Methodology: We use our search traffic data to track the rate of increase in searches for a destination in recent weeks.. We rank cities by their rate of increase in search volume. This does not necessarily represent what’s most popular with travellers, but rather what’s becoming more popular the quickest.

Domestic: Reno, NV (#1), San Jose, CA (#2), and Kansas City, MO (#3) were the highest trending domestic destinations.

International: Dublin, Ireland (#1), Rio de Janeiro, Brazil (#2), and Santiago, Chile (#3) were the highest trending international destinations.

Highest Trending Domestic Destinations

Highest Trending International Destinations

Bookings | Winter 2022 Destinations

Please note: Since Hopper users tend to skew towards younger leisure travelers, our bookings also tend to reflect this demographic’s interests. We’d suggest “Most Popular in Searches” above for popular destinations more representative of the overall population.

Domestic: Las Vegas, NV (#1), Orlando, FL (#2), and Denver, CO (#3) were the most booked domestic destinations on Hopper, closely mirroring the most searched destinations industry-wide.

International: Cancun, Mexico (#1), San Juan, Puerto Rico (#2), and San Jose del Cabo, Mexico (#3) were the most booked international destinations among our users. Mexico and the Caribbean were the most popular options for international getaways among our users.

Where is Demand Clustering?

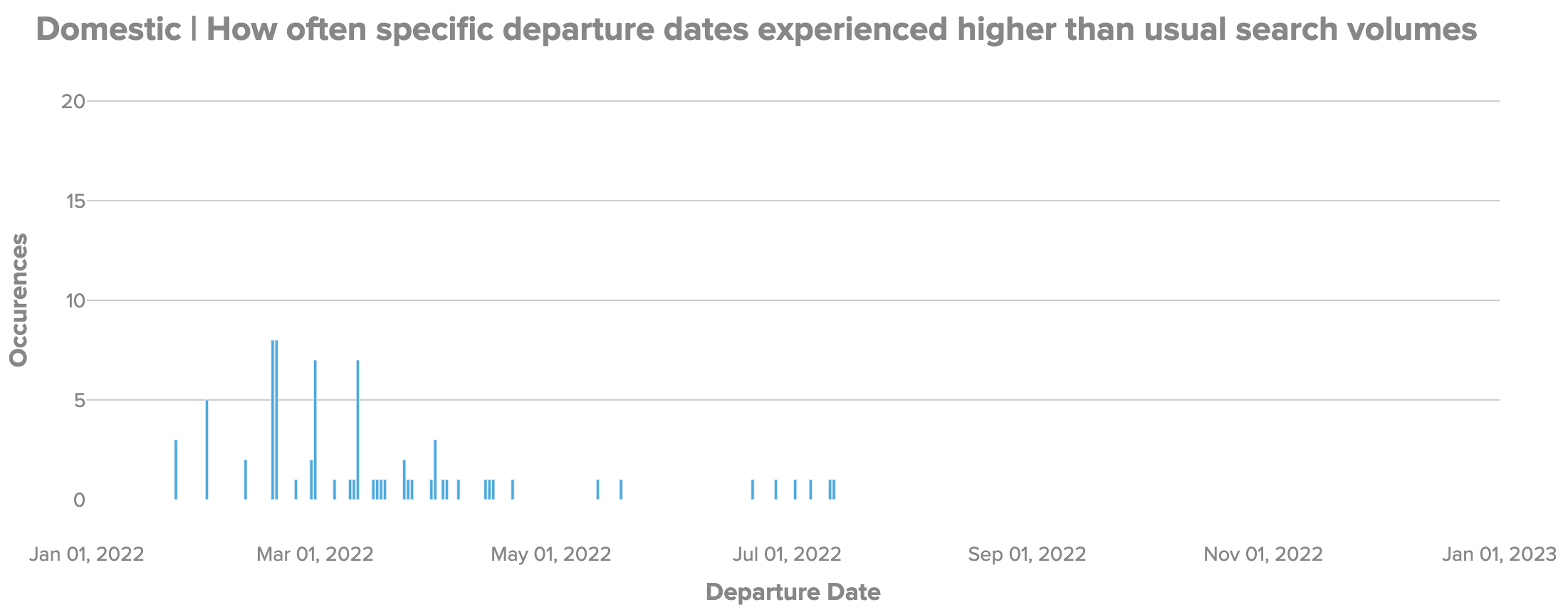

We took a look at which dates tended to have higher than usual search volumes for this year, to get an idea of when we might start to see travel demand really pick up in the coming months.

Domestic | mid-February and mid-March

The weekend following Valentine’s Day and mid-March appeared to see a few instances of higher than expected search volume. This might suggest a rough timeline for when travellers are expecting the situation with the Omicron variant to improve domestically.

International | mid-March

For international destinations, it seems travellers are generally eyeing mid-March. Canada was one of the only international regions seeing earlier demand for February. Canada also appears to be on travellers’ minds for summer trips this year.

How far in Advance are Travellers Booking Flights?

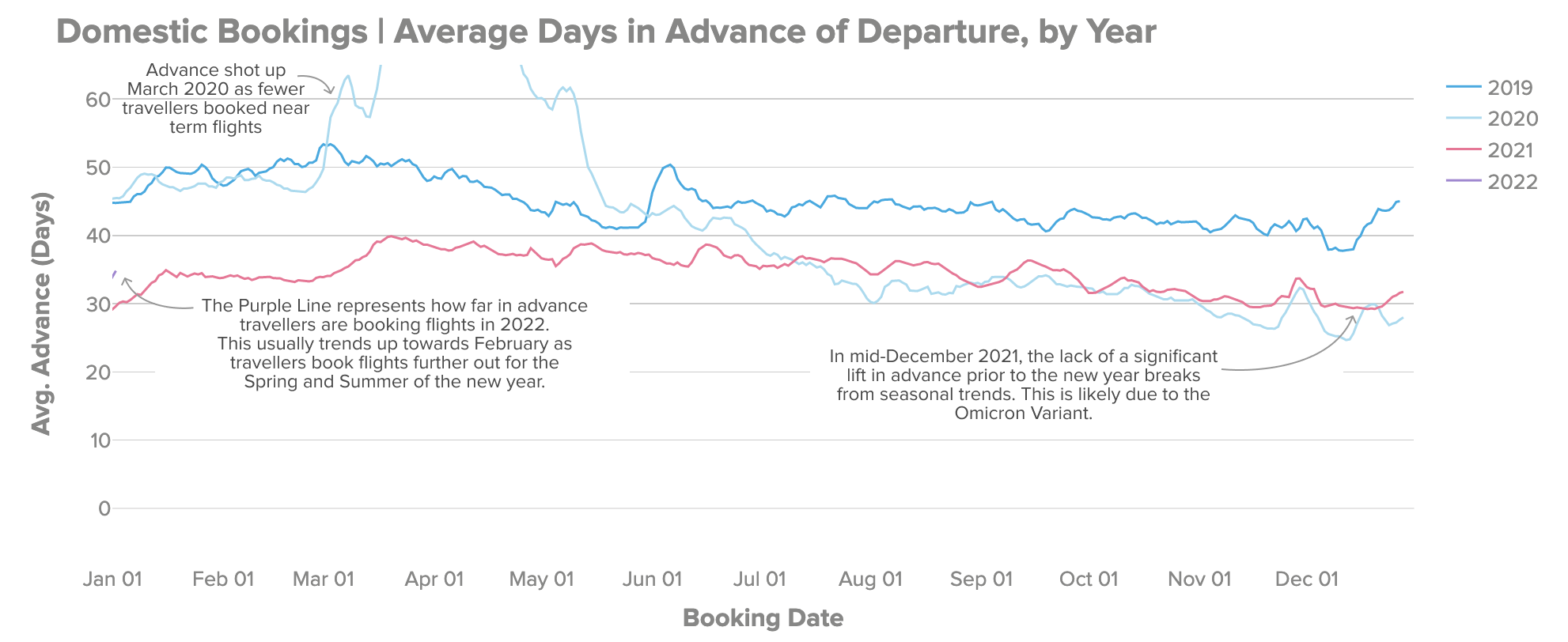

Since Summer 2020, we’ve seen travellers booking closer to their date of departure. This makes sense in an environment where there can be uncertainty about how travel regulations and the pandemic itself will progress further down the line. How far travellers book in advance is a signal of traveller confidence, and here we compare it to pre-pandemic levels for context.

Domestic | 35 Days

Travellers are booking domestic flights 35 days in advance on average, down from 45 days this time in January 2019, but up from 30 days this time last year in January 2021. Historically, we have usually seen a pickup in advance towards the end of December as travellers make plans for the Spring and Summer of the following year. Likely due to the Omicron variant, this usual seasonal increase was much more subdued this year. 29% of travellers are currently booking less than two weeks ahead of departure, which while an improvement over 38% who did so in January 2021, is still significantly higher than the 17% who did so in January 2019.

International | 55 Days

Travellers are booking international flights 55 days in advance on average. This is quite a bit off of the 74 days in advance in January 2019. It is an improvement from 45 days in advance this time last year. Currently, 23% of travellers are booking international flights less than two weeks in advance, compared to just 12% who did so in January 2019. In general this suggests travellers are booking international trips closer to their date of travel, and are hesitant to book international travel far in advance. In other words, few travellers are willing to make a bet this early on booking an international trip later in the year.

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!