Consumer Airfare Index - September 2019

Airfare officially enters off-peak “shoulder season” this month.

Hayley Berg - Tue Aug 27 2019

Summary

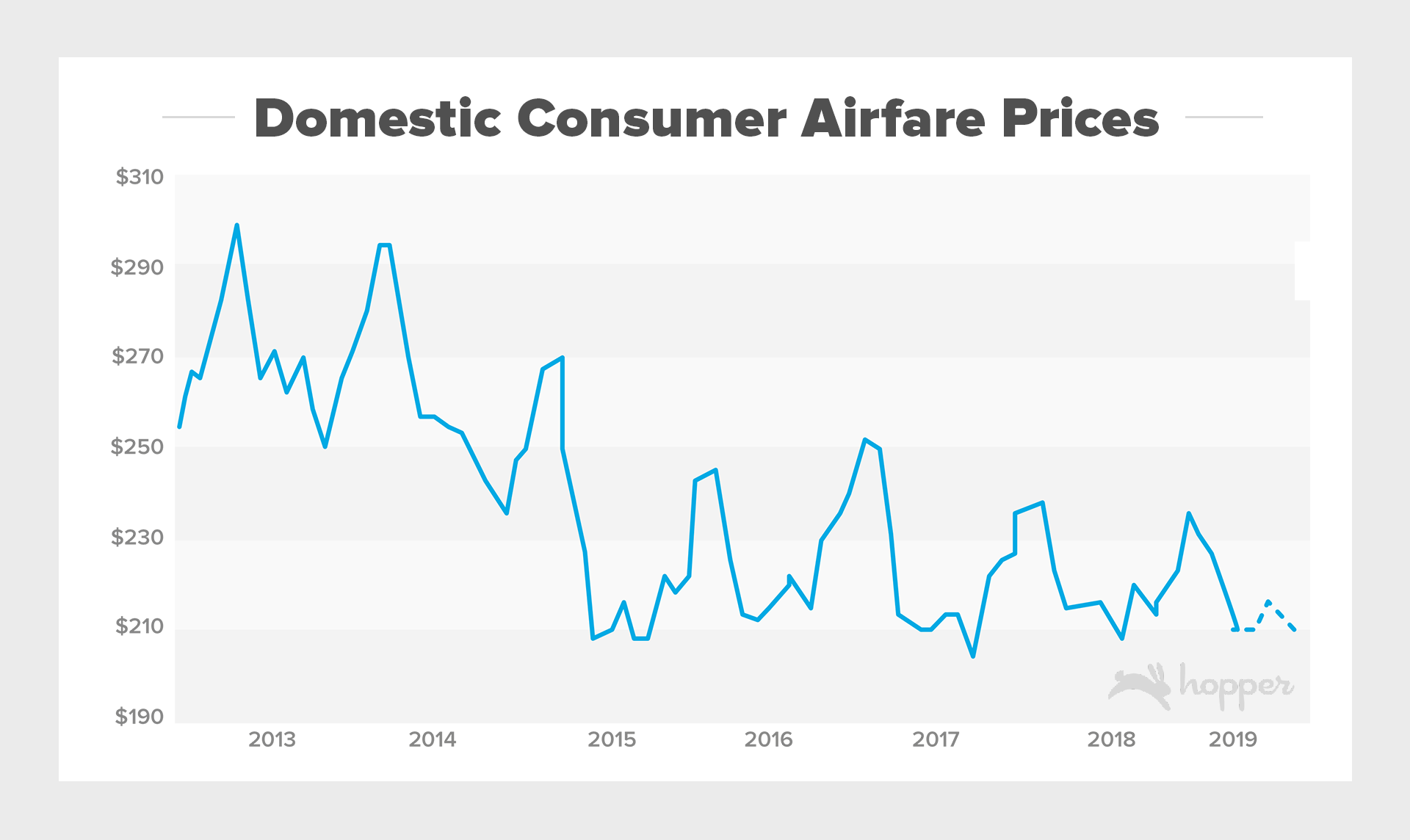

This month, we project a 1.3% decrease in domestic round-trip flight prices to $214.

Flight prices this September are projected to be down 1.5% compared to 2018 levels.

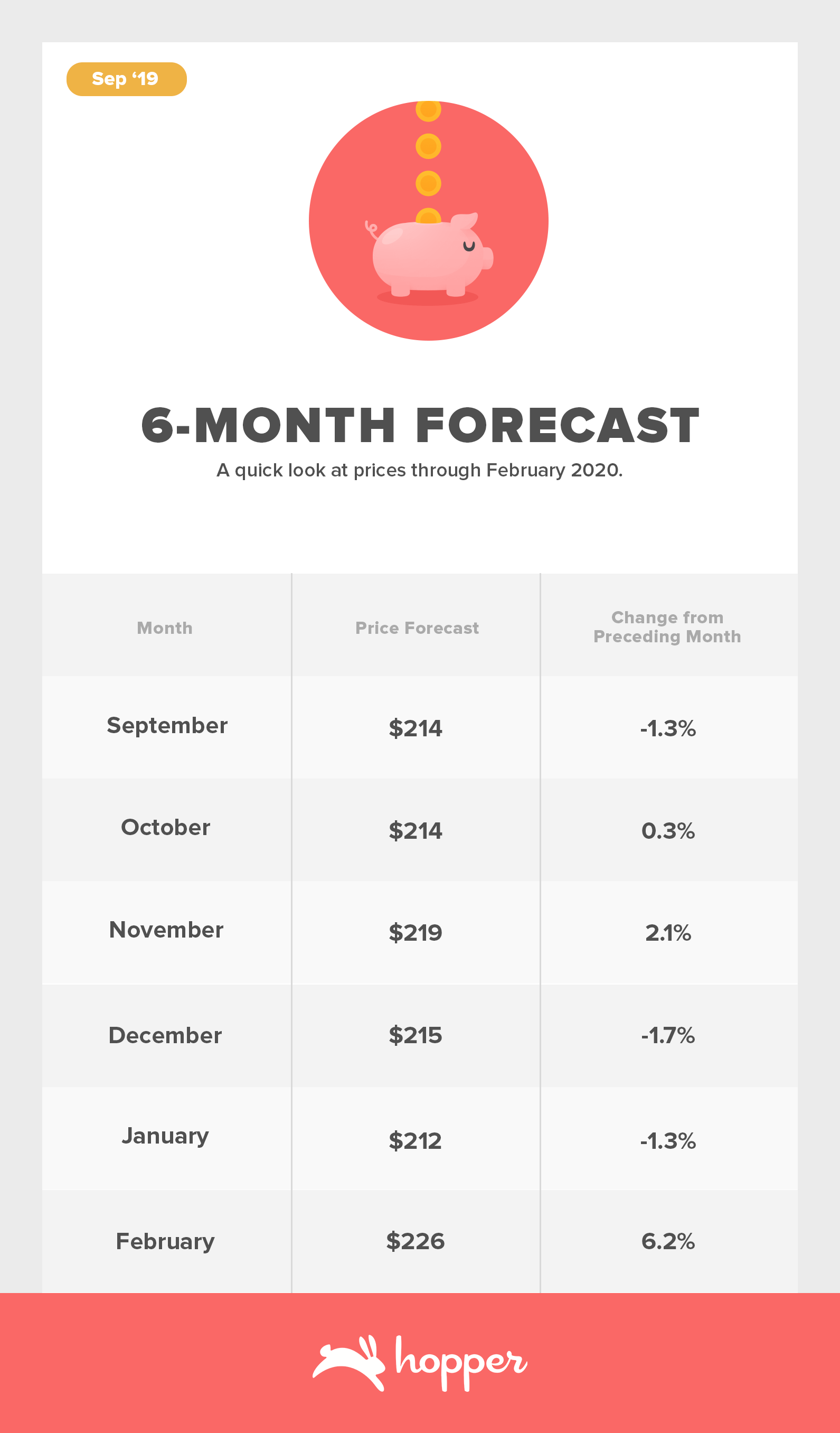

Prices will remain low through the fall shoulder season (September - October) before seeing a short spike in November when Thanksgiving travel demand peaks. Price will drop again in December before rising in the new year.

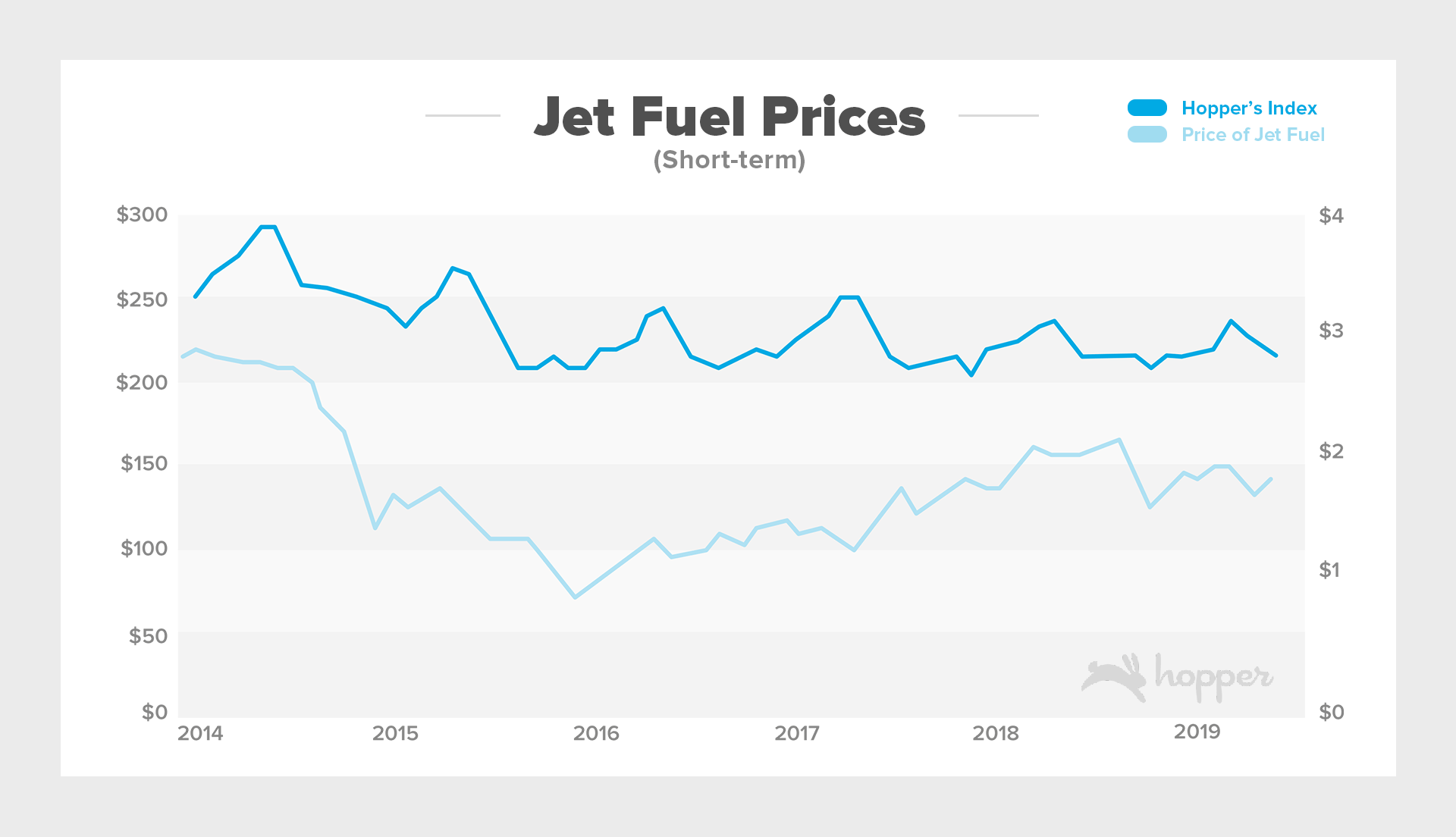

Jet fuel prices rose 5.4% in the most recent month of reporting data compared to the previous month, to $1.92/gal.

September brings with it the official start of the “shoulder season” when prices drop down post-peak summer and before the holidays kick off. This month, we project a 1.3% decrease in round-trip domestic flight prices to $214, which is down 1.5% compared to the same time last year. Prices will remain low throughout the fall season (September - October), before briefly spiking when Thanksgiving travel demand peaks in November. Following the holiday, prices will drop again before rising in December for Christmas and New Year’s flights.

Figure 1: Actual average domestic consumer airfare prices through August 2019 (solid line), with six-month forward forecast price levels (dashed), showing prices remaining low through the end of the year, except for a spike around Thanksgiving.

Figure 2: Jet fuel prices rose 5.4% in the most recent month of reporting data compared to the previous month, to $1.92/gal.

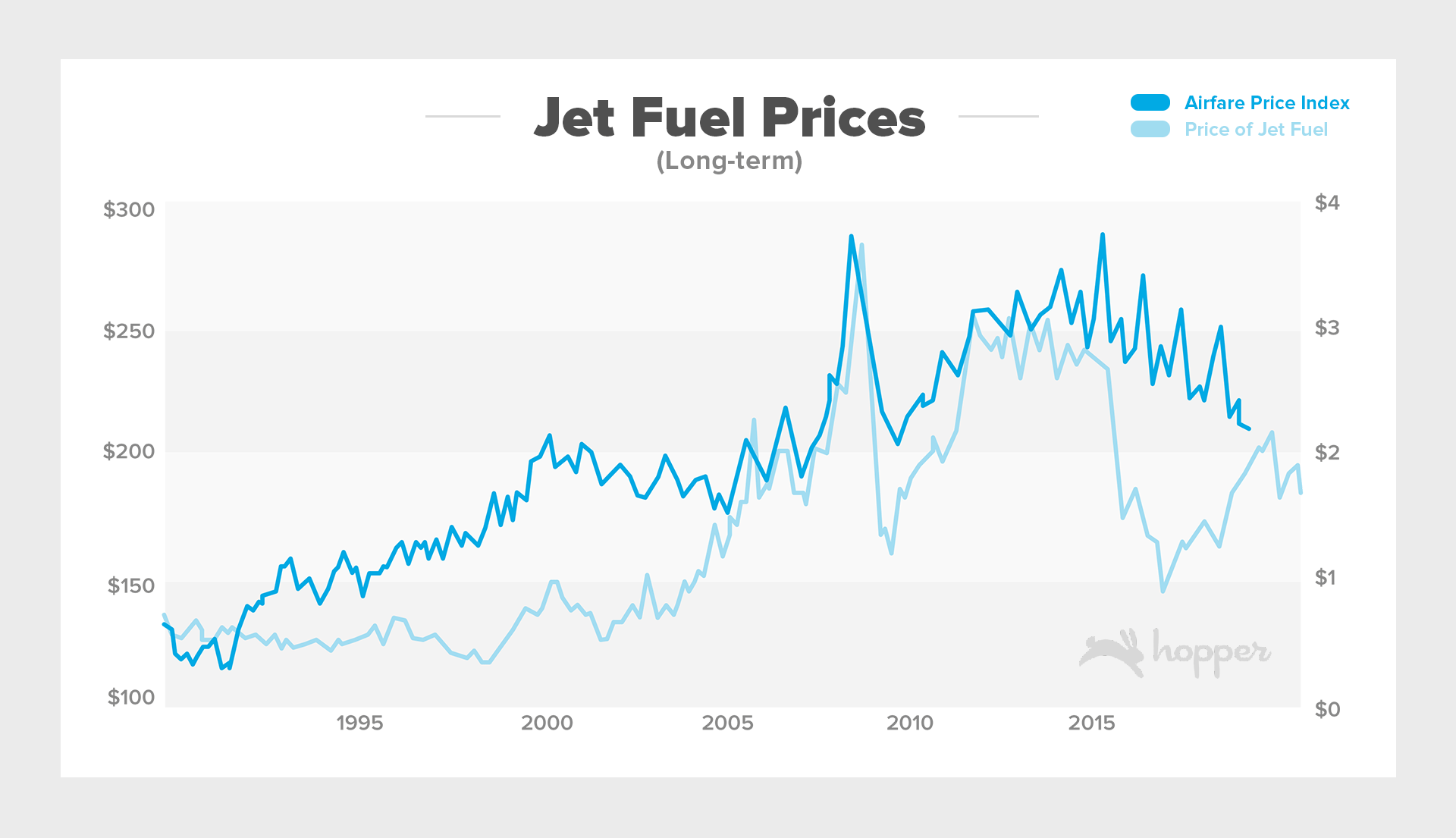

Figure 3: A longer range view shows that jet fuel prices are growing again since a significant drop in 2015.

Table 1: Hopper’s six-month forecast for consumer airfare, showing prices remaining low through the end of the year, with the exception of a spike in November.

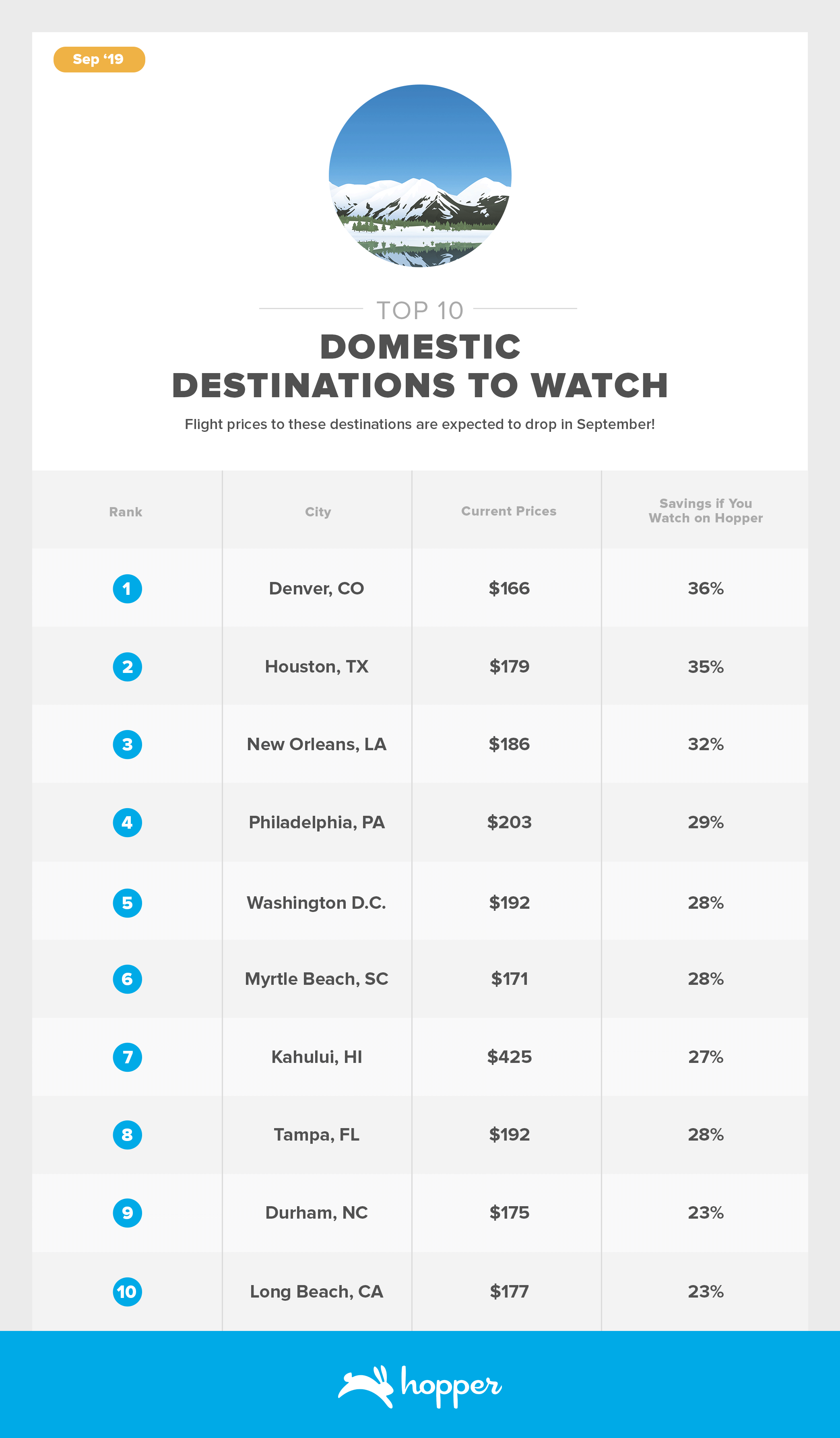

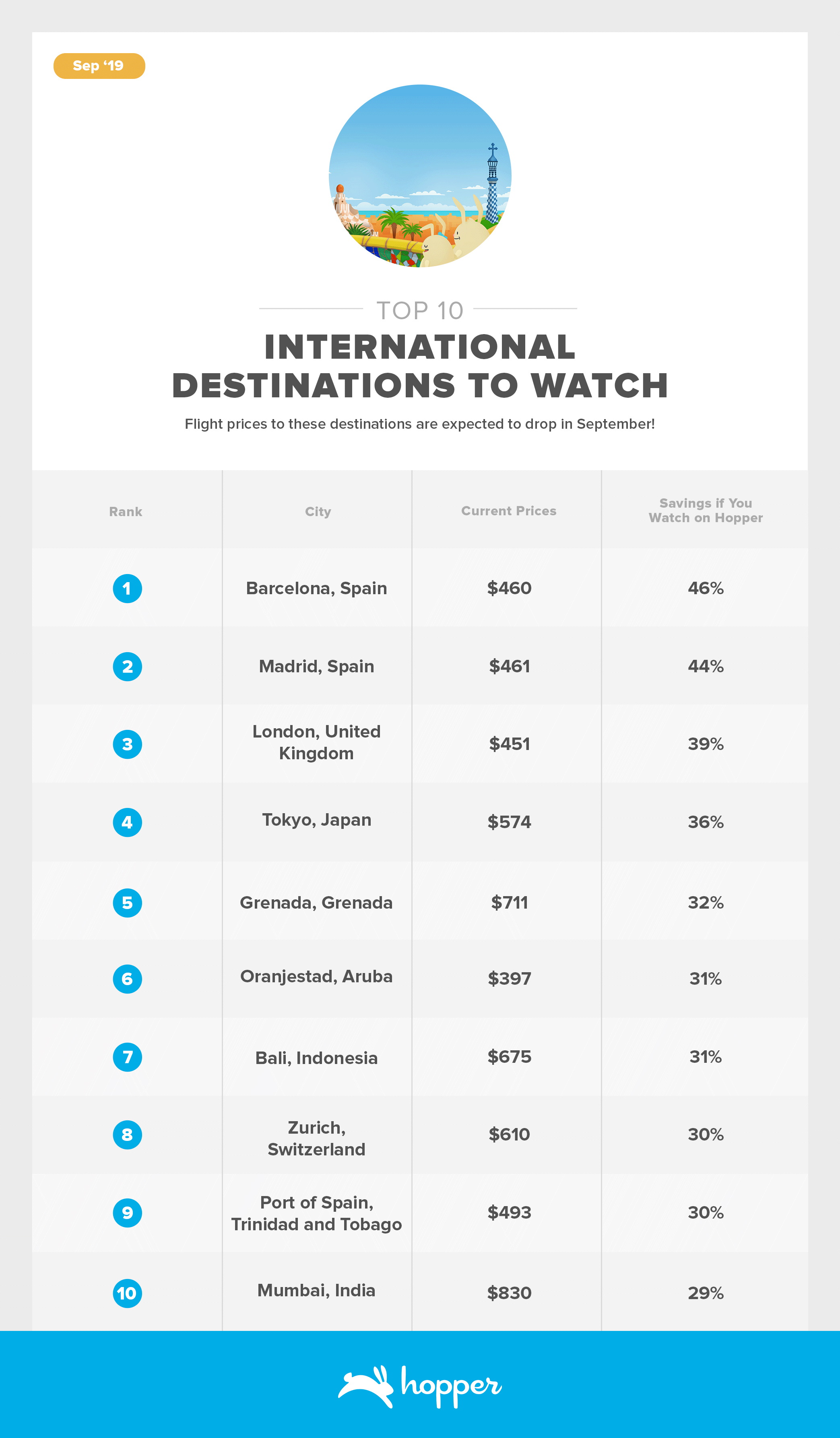

Destinations to Watch on Hopper in September

The Hopper app predicts future flight prices with 95% accuracy. If you select the “Watch This Trip” button, Hopper will constantly monitor prices and notify you the instant you should buy.

We calculated popular destinations for upcoming travel where you could save most by watching prices on Hopper. If you’re interested in visiting any of these destinations in the next few months, we recommend setting your watch on Hopper now so that you can be alerted about price drops this month.

Table 2: Domestic destinations most likely to drop in price on Hopper in September.

Table 3: International destinations most likely to drop in price on Hopper in September.

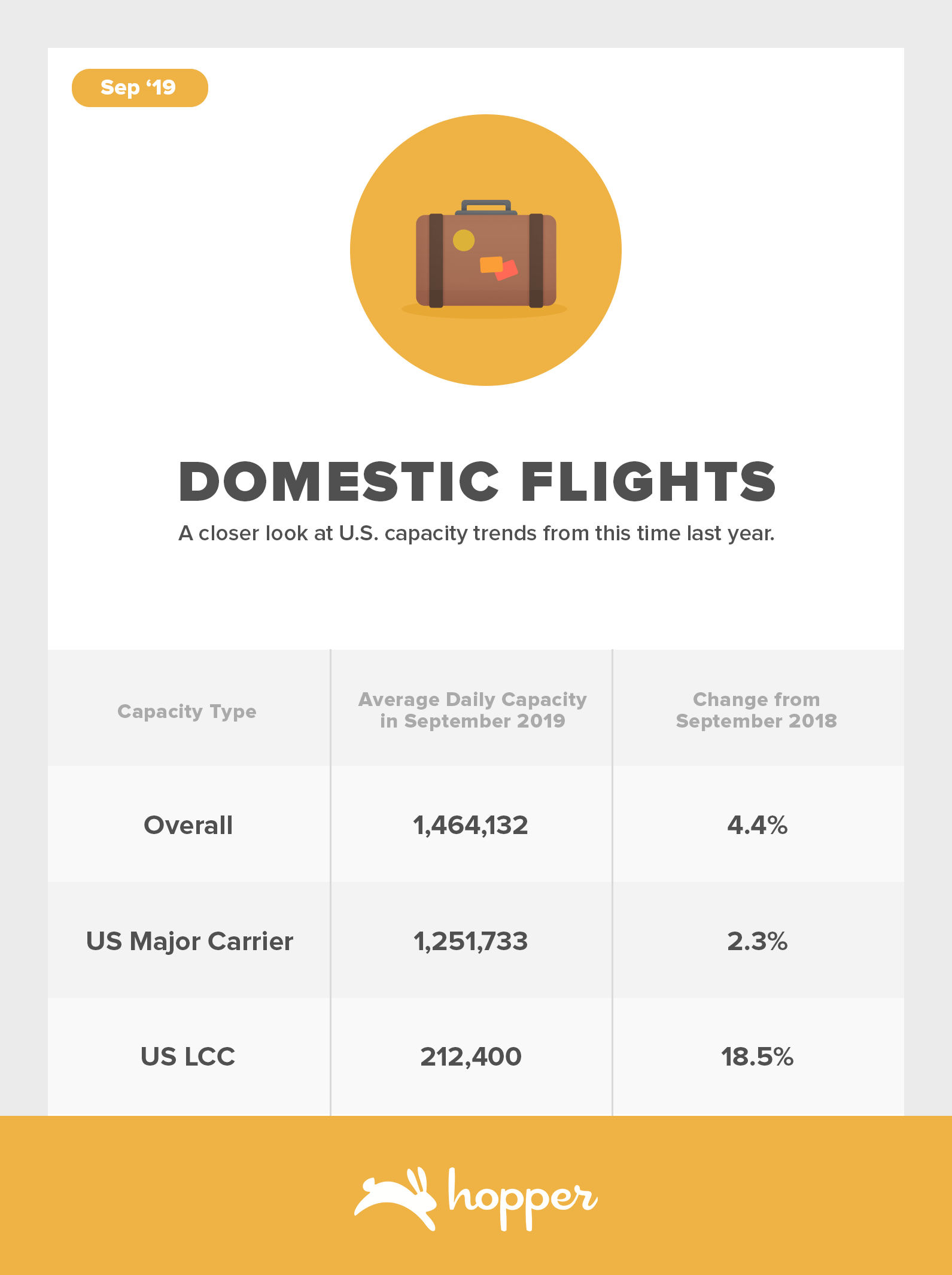

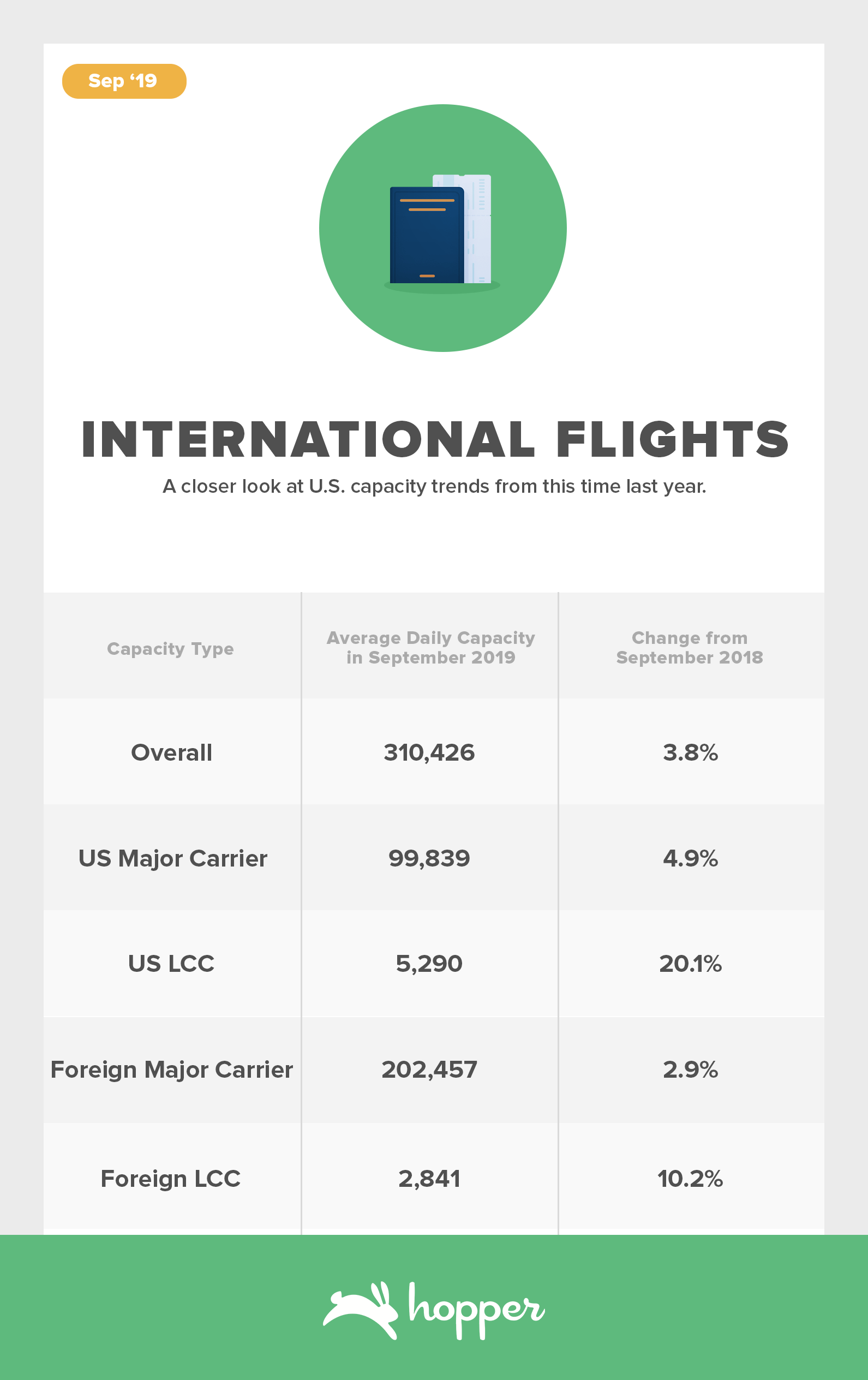

Capacity Trends

The capacity of major US carriers changed 2.3% and 4.9% from September of last year for domestic and international routes respectively. Foreign major carrier capacity grew 2.9% on U.S. international routes. LCC capacity over the past year has drastically expanded. US LCCs exhibited a YoY capacity growth of 18.5% and 20.1% in domestic and international markets respectively.

Methodology

Our Consumer Airfare Index combines search data for every origin and destination in the United States, providing a near real-time estimate of overall airfare prices - unlike other comparable indices that can lag by several months.

Our Consumer Airfare Index represents the price of tickets available for purchase in a given month, not necessarily for travel in that month. Since travel prices are represented in both time dimensions -- time of purchase and time of travel -- it can be difficult to interpret price dynamics. We use date of purchase because it reflects the price consumers are paying at a given point in time, and we report it alongside the typical advance purchase date to give an idea of how these prices translate into travel dates.

Other indices simply take the average of all fares to represent overall price which skews the results toward expensive fares and can give an unrealistic impression of the true cost of flying. We instead use what we consider to be a “good deal” for each route to reflect what consumers should reasonably expect to pay.

Since our index is constructed and forecasted at the origin-destination level, we can also provide comparable estimates for any combination of routes and extract insights on pricing not only across time, but also across different markets. We use monthly passenger data from the Bureau of Transportation Statistics to ensure that each domestic route is properly represented in the final index based on its share of total passengers.

When predicting future prices, we also consider a few key features of airline pricing. First, prices within a given route will fluctuate with the number of passengers.

Second, prices change predictably with the seasons, especially during the peaks of summer and holiday travel. Of course, much of this variation has to do with increased demand - but in peak travel seasons, airlines can raise prices not only because there are more people interested in travelling, but also because the average traveler is willing to pay more for their summer vacation or trip home for the holidays.

Finally, changes in prices may persist, especially if there are underlying conditions pushing prices up or down, as these effects may be spread over several months. Conversely, the opposite may be true - after a big price increase or drop, fares are more likely to change in the opposite direction in future months. Since dynamics like these and the above aren’t always consistent, we evaluate future prices at the origin-destination level to capture the unique properties of pricing for different routes.

Of course, predicting the future is no easy task, and many factors that influence pricing are simply unforeseeable. However, by exploiting the factors that are predictable, like trends in passenger distribution, seasonal variation, and recent price activity, it’s possible to extract insights about the near future of pricing.

The capacity section looks at total scheduled seats across major carriers and low cost carriers (LCC’s). US Domestic Flights includes all scheduled seats on flights within the United States and US International Flights includes all scheduled seats on flights between the United States and destinations outside of the United States.

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!