How economic concerns may impact the travel industry this year

With shorter advance times, bookings leaning heavily domestic, and travelers facing disruption at airports, travel brands are in for a challenging year. Customer-centric travel fintech products offer an opportunity to delight customers and drive revenue.

Hayley Berg - Tue Jul 19 2022

Summary

While Americans will be reducing their spending on many key categories, more than 64% say they still plan to travel for leisure this summer according to a recent survey conducted by Hopper, with more than half planning to spend $1,000 or more

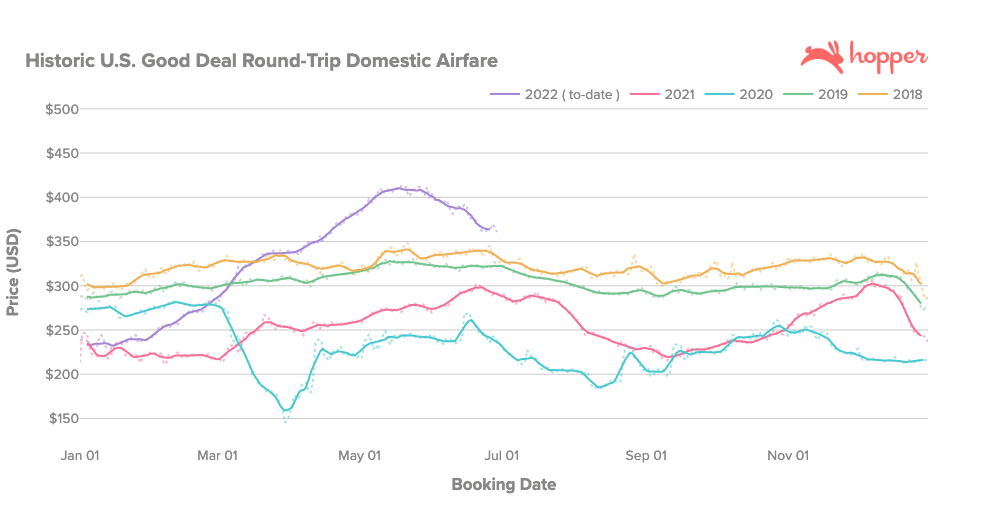

Current domestic round trip airfare will cost Americans $360 per ticket, an increase of 16% compared to 2019, but down 12% compared to the peak at over $410 per ticket in late May. Domestic airfares have already fallen $50 per ticket compared to May peaks, and travelers can expect continued relief for coming weeks.

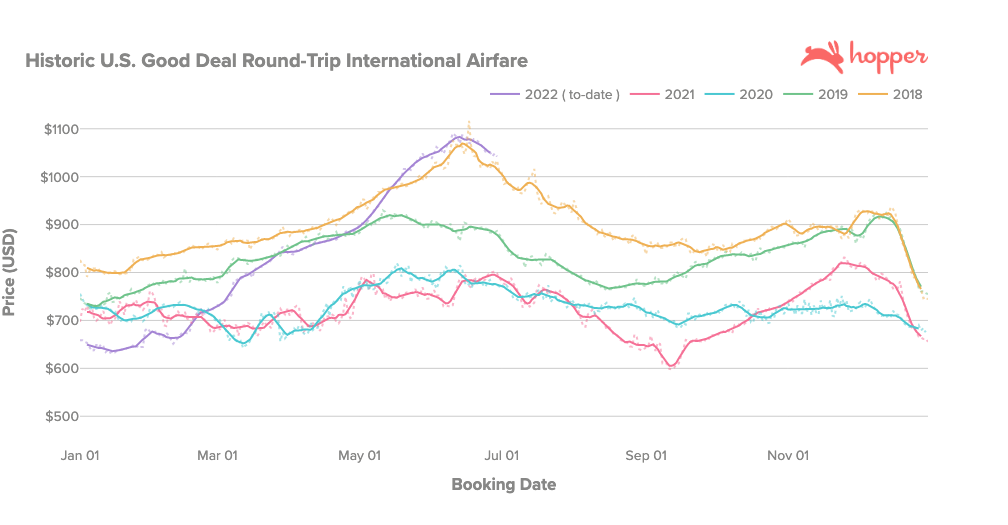

Current international round trip airfare will cost Americans $1,042 per ticket, an increase of 26% compared to 2019, but down slightly from a peak in June. International airfare this year has closely matched 2018 levels and trends since mid spring, and we expect prices to continue to fall into the shoulder season, September and October.

Demand for air travel surged from February through a peak in mid June of this year, before beginning to flatten in line with seasonal expectations. In mid summer, demand seasonally falls off and flattens into the fall shoulder season, as most Americans schedule summer vacations and travel between May - July. Demand will pick back up seasonally in September as travelers begin to plan for holiday trips.

With shorter advance times, bookings leaning heavily domestic, and travelers facing disruption at airports, travel brands are in for a challenging year. Customer-centric travel fintech products offer an opportunity to delight customers and drive revenue.

With last week’s release of the June CPI, marking a 9.1% increase in all items, economic concerns continue to plague Americans and the economy. Nearly 60% of Americans plan to reduce spending this summer, primarily cutting back on entertainment, dining out, major home or car purchases, transportation, and leisure travel. While Americans will be reducing their spending on many key categories, more than 64% still plan to travel for leisure this summer, with more than half planning to spend $1,000 or more. With higher airfare, hotel prices and surging prices at the pump, travelers will have to stretch their budget even further this summer.

Travel costs rising

The cost of vacationing has risen this summer, with a weekend domestic trip averaging $752 for a round trip ticket and a two night hotel stay, nearly 25% more expensive than in 2019. For international travelers, a round trip ticket and a 5 night stay will average $1,335 total this year, an increase of 26% compared to 2019. Add on the potential cost of a rental car and fuel at over $5.00 per gallon, travel budgets are being squeezed from all directions this year.

Airfare: Current domestic round trip airfare will cost Americans $360 per ticket, an increase of 16% compared to 2019, but down 12% compared to the peak at over $410 per ticket in late May. Current international round trip airfare will cost Americans $1,042 per ticket, an increase of 26% compared to 2019, but down slightly from a peak in June. International airfare this year has closely matched 2018 levels and trends since mid spring, and we expect prices to continue to fall into the shoulder season, September and October.

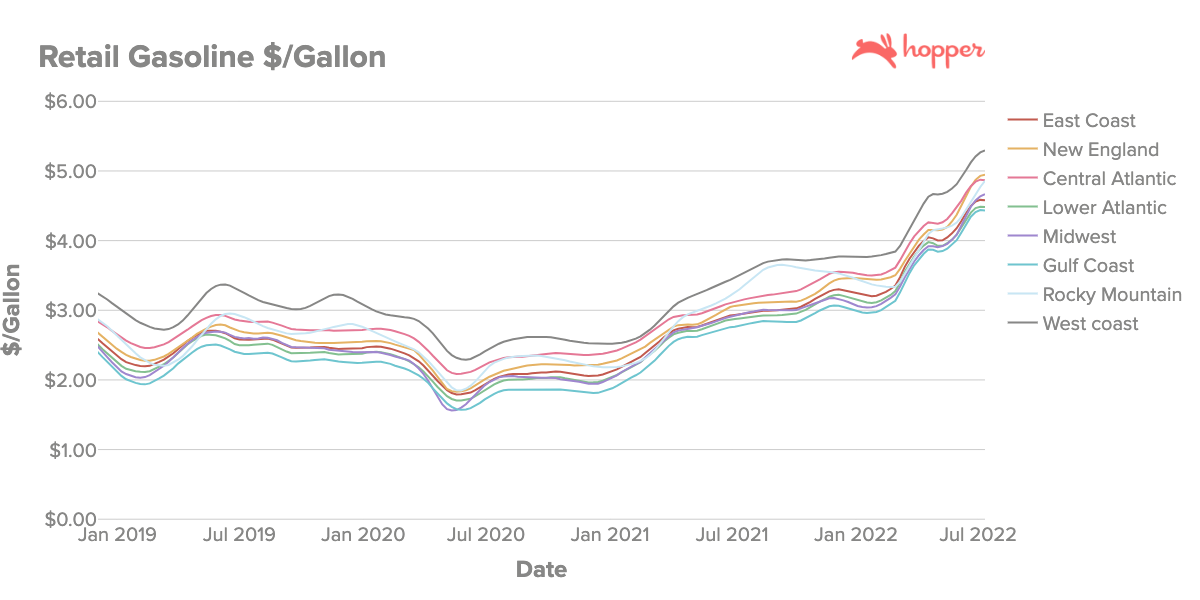

Airfare has risen rapidly this year due to the rapid resurgence of demand for travel, and due to significant increases in the cost of jet fuel. Fuel prices have dropped from peaks over $5/gallon, but remain over $3.40 per gallon, an increase of 88% compared to July of 2019. Jet fuel costs account for anywhere from 10% - 30% of an airline’s operating costs, meaning prices need to recover significantly before airfares will recover to near 2019 levels.

Figure 1: Round trip good deal airfare for domestic travel from 2018 through 2022.

Figure 2: Round trip good deal airfare for international travel from 2018 through 2022.

Hotels & Accommodations: 40% of travelers are planning to stay at a hotel during a trip this summer, and 14% more are taking advantage of the benefits of rental homes for vacation. Americans are currently paying an average nightly rate of $196 for a weekend hotel stay, an increase of 15% compared to 2019. Nightly hotel rates on weekends are up 29% compared to this time last year. We expect domestic nightly hotel rates to continue to rise throughout the remainder of the summer through September.

Internationally, the average nightly rate for a hotel is $146, an increase of 27% compared to 2019. As international travelers have returned and restrictions on travel have been lifted, up 34% from July of 2021.

Car Rentals: More than half (54%) of travelers plan to drive to or on their vacation this summer, despite gas prices peaking over $5.00 per gallon in most regions of the country this month. Prices have continued to surge, showing only slight relief for consumers in the most recent few days. Travelers on the West Coast are seeing the highest prices, with the average per gallon price peaking over $5.50 in late June.

Figure 3: Average price per gallon of retail gasoline since January 2019 reported by the EIA.

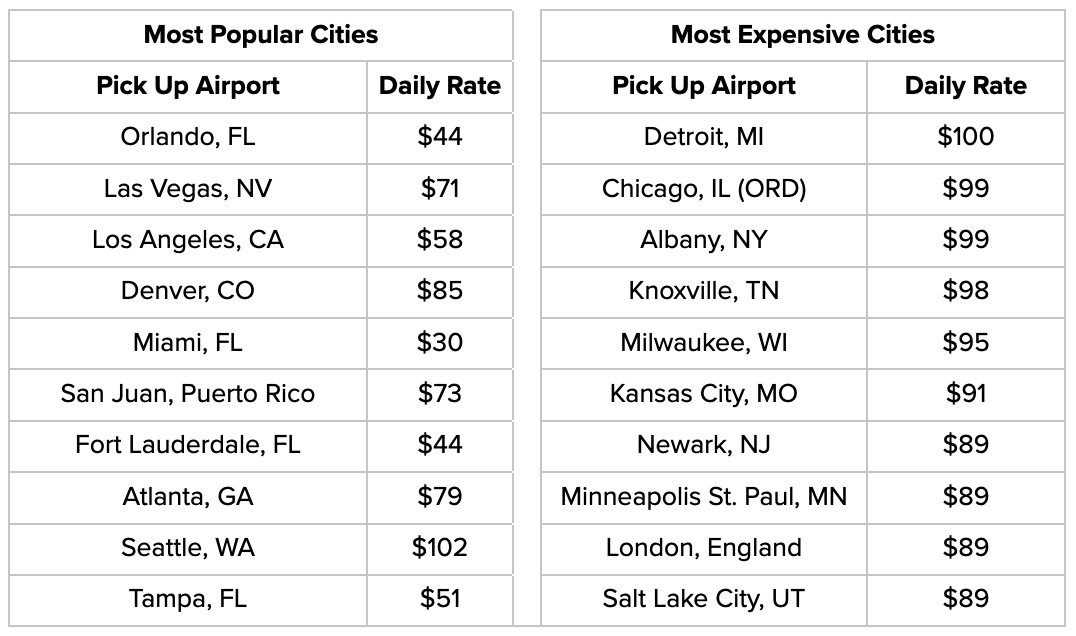

Rental car prices are currently averaging $75/ day in the US, with some major cities like Detroit, Chicago and Newark seeing prices closer to $100 per day. The combined higher cost of gas and demand for rental cars will mean driving this summer may be more expensive than some Americans anticipated.

Table 1: 10 US cities with the highest demand for car rentals for the remainder of the summer, and average price per day per rental car.

What could a recession mean for travel this year?

This is not the first recession or economic downturn the travel industry has faced, nor will it likely be the last. Even as the industry braces for a potential recession, the impact is expected to be significantly smaller than what the industry experienced over the last two years during the pandemic. In previous recessions the travel industry saw an expenditure decline between 8% and 13% from peak to trough, compared to a 90% drop during the pandemic. This year, travel is expected to continue recovering, with consumers focusing on how to get good deals and save more when booking their travel.

Demand remains strong despite higher prices

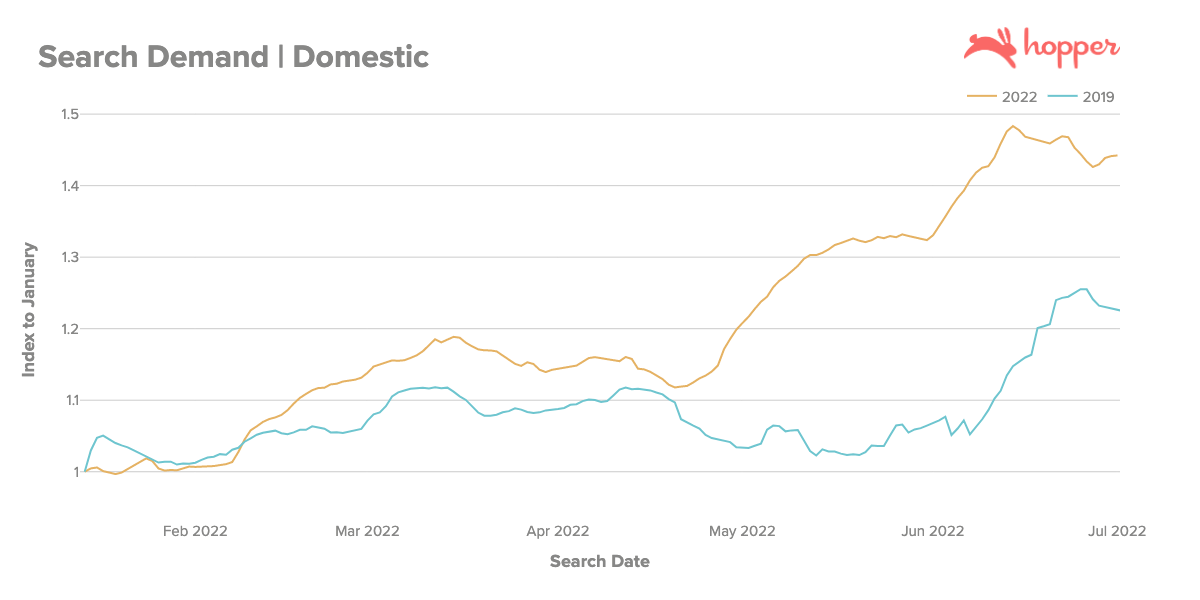

Demand for air travel surged from February through a peak in mid June of this year, before beginning to flatten in line with seasonal expectations. In mid summer, demand seasonally falls off and flattens into the fall shoulder season, as most Americans schedule summer vacations and travel between May - July. Demand will pick back up seasonally in September as travelers begin to plan for holiday trips.

Figure 4: Search demand for domestic flights over 2019 and 2022, indexed to demand levels in January of the same year, showing similar trends in demand from June through July.

3 challenges travel providers need to look out for this year

[1] Last minute travel planning and booking

Though traveler confidence has improved since the deep lows in 2020, travelers continue to start their travel planning process closer to their departure date than in pre-pandemic years. On average, domestic travelers make their first search for a trip 16% (~1 week) closer to their departure date than in 2018 or 2019, and international travelers make their first search 15% (12 days) closer to their departure date.

Travelers are also booking more last minute, with domestic bookings made with a 22% shorter advance, and international bookings made with a 24% shorter advance than pre-pandemic. Combined, these trends mean travel providers will face a shorter window to convert travelers, and a shorter window to upsell travelers post booking.

What does this mean for travel brands? With travelers booking closer to departure date than they were even pre-pandemic, travel brands should consider incorporating features that help mitigate pricing volatility and increasing pricing transparency to help drive conversion. As travelers get closer to the date of departure, they will see more pricing changes, especially in the last 3 weeks leading up to the flight as prices spike. Price Freeze, available via API and full white-label through Hopper Cloud, allows customers to freeze prices for as little as one hour or up to 60 days, across air, hotels and car rentals. It allows customers to take more time to finalize their plans before they book, and for brands, monetizes the shortened planning process. When coupled with Hopper’s Price Prediction capabilities, customers can be confident they are booking at the best time for the best deal possible.

[2] Domestic travel dominating search and booking demand

Most American travelers are searching for and booking domestic travel this year, despite the reopening of many countries and elimination of most travel and testing restrictions due to covid-19. 45% of search demand this summer is for international travel, which has improved compared to the previous two years, but remains 21% below 2019 levels. Providers should expect the recovery of higher AOV international trips to continue to recover more slowly than domestic travel.

What does this mean for travel brands? While bookings remain predominantly domestic, rising international search demand indicates an increased interest in longer-haul trips post-pandemic. American’s financial situations and travel plans will continue to evolve, especially with the euro now reaching parity with the USD and inflation hitting the domestic market hard. With today’s conversion rate, travelers will get more for their dollar in Europe than in the past 20 years – this means dollars will stretch 19% further than last summer and 13% further than at this time in 2019. Travel brands should offer the most flexibility to travelers during this time, with Cancel for Any Reason and Change for Any Reason products – available via Hopper Cloud – that will increase average order value and give customers the flexibility to change plans this summer should they desire.

[3] Travelers facing disruption during travel

Demand for flights has recovered with incredible speed this year, but airlines and airports have struggled to keep up with the surging demand and airport traffic. As a result, mass delays, cancellations and hours-long lines at security checkpoints have plagued airports across the globe in recent months. In June, U.S. airports saw a 57% increase in flight cancellations compared to June of 2019. At their peak, as many as 27% of flights in June were delayed, almost half for an hour or more. For many travelers a major disruption can mean missing an important event or vacation, but even more, it can mean extra hotel nights in a new city or purchasing a new flight out of pocket to get to a destination on time.

What does this mean for travel brands? Customers are increasingly concerned about disruptions of their flights, and rightfully so as U.S. airports saw a 57% increase in flight cancellations compared to June of 2019. In fact, Hopper has seen a 23% increase in passengers adding Flight Disruption Guarantee to their bookings. With this product, if a customer's trip is delayed or they miss their connection, they can instantly rebook the next flight to their destination – no matter the airline – at no additional cost. Adding disruption products to your existing travel offering – like Flights Disruption Guarantee, available via Hopper Cloud – can help your customers gain peace-of-mind, while also driving incremental revenue on bookings. The average cost of this product is $25, meaning that customers are willing to spend 7% more on an average domestic flight to help avoid the impacts of disruptions. The best news for travel brands? Hopper takes on all the financial risk when partners implement our fintech products.

Methodology: The pricing data utilized for this study comes from Hopper's real-time "shadow traffic" containing the results of consumer airfare searches. Hopper collects, from several Global Distribution System partners, 25 to 30 billion airfare price quotes every day from searches happening all across the web. The prices reflected in this analysis are Hopper’s “good deal price” which represents what a typical leisure traveler should expect to pay, measured using a “tenth percentile.” Delay and cancellation data comes from OAG’s historical flight performance database. Historical recession expenditure changes from Morgan Stanley Research: seasonally adjusted Air, Hotel, Motel personal consumption expenditures BEA.

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!