Q3 2023 Consumer Travel Index

Domestic airfare will plateau in August, falling 2% to $267 per ticket.

Hayley Berg - Tue Aug 08 2023

6 Month Airfare Index

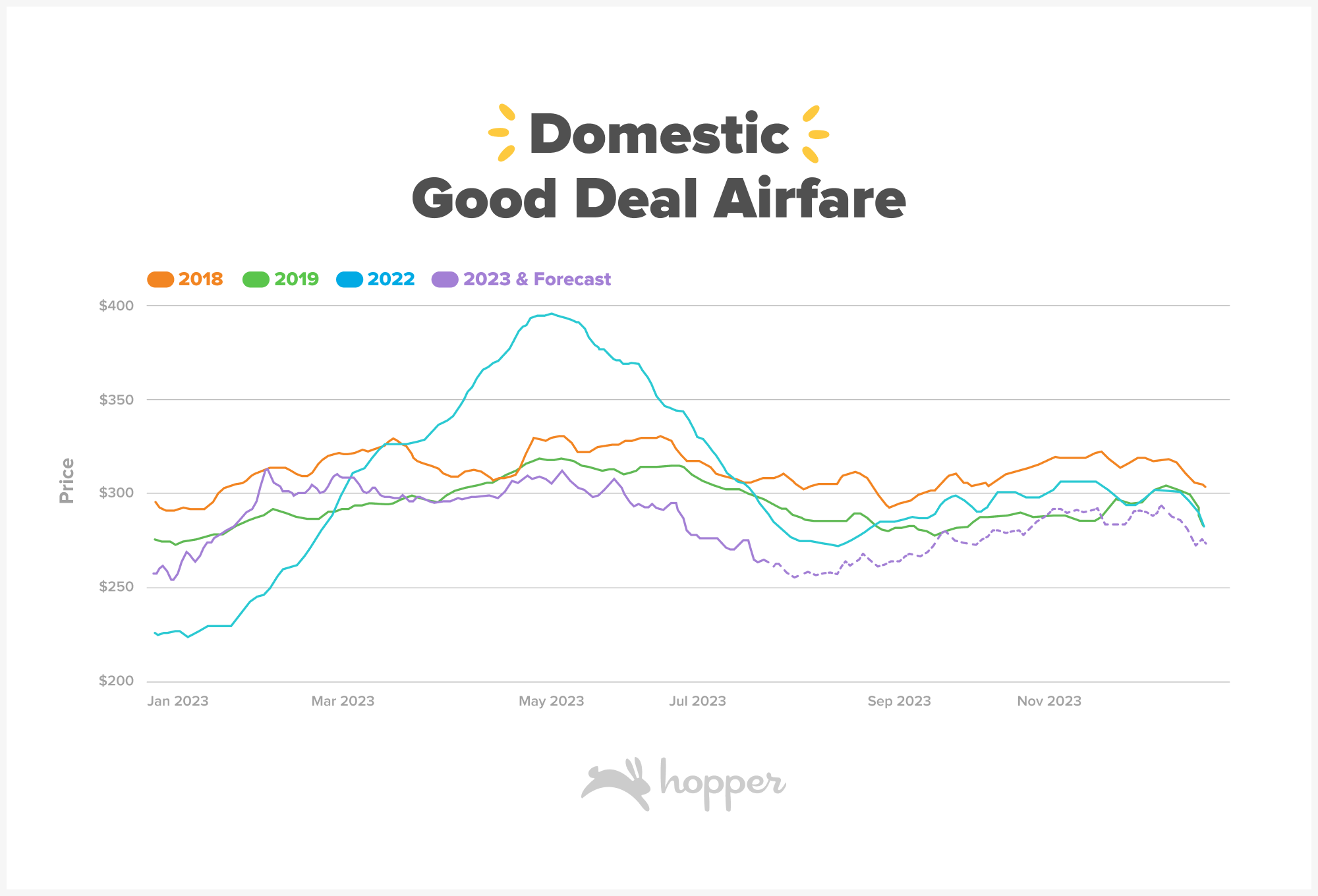

We're expecting the cost of domestic airfare to level off this August. This means that the average price for a round-trip domestic ticket, which was $274 in July, will decrease by 2% to $267 for the month of August. Airfares will remain low through mid September before beginning to rise into the fall and winter holiday season. Fares will peak in late November and early December around $283 per ticket as travelers book their last minute Thanksgiving and Christmas trips. Fares will remain below 2019 levels until November when they will come close to matching pre pandemic levels through Christmas.

Airfare

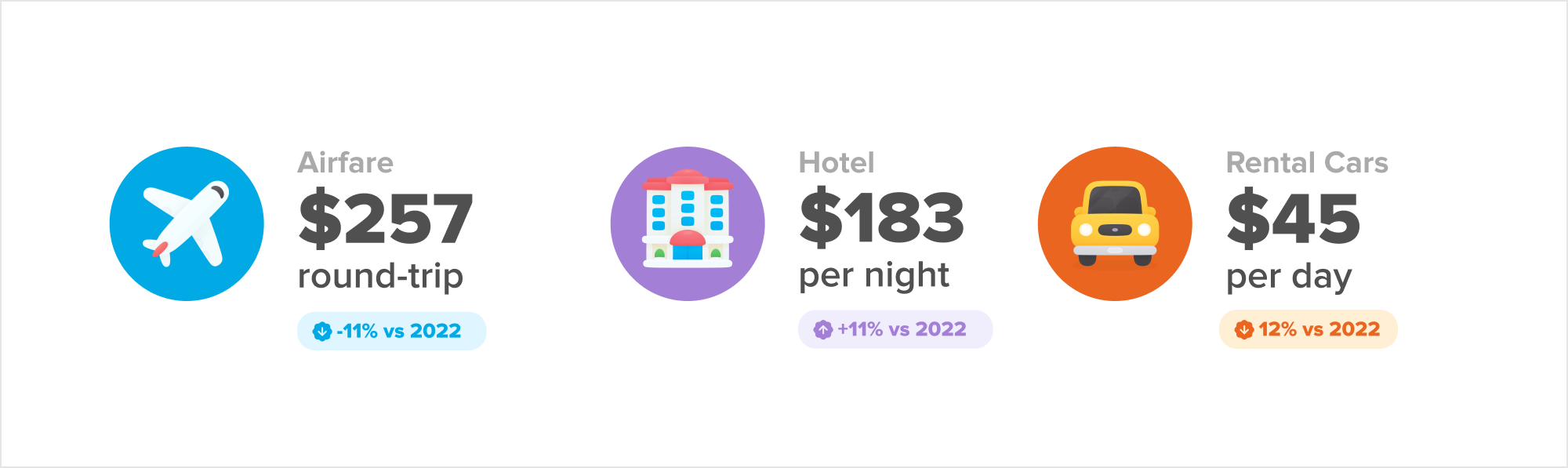

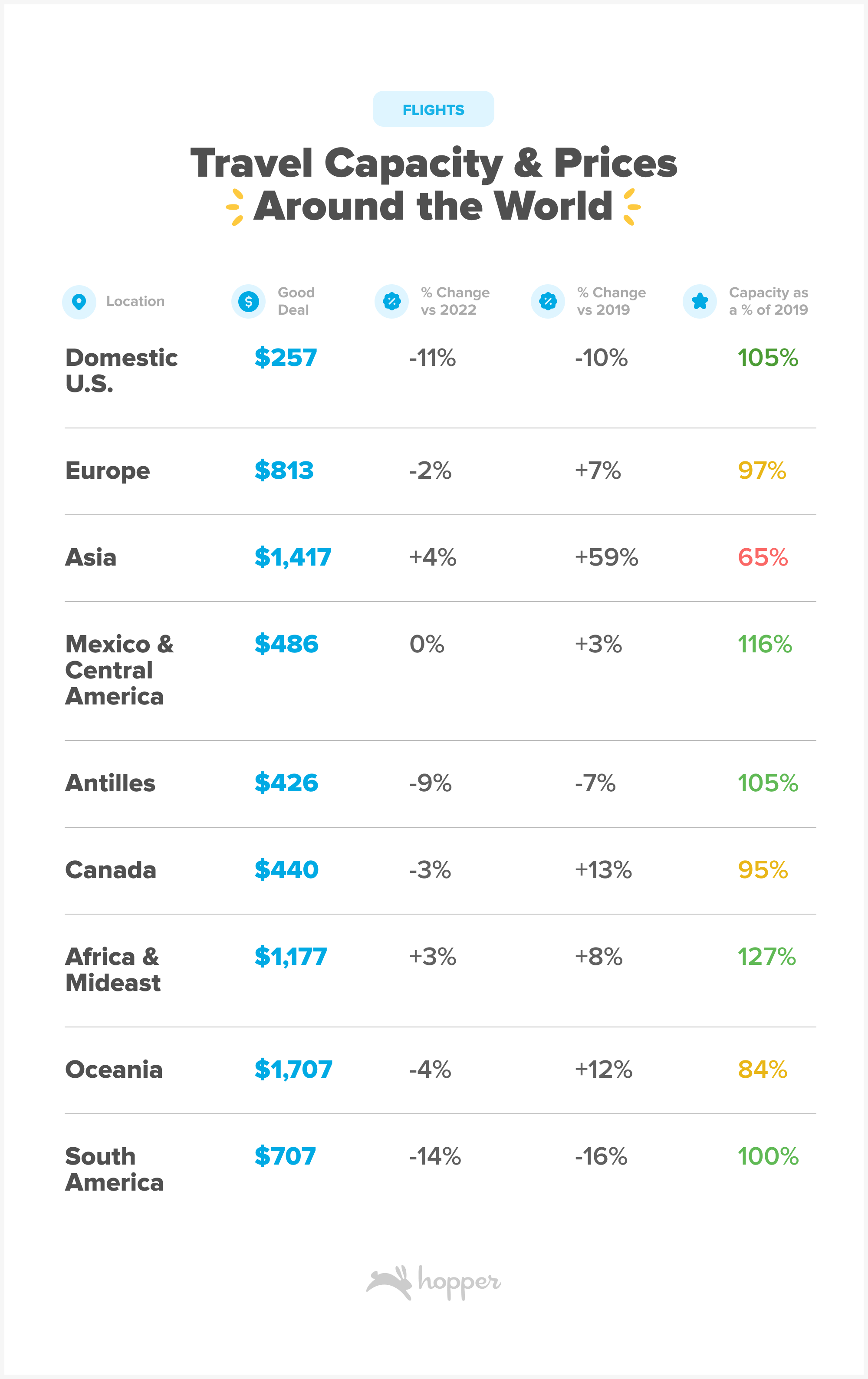

Domestic: Today, domestic round trip airfare is averaging $257 per ticket, down 11% or about $32 per ticket compared to this time last year and this time in 2019. With domestic airline capacity back above 2019 levels, a shift towards international trips and improving jet fuel costs compared to last year, domestic airfare is expected to remain slightly below pre pandemic levels until the busy holiday season begins. As travelers focus on less flexible trips home for the holidays that skew heavily domestic during the holiday season, domestic prices will begin to rise.

Short Haul International: Routes like US to Antilles, Mexico and Central America have seen significant price improvement compared to previous years, with fares to the Caribbean down 9% vs last year and fares to Mexico and Central America in line with last year. As these routes are regional they’re less impacted by high fuel prices than longer haul routes, where airlines historically struggle to keep costs low. These routes also saw significant demand recovery starting in 2021 and are benefiting from normalized seasonal demand and operating capacity above pre-pandemic levels. These factors combine to provide price relief for Americans!

Long Haul International: International travelers won’t see the same price relief if traveling to top regions like Europe and Asia this fall.

Airfare to Europe, the most popular region outside of the US for American travelers, remains 7% higher than pre-pandemic. While demand to Europe has recovered to 2019 levels, capturing 23% of all searches made from the US, capacity remains 3% lower than pre-pandemic. This surplus of demand, combined with higher fuel costs for airlines, has pushed fares to record levels this summer. There is relief in sight; as capacity was added over the summer prices began to plateau and have even dropped below 2018 levels in the last few weeks. As demand remains strong and capacity rises, prices should stabilize this fall.

Demand for travel to Asia has rebounded to near 2019 levels but fares remain 59% higher than pre-pandemic on average, about $525 more per ticket. Until capacity is unlocked on these transpacific routes, prices will remain elevated.

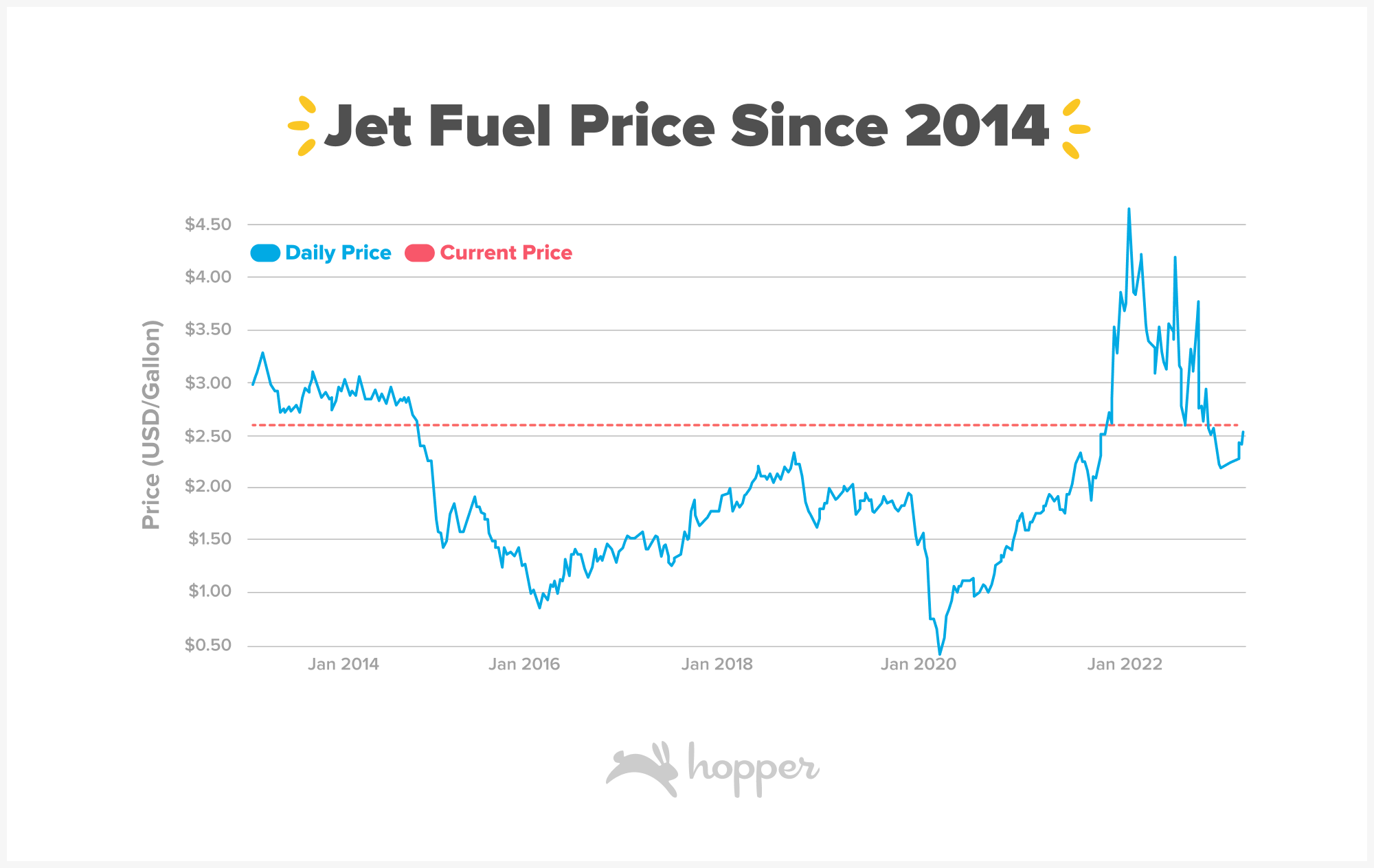

Jet Fuel prices are averaging $2.59 per gallon at the end of July and remain 37% or $0.70 per gallon higher than pre pandemic levels. Despite this, prices have seen considerable improvement over the last year, and are currently 27% lower than at the end of July 2022. Though fuel costs have improved considerably in the last 12 months, prices remain the highest they’ve been since late 2014. Higher fuel costs will continue to put pressure on airfares, especially on expensive long haul international routes.

Accommodations

Hotel prices in the US are averaging $183 per night, up 11% compared to this time in 2022 but down from summer peaks over $200 per night.

For trips in the US, travelers are booking stays in Las Vegas, New York and Orlando. Prices in Las Vegas are about 4% higher than last year, averaging $147 a night, but with rooms as low as $85 a night. Prices for stays in New York have surged compared to last year, averaging $312 per night, up 16% or an additional $42 per night. Travelers headed to Orlando are in luck, prices are in line with last year and averaging around $128 per night.

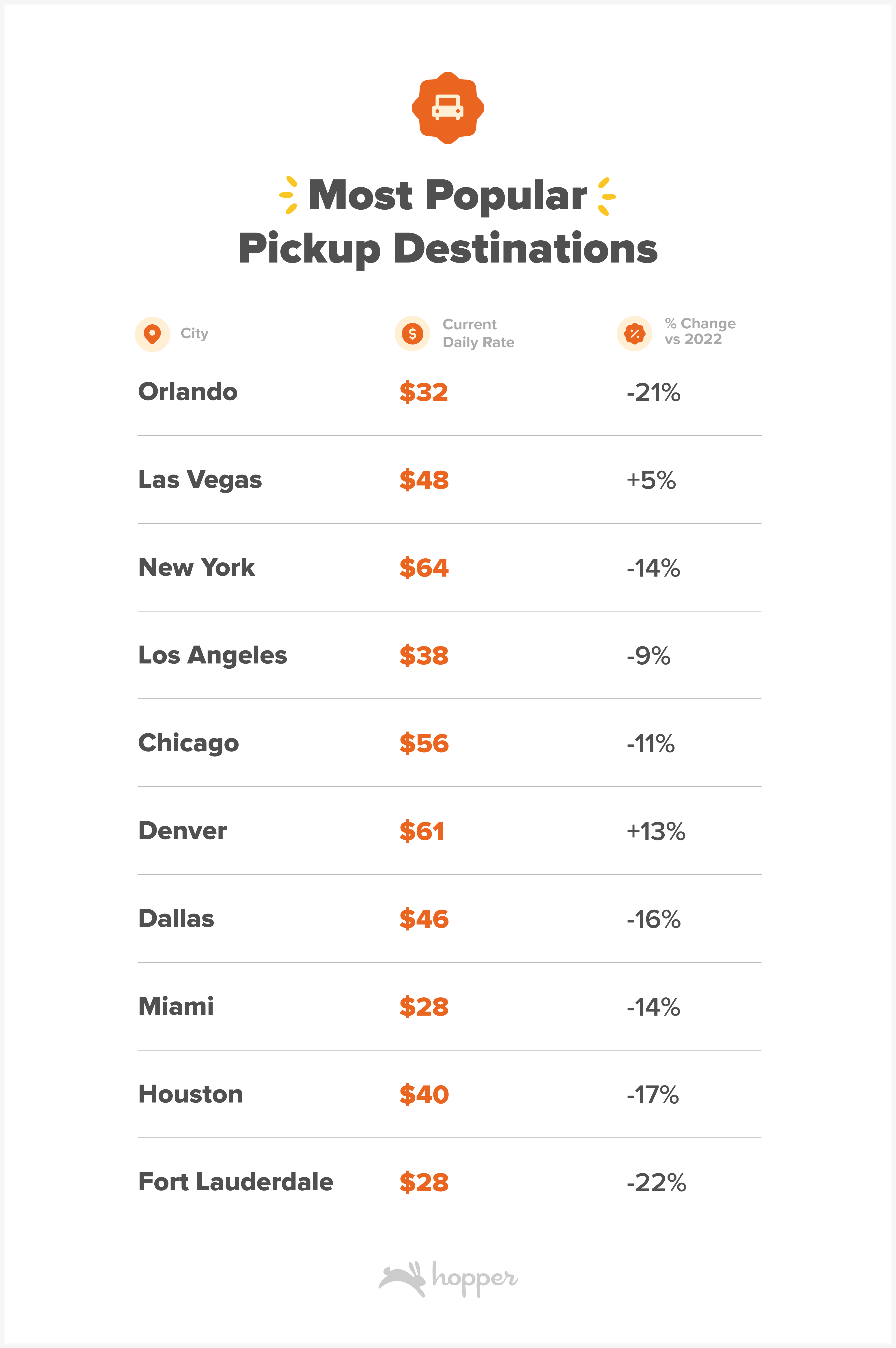

Car Rentals

Road trippers will see price relief this spring and summer with average rental rates in the US down 12% from last year, averaging $45 per day. Travelers will feel relief at the pump as well, with retail gas prices down $0.73 to $3.60 per gallon, or about a 25% drop compared to this time last year.

Airfare Forecast: Airfare to fall into shoulder season

Domestic airfare will plateau in August, falling 2% to $267 per ticket. Airfares will remain low through mid September before beginning to rise into the fall and winter holiday season. Fares will peak in late November and early December around $283 per ticket as travelers book their last minute Thanksgiving and Christmas trips. Fares will remain below 2019 levels until November when they will come close to matching pre pandemic levels through Christmas.

Trending Destinations

This fall travelers are headed to outdoor destinations, seeking out sandy beaches and scenery. From Atlantic beaches via Melbourne, Florida to Lake Tahoe, via Reno, Nevada or the White Mountains via Manchester, New Hampshire, travelers are heading outside. Colorado Springs, Colorado and Eugene, Oregon also made the ranking, both offering access to lakes, mountains and incredible hiking.

On the international front destinations in Asia remain extremely hot, with Japan, Taiwan and South Korea dominating trending destinations for this fall. Sharjah, UAE, topped the list as the hottest trending international destination, making the ranking for the first time ever.

While the demand recovery to Asia has been astounding to watch over the last 8 months, there is another region of the world primed for demand surges this year and next. Africa and the Mideast as a region is capturing more share of international search demand than ever before. Today, 10% of international searches from the US are to destinations like Sharjah, Zanzibar and Abu Dhabi.

Flight Capacity and Disruption

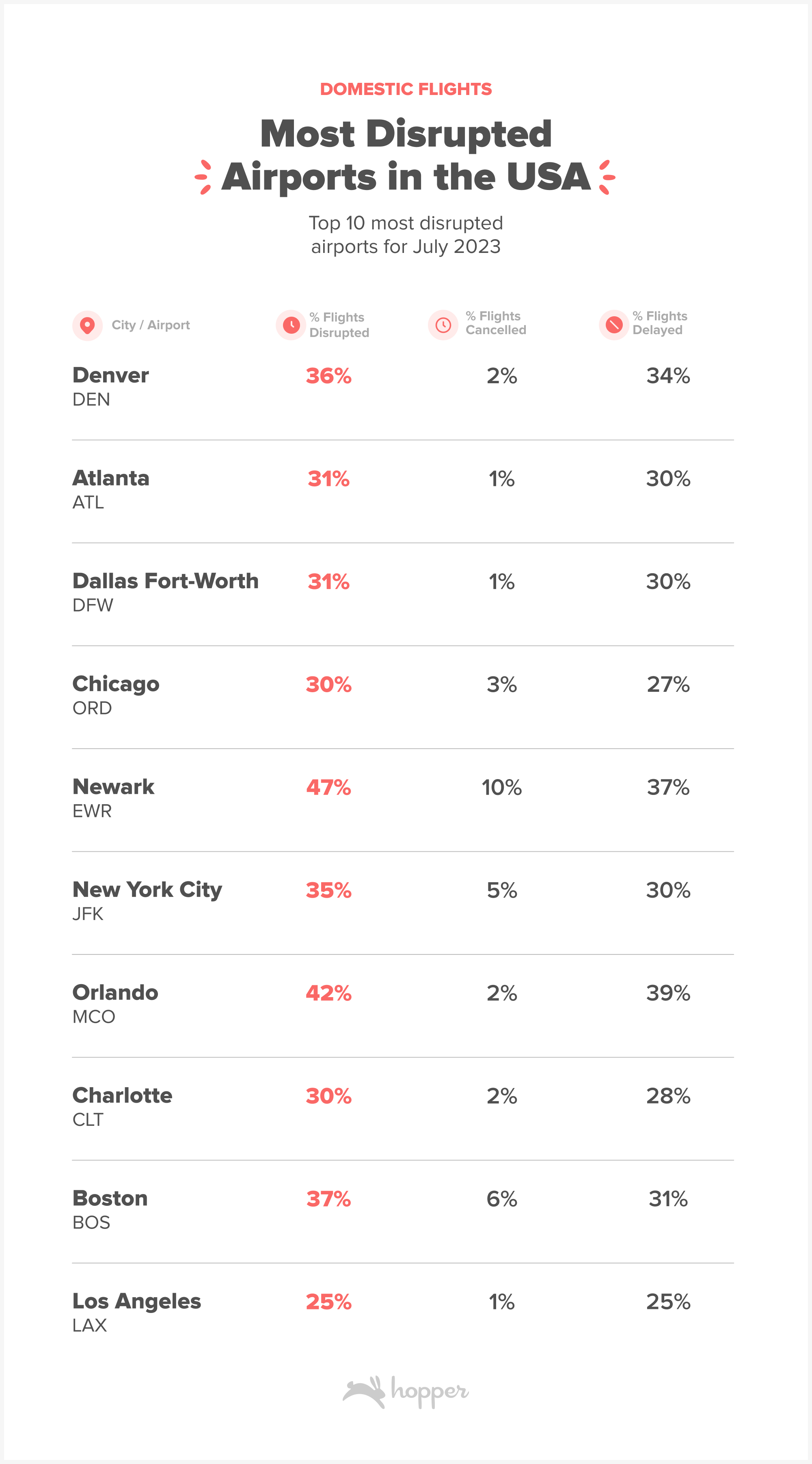

Long lines and frequent disruptions at airports around the world have millions of travelers asking; is this the new normal?

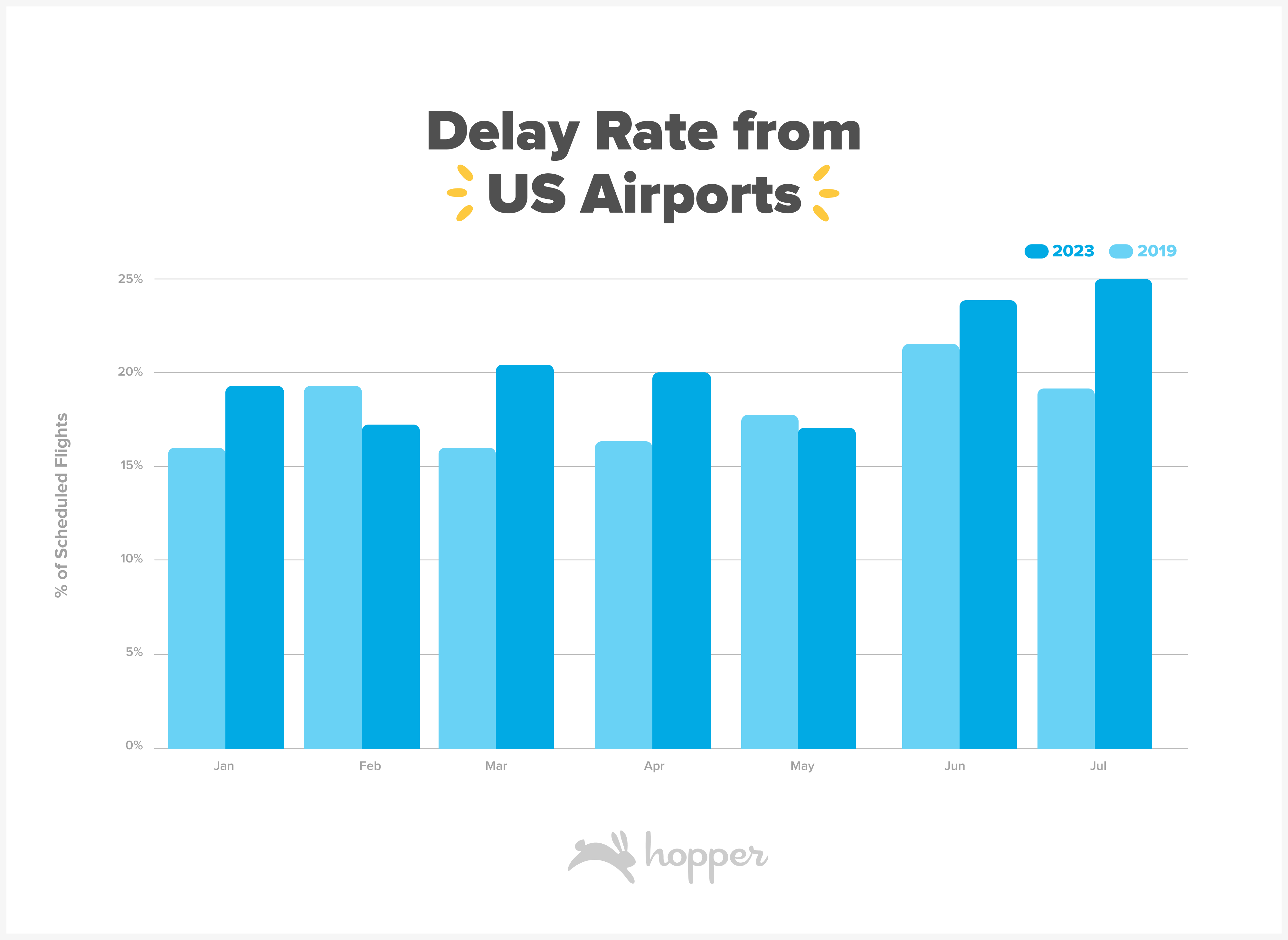

In July, 11% fewer domestic flights departed from US airports than in the same month in 2019, but airlines overall increased capacity by 5%. How did this happen? Airlines are scheduling fewer flights than pre-pandemic, but simultaneously operating larger jets on remaining routes. The end result is fewer flights, but more seats available for customers to book.

At the same time airlines are operating fewer flights, delay and cancellation rates have ballooned. In July, 25% of flights departing from US airports were delayed on departure compared to 19% pre-pandemic. Cancellations have also increased, with 2.4% of departing flights canceled in July compared to 1.9% in 2019.

Though delays are becoming more frequent their length remains about the same as pre pandemic. Today, about 40% of delays from US airports are for 15 minutes or less, likely having little impact on travelers’ plans. 23% of flights delayed are stalled for more than one hour, putting travelers at risk of missing connecting flights.

Combined, higher delay rates over fewer flights departing on domestic routes means customers are right to feel as though they are experiencing unprecedented levels of disruption. The main drivers of disruptions this summer have been inclement weather across the nation, including everything from thunderstorms and tornadoes to wildfires and their traveling smoke. On this front, travelers can expect these events will continue to cause disruptions as long as they continue.

However, we expect continued improvement in disruption rates over the coming months and certainly years. Airlines, airports, TSA and the FAA have been rebuilding workforces for the last 18 months, hiring and training to fill roles left empty by layoffs in 2020. As these workforces build experience, and continue to grow, so will the resilience of the industry when faced with anything from poor weather to technical failures.

Why is domestic airfare so low?

Demand for travel, domestic and international, remains incredibly strong this year. Given this, Americans may be surprised that domestic airfare is averaging 10% lower than last year and summer 2019. We break down the main drivers of this price relief here:

Jet Fuel prices -22% vs July 2022. Though prices remain above 2019 levels, the continued improvement in fuel prices provides relief on a major cost driver for airlines. With lower costs, airlines can drop fares.

Domestic capacity is back. Airlines flew 5% more seats this summer than in 2019, with long weekends and busy dates seeing as much as 10% more capacity than historical years. Airlines have achieved these capacity gains not by bringing back more flights than 2019, but by optimizing a smaller set of routes with larger planes. While a major driver of this approach are FAA/ATC limits on flight volumes due to staffing constraints, this is also a method of optimizing costs and revenue for airlines. Higher capacity combined with some relief on costs further enables airlines to drop prices.

Domestic competition is back, too. Pre-pandemic, domestic airfare had been dropping consistently each year driven by low fuel costs, entry of new low cost carriers (LCCs) to the market and expansion of existing carriers into new routes, and new, cheaper, fare classes. From 2017 to 2018, prices on domestic routes dropped -10%, and a further -5% in 2019. If not for the pandemic, domestic airfare would likely have continued to drop as domestic carriers expanded and low cost carriers continued to dial up competition. In many ways the fares we see today are in line with what we could have expected in the domestic market if not for the pandemic.

International demand has recovered to pre-pandemic levels. Travelers who skipped the international trips from 2020 - 2022 are headed international once more. This marks a return to the pre-pandemic equilibrium, as the domestic market has been over concentrated in the last 3 years due to covid era travel restrictions. Though travelers have looked international this summer, expect that as the holidays approach Americans’ focus will return to domestic “home for the holidays” destinations very soon.

Destinations to Book Now

If you’re looking to book an upcoming trip, Hopper is running its End of Summer Sale (8/15-8/17) with deals to popular domestic and international destinations.

Domestic Destinations on Sale:

Panama City Beach - $50 off flights; 15% off hotels on Hopper

Orlando - $20 off flights; 25% off hotels on Hopper

Los Angeles - $20 off flights; 20% off hotels on Hopper

New York City - $20 off flights; 20% off hotels on Hopper

Houston - $15 off flights; 40% off hotels on Hopper

New Orleans - 15% off 3+ nights at hotels on Hopper

International Destinations on Sale:

Switzerland (Interlaken) - $200 off hotels on Hopper

Istanbul - $100 off flights; 20% off hotels on Hopper

Manila - $100 off flights; 25% off hotels on Hopper

Athens - $60 off flights; 20% off hotels on Hopper

Amsterdam - $60 off flights; 20% off hotels on Hopper

Abu Dhabi - $50 off flights; $50 off hotels on Hopper

Korea - $40 off flights on Hopper

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!