Late Summer (Q3) Travel Index

Domestic airfare this fall will drop to $286 in August, down -25% compared to the airfare peak in May of this year.

Hayley Berg - Mon Aug 01 2022

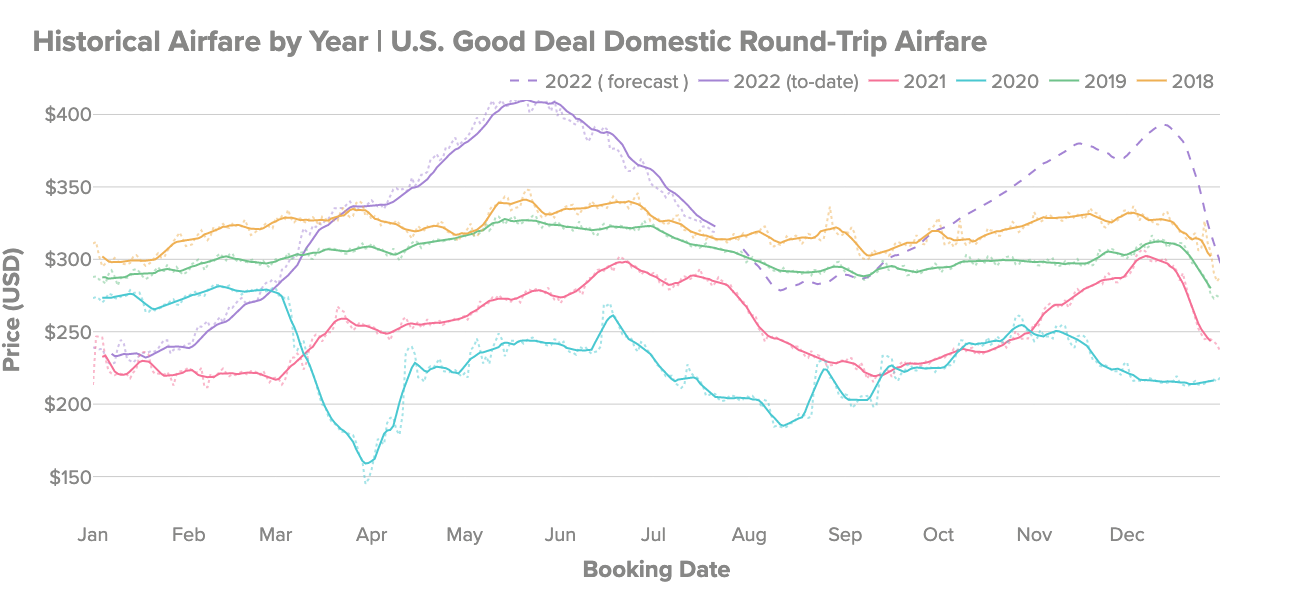

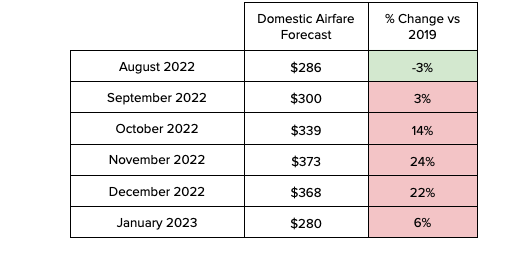

6 Month Airfare Index

Domestic airfare this fall will drop to $286 in August, down -25% compared to the airfare peak in May of this year. Airfare will remain at or below $300 through September, before beginning to rise in October and November. Airfare will average $368 per ticket in December, with daily airfare peaking over $390 for last minute holiday bookings.

Factors Influencing Air Travel

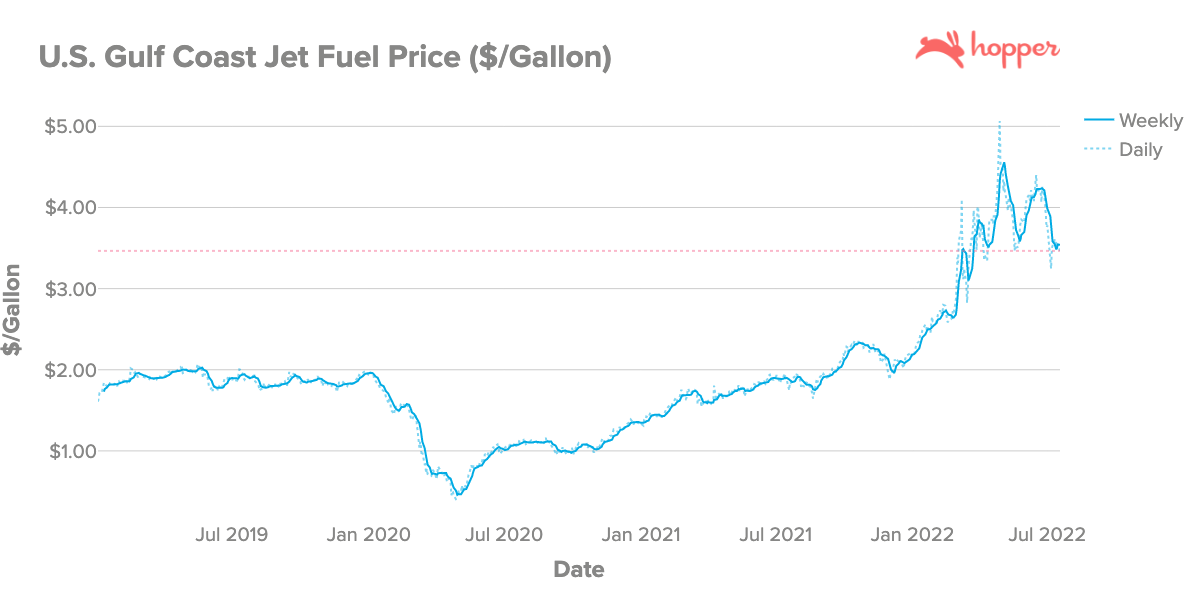

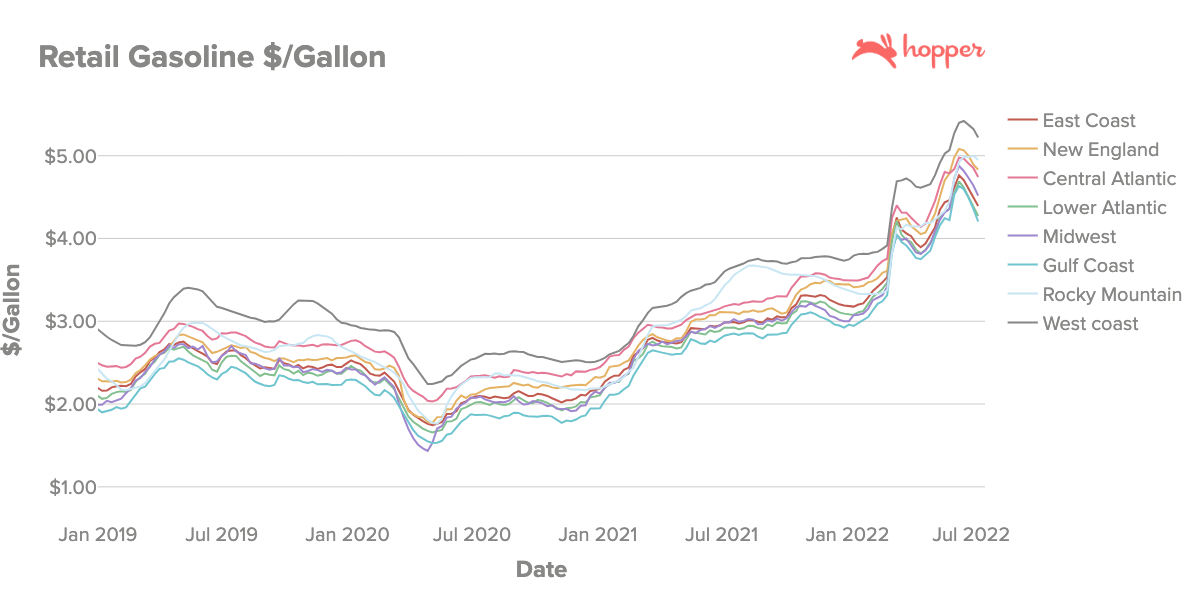

Jet Fuel Prices: Currently, US Gulf Coast jet fuel is averaging $3.60 per gallon, an increase of 80% compared to 2019 and 90% compared to 2021. Jet Fuel prices typically account for 15% - 30% of an airline’s operating expenses and will continue to be a significant contributing factor to the high airfares seen by travelers this year until prices fall.

Demand: Demand for flights continues to grow compared to earlier this year but growth has slowed as much of the pent up demand post covid was exhausted with summer vacations. Slowing demand growth in August and September drives airlines to lower prices during the fall months, to incentivize travelers to book trips during that slower shoulder season.

Capacity: Airline domestic seat capacity remains at ~95% of 2019 levels, while international seat capacity has only reached 83% of 2019 levels. Many airlines plan to maintain capacity below 2019 levels through the end of the year to prevent future disruptions, meaning more customers vying for fewer available seats this fall and holiday season.

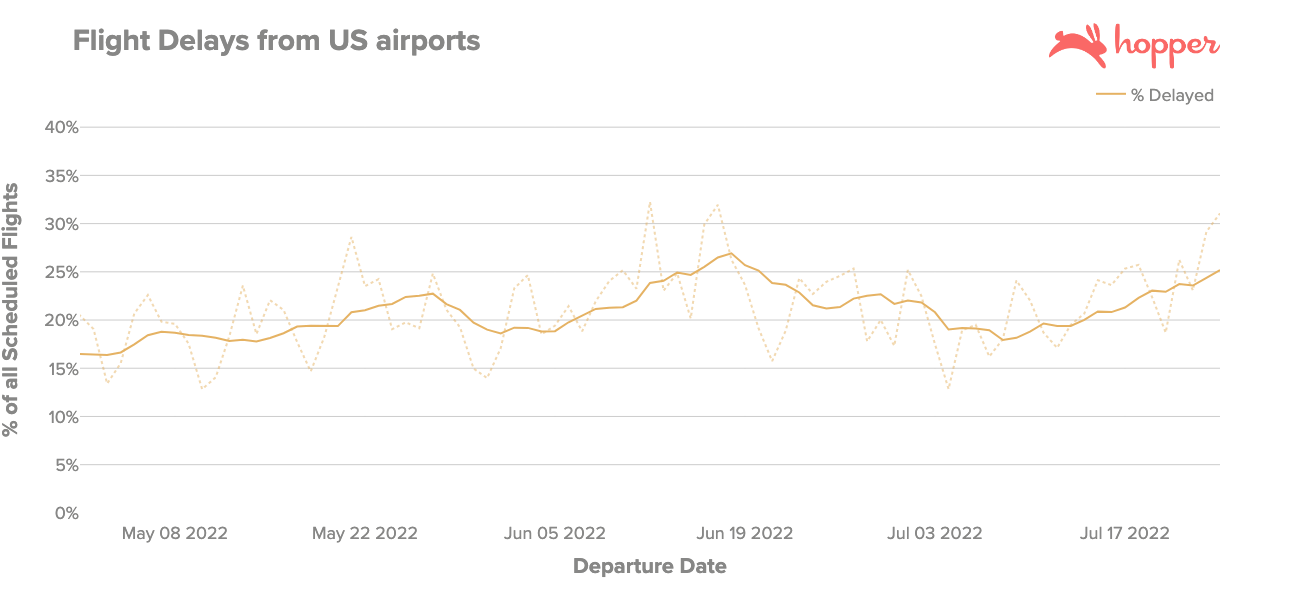

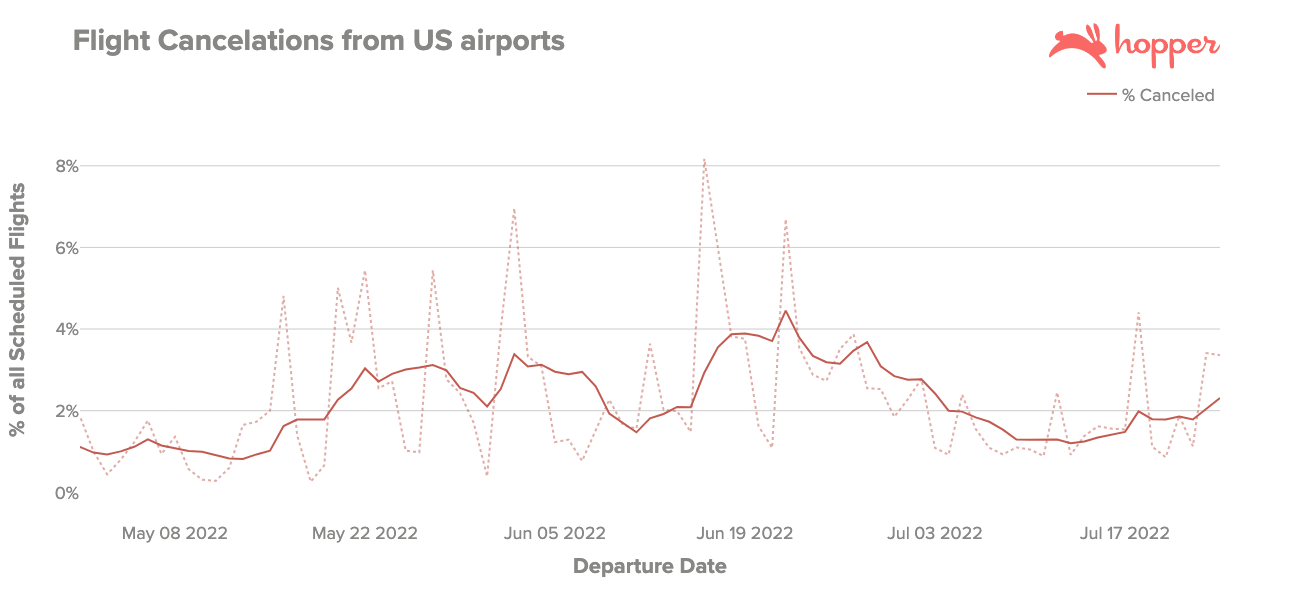

Disruption: More than 5,000 flights per day in the US have been delayed or canceled in the last week of July alone. Delay rates had improved in mid July, as airlines took proactive steps to reduce their capacity to better service remaining routes, but have risen again from 18% of flights delayed, to over 25% in the most recent week. Today, 1 in 5 Hopper customers is including a Flight Disruption Protection product when they book to mitigate the risk of unplanned disruptions.

Trending Destinations

Domestic: Beach destinations top the domestic trending list, with all cities in Hawaii ($500 or less) and Hilton Head, South Carolina ($315) in the top 3 trending destinations for fall. Mountain towns are also trending up, with Jackson, Wyoming ($460) the top destination increasing in popularity for this fall.

International: Southeast Asia is trending this fall with Bali, Indonesia ($1,951) and Ho Chi Minh City, Vietnam ($1,085) topping the list of destinations increasing in popularity in September and October. Australia is also in high demand, with Sydney ($1,394) ranked the #3 trending fall destination this year.

Air Travel

Airfare to drop below $300 in August

Domestic airfare this fall will drop to $286 this August, down -25% compared to the airfare peak in May of this year, in line with 2019 prices. Airfare will remain at or below $300 through late September, before beginning to rise slowly in October and November. Domestic flights are expected to average $368 per ticket in December, with daily airfare peaking over $390 for last minute holiday bookings.

Why are prices dropping rapidly?

Prices this summer were elevated beyond normal seasonal airfare increases by high jet fuel prices and pent up demand coming out of two depressed summer seasons, and by traveler demand peaking earlier in the summer than in a normal year. Flight prices drop seasonally in late August through mid October, as demand tapers off following the peak vacation months in May, June and July. The drop this year is larger than usual as a result of the abnormally high summer prices and earlier peak in demand. This fall, demand seasonality and jet fuel prices are the primary drivers of airfare.

[1] Demand growth slows seasonally into September and October

Demand for flights continues to grow compared to earlier this year but growth has slowed as much of the pent up demand post covid was exhausted with summer vacations. The slowing in demand growth is a seasonal fixture at this time of year, and will pick back up in October and November as travelers search for and book their holiday travel. Slower demand over the fall shoulder season drives airlines to lower prices in an effort to incentivize travelers to plan one more trip before the holiday season. For travelers who held off on summer trips given the soaring airfares, this lower demand season can mean lower fares and less crowded tourist destinations!

[2] Jet fuel prices remain +85% above 2019 levels

Currently, US Gulf Coast jet fuel is averaging $3.46 per gallon, an increase of 85% compared to 2019 and 86% compared to 2021. Prices have risen rapidly this year, +58% since January, as global supply constraints were further taxed by supply uncertainty resulting from the Russian invasion of Ukraine in February. Jet Fuel prices typically account for 15% - 30% of an airline’s operating expenses and have been a significant contributing factor to the high airfares seen by travelers this year. As jet fuel prices remain elevated, airlines will be pressured to maintain higher airfares, and lower overall capacity to offset the increase in costs.

Thousands of flights continue to be delayed or canceled daily

Travelers this summer were plagued by high delay and cancellation rates, as airlines grappled with surging demand while their networks and staffing were still in recovery mode. In late July, cancellation rates dropped from their peak of over 4% of US departing flights to closer to 2% of departing flights daily. Many of these cancellations were proactive, meaning airlines canceled flights weeks or months prior to departure in a strategic move to reduce their schedules this summer. Despite this, delay rates have risen to 25% of departures in the most recent two weeks, impacting more than 5,000 flights per day in the last week alone.

As disruptions remain a fixture in travel this summer, travelers are taking proactive measures to mitigate the scheduling and financial risk of major disruptions. Today, 1 in 5 customers booking with Hopper are adding Flight Disruption Protection when they book. With this product, if your trip is delayed or you miss your connection, you can instantly rebook the next flight to their destination in the app – no matter the airline – at no additional cost.

Airline capacity to remain below 2019 levels through holidays

Available domestic seat capacity in July was at about 95% of 2019 levels, averaging 2.7 million available seats per day compared to 2.87 million per day in 2019. International capacity has been slower to recover than domestic capacity, remaining at about 83% of 2019 levels, averaging 379K passengers per day compared to 458K in 2019.

Daily TSA throughput also remains at about 90% of 2019 levels, peaking above 2019 levels on only a handful of days this year, most notably over the 4th of July weekend and ahead of Memorial Day weekend.

This spring and early summer was ravaged by high delay and cancellation rates as airlines battled understaffing, surging demand and still recovering networks. In an effort to reduce disruptions, many airlines proactively reduced their schedules for the remainder of this summer, or this year. Given this, capacity is not expected to fully recover until summer 2023. This means there will be fewer seats available to book this year, despite record demand for air travel this summer, and expected this fall and holiday season.

Figure: Estimated daily seat capacity on domestic US flights based on airline schedules and aircraft capacity from 2019 to late July, showing capacity building from the depths of 2020. Based on data from OAG.

Trending Fall 2022 Destinations

Top 10 domestic and international destinations increasing in popularity this fall based on searches made by travelers planning their trips.

Domestic: Beach destinations top the domestic trending list, with all cities in Hawaii ($500 or less) and Hilton Head, South Carolina ($315) in the top 3 trending destinations for fall. Mountain towns are also trending up, with Jackson, Wyoming ($460) the top destination increasing in popularity for this fall.

International: Southeast Asia is trending this fall with Bali, Indonesia ($1,951) and Ho Chi Minh City, Vietnam ($1,085) topping the list of destinations increasing in popularity in September and October. Australia is also in high demand, with Sydney ($1,394) ranked the #3 trending fall destination this year.

Accommodations

Demand for hotels has steadily increased each week since Memorial Day over the summer. The average nightly rate for a hotel has decreased slightly in recent weeks from a peak of $199 per night in mid-June to a current nightly rate of $185 per night.

Hotel prices are expected to continue to decrease slightly over the month of August before rising in September and October. While prices usually decline after summer, current rates show an increase for stays in September and October at an average of $217 per night. Hotel nightly rates this fall are 28% higher than 2019 when fall nightly rates averaged $169 per night. Nightly rates are also far above the 2021 average in the fall of $148 per night. The accommodations and hospitality sector has had some of the highest wage growth relative to other sectors in the economy. Increased operating costs for hotels coupled with sustained high demand for travel is leading to higher nightly rates in the fall season than we've typically seen in the past.

Las Vegas ($217 per night), New York ($338 per night), and Miami ($207 per night) are the top destinations travelers are searching for this fall. Top trending destinations for hotel stays in the fall are Honolulu ($282 per night), Los Angeles ($262 per night), and Orlando ($143 per night) increasing most in popularity relative to this summer. Top trending international destinations travelers are searching for in the fall are Cancun, Mexico ($227 per night), Bangkok, Thailand ($43 per night), and Cartagena, Colombia ($85 per night).

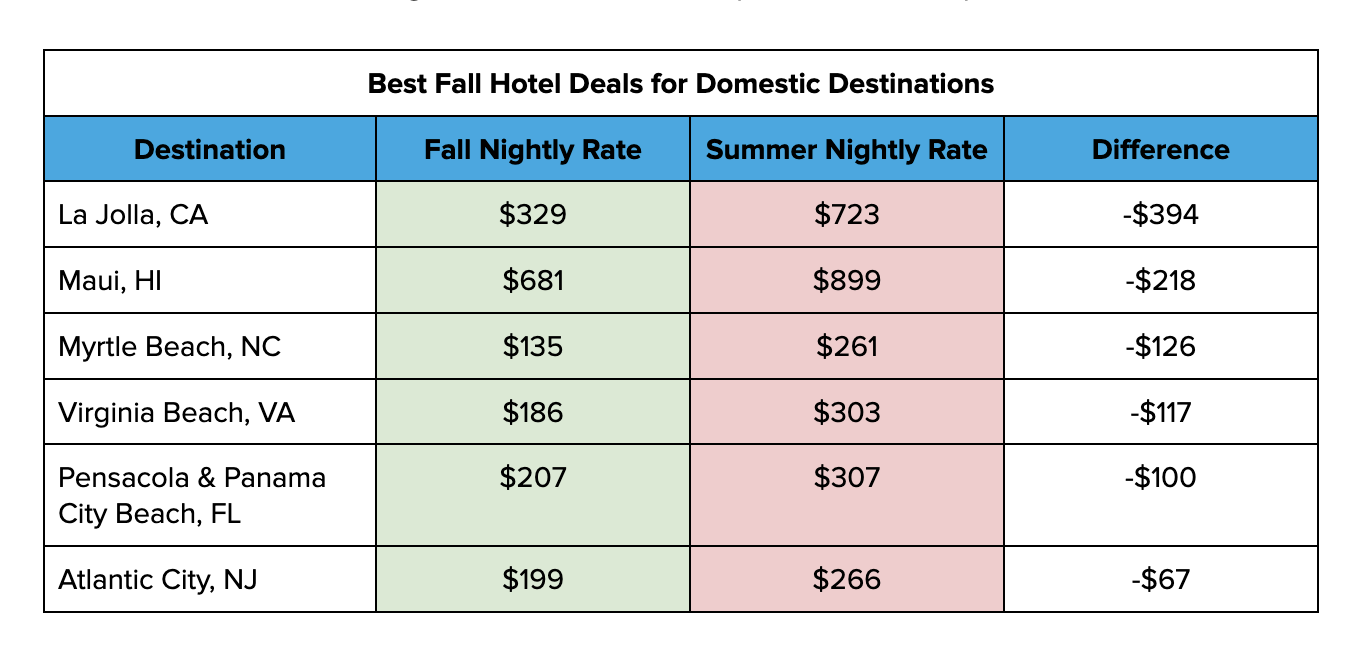

Several beach destinations offer a good value in the fall compared to summer prices.

A similar trend can be found at international island destinations for travelers searching for a good value compared to summer rates.

Car Rentals

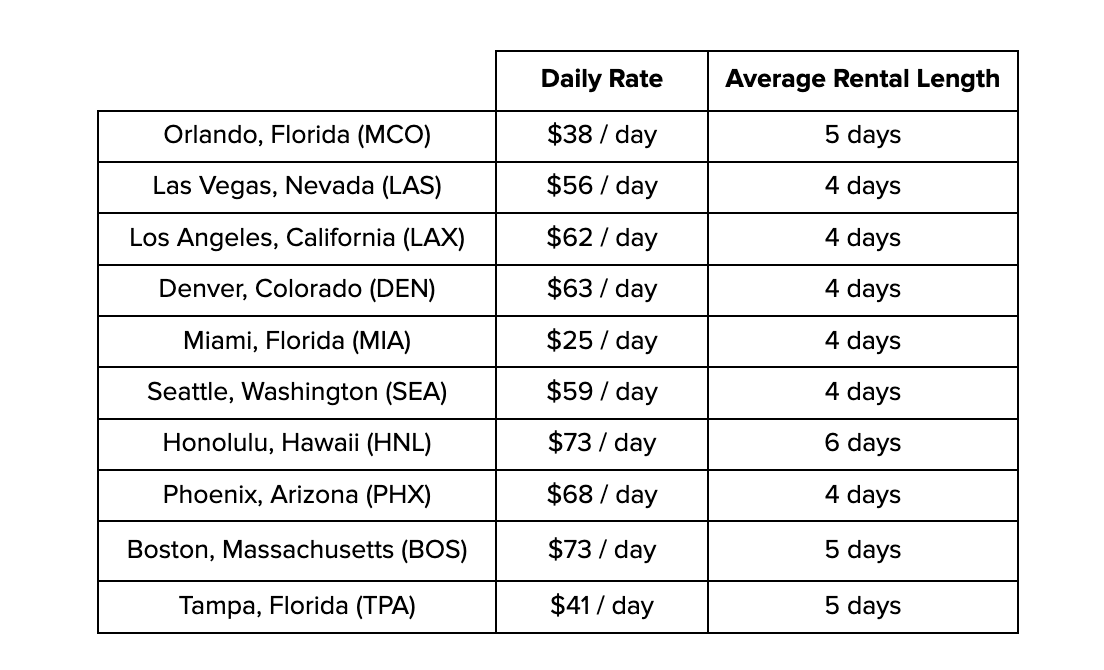

Vehicle rental prices are currently averaging $80 per day, with most travelers searching and booking for 4 day rentals. 40% of renters are booking an intermediate sized vehicle or SUV, which have increased in popularity over the course of the summer as families head out on vacations across the country. As gas prices remain at record highs headed into the fall, many travelers are considering electric vehicles to stretch their travel budgets further. Electric vehicles still represent a small portion of overall car rentals, but are growing in popularity as their availability increases at suppliers nationwide.

Orlando, Las Vegas and Los Angeles are the most searched for cities to pick up rental cars this fall, with vacationers looking for rentals lasting 4-5 days.

Car rental demand to remain high through fall

Demand for car rentals peaked over 4th of July weekend this summer, and will remain elevated through the end of the summer season in mid September. Seasonally, demand flattens in the fall period after peak summer weekends, but will increase rapidly again during the November and December over the holiday season.

Driving still key to vacations this summer despite high fuel prices

Americans have been feeling the recent rise in prices at the pump this summer, with US regular gasoline averaging $4.18 as of the last week of July. Gas prices have risen by 60%, that’s more than $1.58 per gallon, since 2019 and only recently began to improve after peaking over $5 in some regions in the last week of June. As gas prices remain elevated, Americans will pay more for the daily commute, and for road trips to vacation destinations. Despite this, 54% of Americans vacationing this summer and fall plan to rent a car or drive their own on vacation.

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!