Travel Impact: Coronavirus 2020

With the State Department issuing a “do not travel” advisory and a declaration by the World Health Organization of a global health emergency, airlines have cancelled flights to and from China - as the Coronavirus continues to spread around the world.

Hayley Berg - Wed Feb 05 2020

Updates (as of February 10th)

In the wake of the spread of Coronavirus across China, there has been a shift in where US travelers are looking to book travel. Demand for travel continues to grow within the United States, but we are beginning to see a shift towards domestic destinations over international destinations.

Hopper estimates that there has been at least a 3% decline in demand for international travel since the first week in January. ~80% of this decline is directly driven by demand from the US to China, while 20% of the decline is a peripheral impact on other international destinations.

Planned Capacity & Impact for US travelers

Travel to China from the US was planned to represent 4.6% of US international capacity over the next two months, though many US airlines have already announced reductions in service through the end of March. Before the outbreak, ~4,000 seats were planned to depart from the US each day to Chinese destinations over the next 2 months. Cathay Pacific currently holds the highest share of capacity on US <> China routes, with ~20% of expected seats flying, followed by United Airlines with ~18% share.

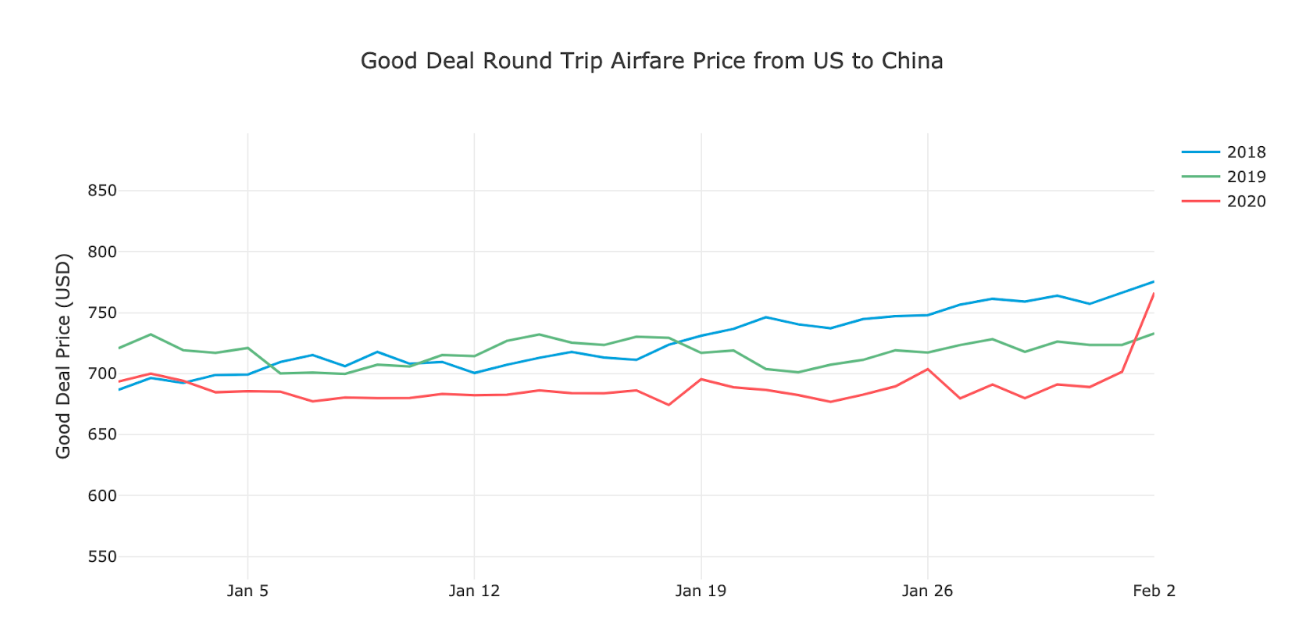

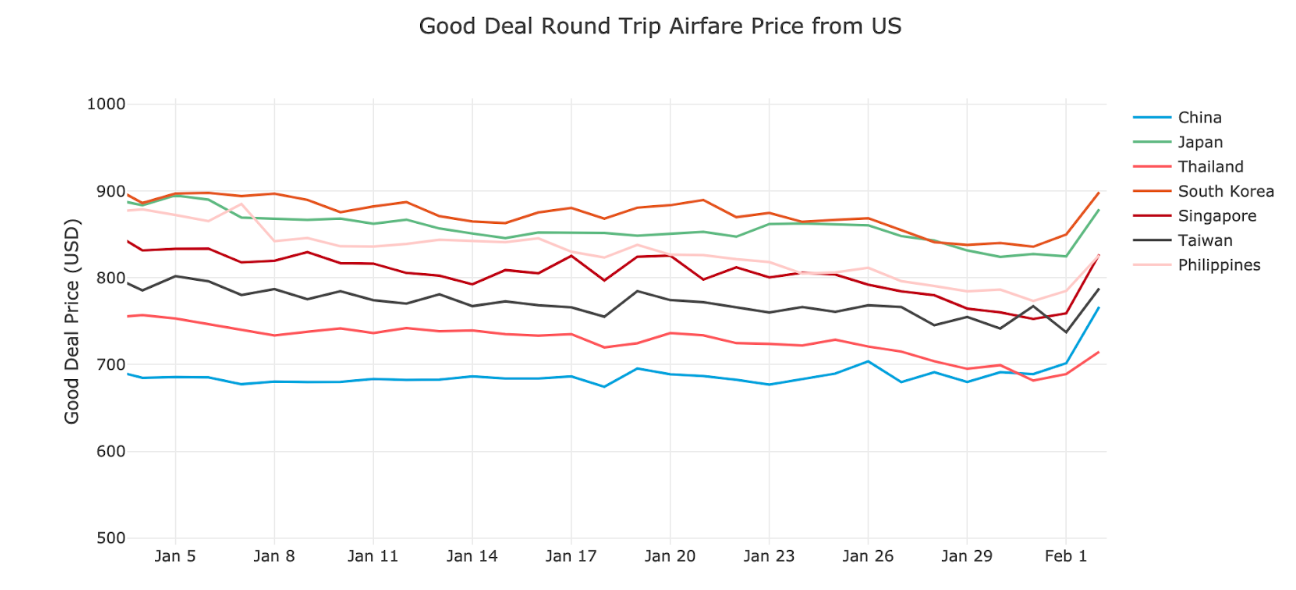

Initial Signals: Coronavirus Impact on Pricing

Round-trip airfare prices from the US to China remained relatively stable through January, but began to spike following announcements from airlines indicating a significant reduction in service to mainland China. Prices to China rose 11% between January 31st and February 3rd, 2020 alone. This price spike was not isolated to Chinese destinations, but was seen across Asian and Southeast Asian destination countries.

Fluctuating levels of demand for international travel and changes in oil prices and supply as a result of the spread of the virus in coming weeks could impact airfare prices at a global level. However, outside of these US <> Asia routes, there has not yet been a notable impact of the coronavirus on global airfare prices.

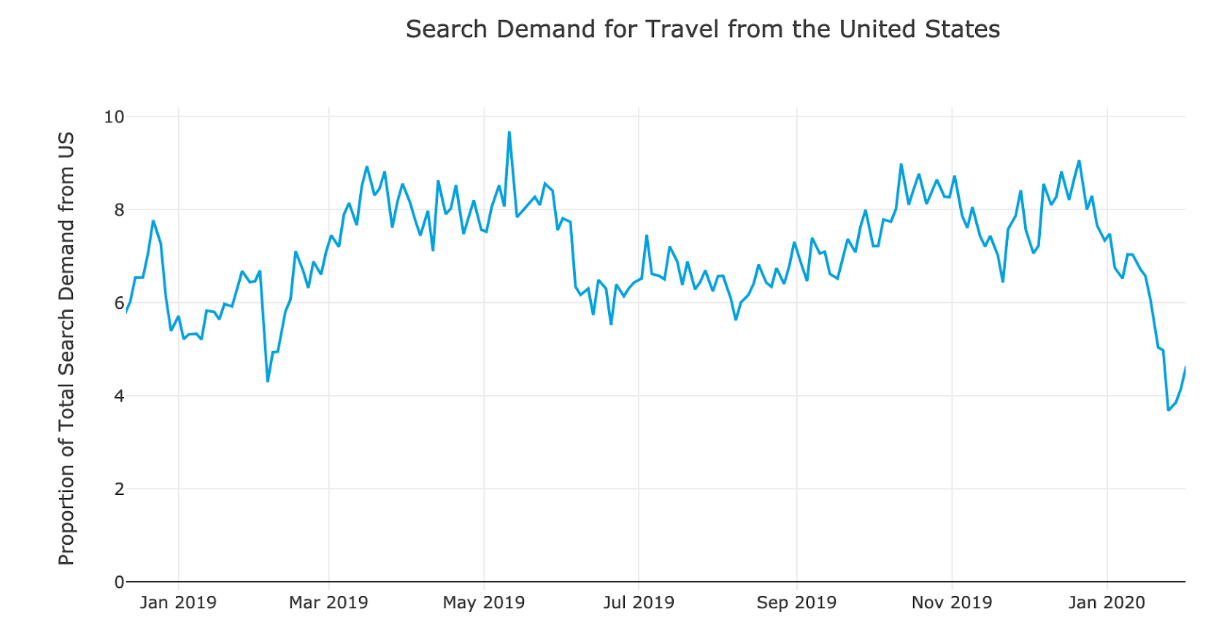

Initial Signals: Impact on Demand

Since the start of the coronavirus outbreak, there has been a significant drop in search demand for travel from the US to China. At its lowest point in 2020 so far, demand had dropped more than 58% compared to the seasonal low at the same time in 2019.

In the wake of the spread of Coronavirus across China, there has been a shift in where US travelers are looking to book travel. Demand for travel continues to grow within the United States, but we are beginning to see a shift towards domestic destinations over international destinations.

Hopper estimates that there has been at least a 3% decline in demand for international travel since the first week in January. ~80% of this decline is directly driven by demand from the US to China, while ~20% of the decline is estimated to be a halo impact on other international destinations.

Planned Capacity and Impact for Chinese Travelers

Airline capacity in January and February, especially during the weeks of Chinese New Year, is typically higher than average in China to accommodate increased demand for travel over the holiday period. International travel capacity was scheduled to be 20% higher the week of Chinese New Year than the same week the following month, while domestic travel capacity was scheduled to be 11% higher.

Expected Capacity Pre-Virus Cancellations:

Domestic: 18.2 million seats, +1.9% compared to the 2019 New Year holiday week

International: 3.6 million, +6.2% compared to the 2019 New Year holiday week

Tourism Impact

The reduction in international travel from China will have a tangible impact on tourism to many parts of Asia, Southeast Asia, and the United States. It’s estimated by the UN World Tourism Organization that in 2018, Chinese tourists spent ~277 billion while traveling outside of their home country. With ~168 million Chinese nationals estimated to have traveled in 2018, this gives the average Chinese tourist a spending value of over $1,600. (Source: U.N. World Tourism Organization). Without this spending in cities expecting a wave of large Chinese group tours or high net worth Chinese nationals, tourism-based economies will likely feel an immediate impact.

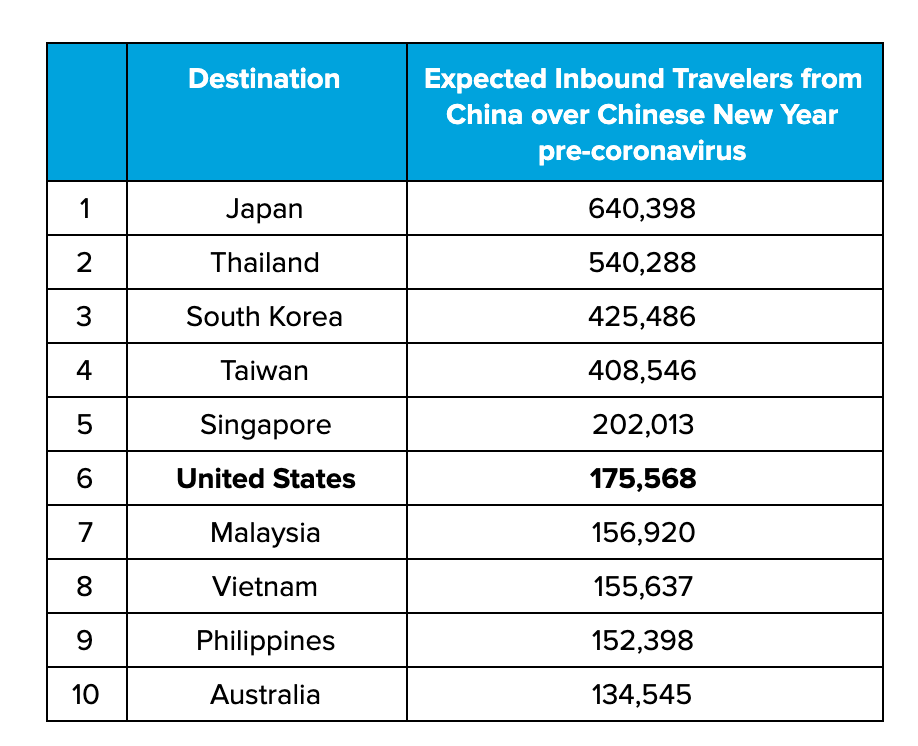

Impact by Country: Countries who were expecting the highest volume of travelers from China pre-virus:

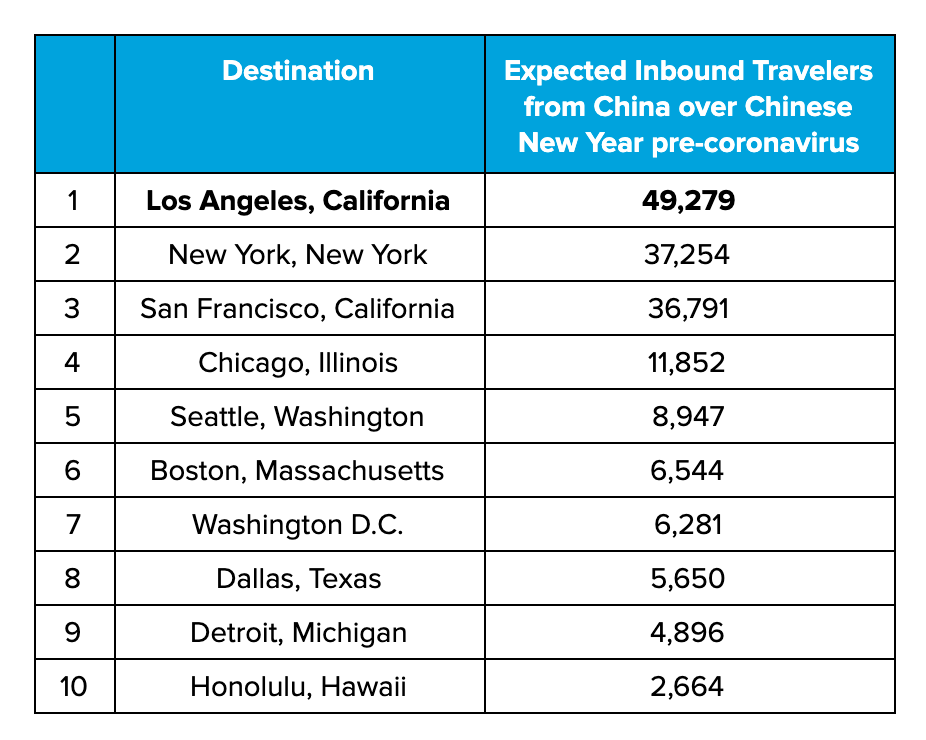

Impact by US City: Top 5 cities that were expecting 77% of all Chinese tourists

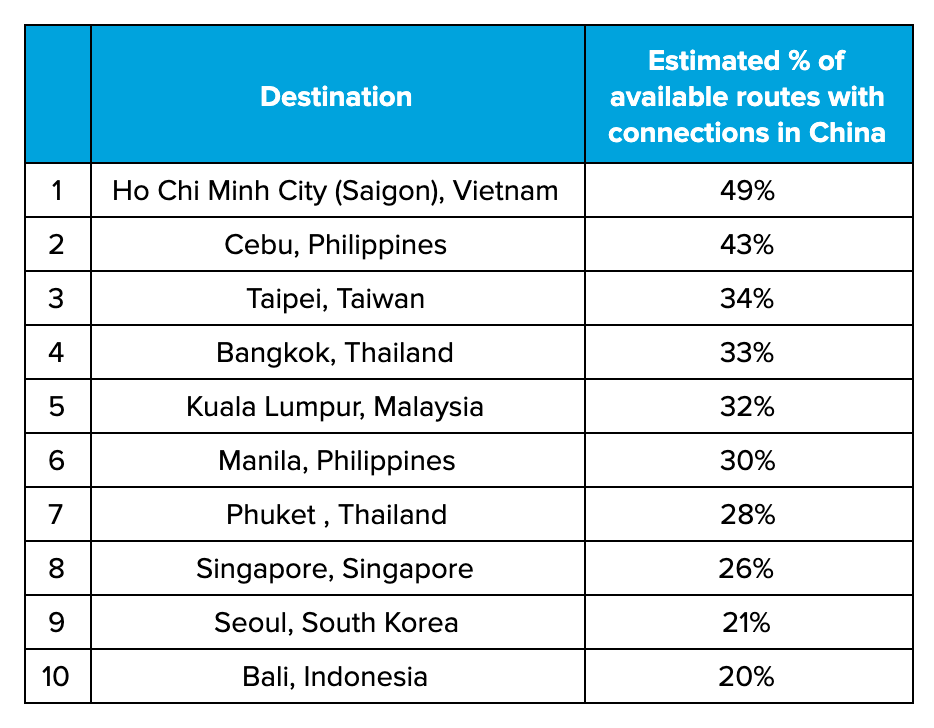

Nearly 5% of all international capacity from the US in the next 2 months was planned to route travelers to China. Some of these travelers were headed onto further destinations, primarily across Asia and Southeast Asia. Our ranking below shows the international destinations where flights with connections through China have previously represented a large proportion of the available routes US travelers could fly to visit.

Read as: Nearly 50% of all route options for travelers flying from the US to Ho Chi Minh, Vietnam have a connection in China.

Methodology

The data utilized for this study comes from Hopper's real-time "shadow traffic" containing the results of consumer airfare searches. Hopper collects, from several Global Distribution System partners, 25 to 30 billion airfare price quotes every day from searches happening all across the web. The prices reflected in this analysis are Hopper’s “good deal price” which represents what a typical leisure traveler should expect to pay, measured using a “tenth percentile.”

Get the Hopper app to find the best deals.

You could save up to 40% on your next flight!